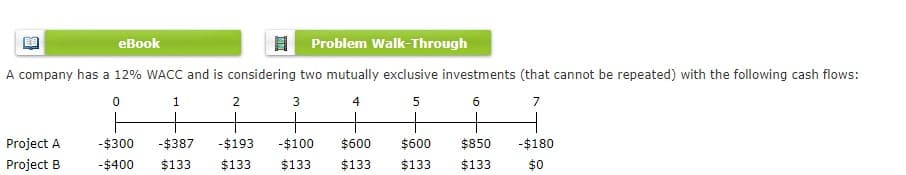

A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: 4 7 + Project A -$300 -$387 -$193 -$100 $600 $600 $850 -$180 Project B -$400 $133 $133 $133 $133 $133 $133 $0

A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: 4 7 + Project A -$300 -$387 -$193 -$100 $600 $600 $850 -$180 Project B -$400 $133 $133 $133 $133 $133 $133 $0

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

100%

Transcribed Image Text:еВook

Problem Walk-Through

A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows:

1

2

3

4

5

7

Project A

-$300

-$387

-$193

-$100

$600

$600

$850

-$180

Project B

-$400

$133

$133

$133

$133

$133

$133

$0

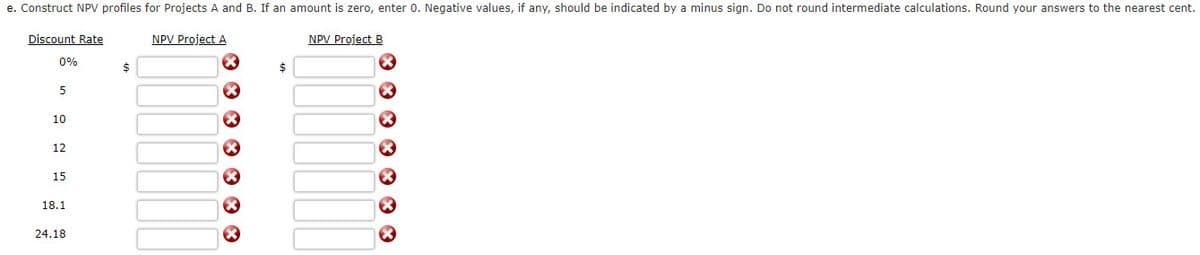

Transcribed Image Text:e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent.

Discount Rate

NPV Project A

NPV Project B

0%

$4

2$

10

12

15

18.1

24.18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning