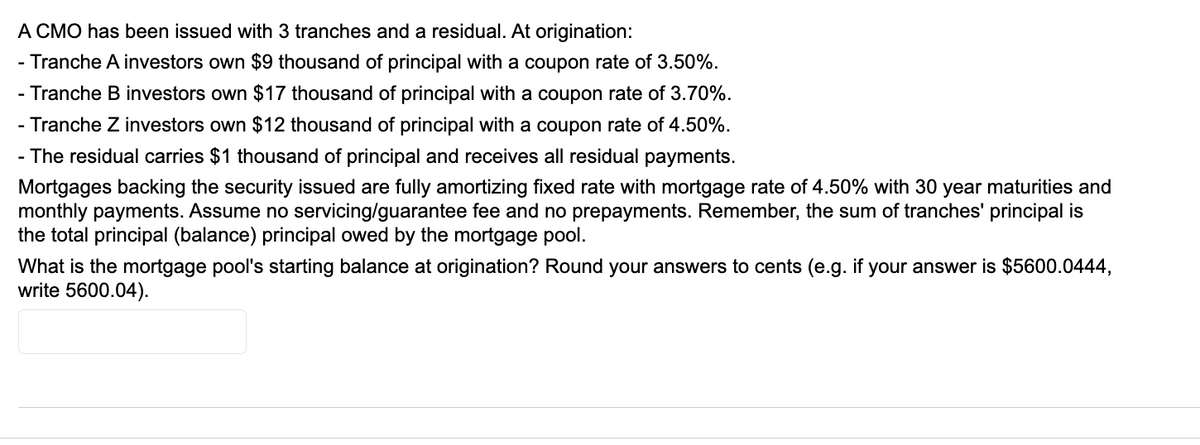

A CMO has been issued with 3 tranches and a residual. At origination: - Tranche A investors own $9 thousand of principal with a coupon rate of 3.50%. - Tranche B investors own $17 thousand of principal with a coupon rate of 3.70%. - Tranche Z investors own $12 thousand of principal with a coupon rate of 4.50%. - The residual carries $1 thousand of principal and receives all residual payments. Mortgages backing the security issued are fully amortizing fixed rate with mortgage rate of 4.50% with 30 year maturities and monthly payments. Assume no servicing/guarantee fee and no prepayments. Remember, the sum of tranches' principal is the total principal (balance) principal owed by the mortgage pool. What is the mortgage pool's starting balance at origination? Round your answers to cents (e.g. if your answer is $5600.0444, write 5600.04).

A CMO has been issued with 3 tranches and a residual. At origination: - Tranche A investors own $9 thousand of principal with a coupon rate of 3.50%. - Tranche B investors own $17 thousand of principal with a coupon rate of 3.70%. - Tranche Z investors own $12 thousand of principal with a coupon rate of 4.50%. - The residual carries $1 thousand of principal and receives all residual payments. Mortgages backing the security issued are fully amortizing fixed rate with mortgage rate of 4.50% with 30 year maturities and monthly payments. Assume no servicing/guarantee fee and no prepayments. Remember, the sum of tranches' principal is the total principal (balance) principal owed by the mortgage pool. What is the mortgage pool's starting balance at origination? Round your answers to cents (e.g. if your answer is $5600.0444, write 5600.04).

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter12: Valuation: Cash-flow Based Approaches

Section: Chapter Questions

Problem 13PC

Related questions

Question

Transcribed Image Text:A CMO has been issued with 3 tranches and a residual. At origination:

- Tranche A investors own $9 thousand of principal with a coupon rate of 3.50%.

- Tranche B investors own $17 thousand of principal with a coupon rate of 3.70%.

- Tranche Z investors own $12 thousand of principal with a coupon rate of 4.50%.

- The residual carries $1 thousand of principal and receives all residual payments.

Mortgages backing the security issued are fully amortizing fixed rate with mortgage rate of 4.50% with 30 year maturities and

monthly payments. Assume no servicing/guarantee fee and no prepayments. Remember, the sum of tranches' principal is

the total principal (balance) principal owed by the mortgage pool.

What is the mortgage pool's starting balance at origination? Round your answers to cents (e.g. if your answer is $5600.0444,

write 5600.04).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning