A company estimates that it will need $300,000 in 9 years to replace an important machine. If it establishes a sinking fund, by making fixed monthly payments into an account paying 6.5% compounded monthly, a) how much should each payment be? b) How much of the $300,000 that is in the account in the end will be interest?

A company estimates that it will need $300,000 in 9 years to replace an important machine. If it establishes a sinking fund, by making fixed monthly payments into an account paying 6.5% compounded monthly, a) how much should each payment be? b) How much of the $300,000 that is in the account in the end will be interest?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 16EA: Project B cost $5,000 and will generate after-tax net cash inflows of $500 in year one, $1,200 in...

Related questions

Question

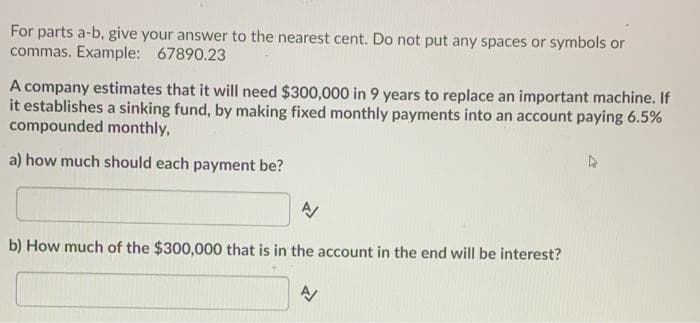

Transcribed Image Text:For parts a-b, give your answer to the nearest cent. Do not put any spaces or symbols or

commas. Example: 67890.23

A company estimates that it will need $300,000 in 9 years to replace an important machine. If

it establishes a sinking fund, by making fixed monthly payments into an account paying 6.5%

compounded monthly,

a) how much should each payment be?

b) How much of the $300,000 that is in the account in the end will be interest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning