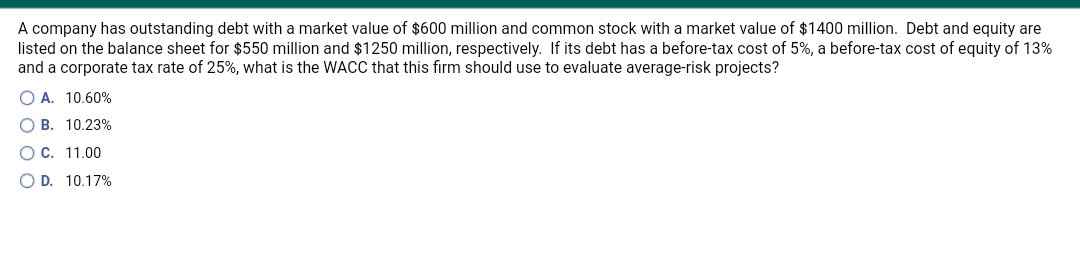

A company has outstanding debt with a market value of $600 million and common stock with a market value of $1400 million. Debt and equity are listed on the balance sheet for $550 million and $1250 million, respectively. If its debt has a before-tax cost of 5%, a before-tax cost of equity of 13% and a corporate tax rate of 25%, what is the WACC that this firm should use to evaluate average-risk projects? O A. 10,60% O B. 10.23% OC. 11.00 O D. 10.17%

Q: Adamson Corporation is considering four average-risk projects with the following costs and rates of…

A: a) Computation:

Q: Alpha Inc. has a target debt-to-value ratio of .6. The pretax cost of debt is 10 percent, the tax…

A: Debt to Equity ratio =Debt to Value Ratio/(1-debt to Value Ratio) Levered Cost of Equity =Unlevered…

Q: 15.00 3 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a…

A: Given information :

Q: A firm is financed with a mix of risk-free debt (currently valued at £800,000) and equity (which has…

A: Weighted average cost of capital is the average cost of capital that the firm incur for raising…

Q: The firm has capital structure of 25% debt and 75% equity. The company is planning to raise the…

A: Computation:

Q: Adamson Corporation is considering four average-risk projects with the following costs and rates of…

A: Firm issued various securities to collect the funds for the firm and pay return on it. This return…

Q: Walther enterprises has a capital structure target of 60 percent common equity, 15 percent preferred…

A: Weight of common equity (We) = 60% Weight of preferred stock (Wp) = 15% Weight of long term debt…

Q: company is financed by both debt and common equity, and the market value of debt is 25% and equity…

A: The question is related to Cost of Capital and is related with Capital Asset Pricing Model (CAPM).…

Q: A firm has an net operating profit of P300,000, interest of P35,000, and a tax rate of 25%. The firm…

A: Earnings before interest and taxes: Earnings before interest, depreciation and taxes are the…

Q: What is their WACC

A: The mix of equity and debt in a business organization is known as the capital structure of the…

Q: Suppose that B2B, Inc. has a capital structure of 35 percent equity, 16 percent preferred stock, and…

A: Calculation of WACC:The WACC is 9.59%.Excel Spreadsheet:

Q: Suppose Alcatel-Lucent has an equity cost of capital of 10.5%, market capitalization of $9.36…

A: Free cash flow is the amount of cash available for operating business activities after all the…

Q: Suppose Firm A plans to retain $100 million of earnings for the year. It wants tofinance its capital…

A: Computation:

Q: Altamonte Telecommunications has a target capital structurethat consists of 45% debt and 55% equity.…

A: Calculation of payout ratio under residual income policy is shown below: Hence, the dividend payout…

Q: Rogers’ Rotors has debt with a market value of $250,000, preferred stock with a market value of…

A: WACC (weighted average cost of capital) refers to the average cost that is paid by a company to…

Q: Adamson Corporation is considering four average-risk projects with the following costs and rates of…

A: Capital budgeting indicates the evaluation of the profitability of possible investments and projects…

Q: A firm with a corporatewide debt-to-equity ratio of 1:2, an after-tax cost of debt of 7%, and a cost…

A: Weighted average cost of capital (WACC) is also known as the Composite Cost of Capital or Average…

Q: a. What is the company’s expected growth rate? b. If the firm’s net income is expected to be $1.1…

A: A company’s growth rate is used to assess its performance over a period of time and is useful in…

Q: NEKO Inc. has forecasted that its net income will be P520,000. The company has an debt-to-equity…

A: Debt to equity ratio = 25% Funding amount = P 600000

Q: Panelli's is analyzing a project with an initial cost of $139,000 and cash inflows of $74,000 in…

A: WACC = ( weight of equity * Cost of equity) + ( weight of debt * after Tax cost of debt) = ( 1/1.39…

Q: A firm has an net operating profit of P300,000, interest of P35,000, and a tax rate of 25%. The firm…

A: Net operating profit = P300,000 Before tax cost of debt (Kd) = 0.06 Cost of equity (Ke) = 0.15…

Q: Consider a project of the Cornell Haul Moving Company, the timing and size of the incremental…

A: A firm can finance its business operations through different sources of capital such as equity and…

Q: Adamson Corporation is considering four average-risk projects with the following costs and rates of…

A: The question is based on the concept of Financial Management.

Q: Majan Mining has found that its cost of common equity capital is 15 percent and its cost of debt…

A: The cost of capital is the cost that is incurred by a corporation on the acquisition of capital from…

Q: Suppose that TW, Inc. has a capital structure of 25 percent equity, 15 percent preferred stock, and…

A: Weighted Average Cost of Capital (WACC) is the overall cost of capital from all the sources of…

Q: A firm is financed with a mix of risk-free debt (currently valued at £800,000) and equity (which has…

A: Let's start with the understanding the meaning of weighted average cost of capital it is a…

Q: The ABC corp. is expected to have the earnings before interest and taxes of $60,000 and the…

A: Value of Unlevered firm (Vu)Vu=EBIT1-TRu where T= Tax rate, Ru=Unlevered cost of capital Value of…

Q: The ABC corp. is expected to have the earnings before interest and taxes of $60,000 and the…

A: As per MM proportion 2 value of unlevered firm will increase by present value of tax shield provided…

Q: The firm is financed with debt and equity. The book value of the debt is $10,000,000; the book value…

A: Weighted average cost of capital (WACC) refers to the average cost that is paid by a company to…

Q: Majan Mining has found that its cost of common equity capital is 15 percent and its cost of debt…

A: Given that, cost of common equity capital is 15 percent cost of debt capital is 12 percent common…

Q: A firm has total assets of $1,000,000 and a debt ratio of 30 percent. Currently, it has sales of…

A: Return on equity (ROE):It is a profitability measure that is related with the firm's equity. It is…

Q: Medallion Cooling Systems, has total assets of $10,900,000, EBIT of $1,990,000, and preferred…

A: The earnings per share ratio are used to measure a company's profitability. It shows the amount of…

Q: You have been asked to value a firm with expected annual after-tax cash flows, before debt payments,…

A: Capital structure of the firm consists of both debt and equity. Cost of raising funds from each…

Q: Your company is financed 20% with riskless debt with a yield of 6% and 80% with equity with a cost…

A: Debt ratio = 20% Debt yield = 6% Equity ratio = 80% Cost of equity = 14%

Q: An unlevered firm has a value of $800 million. An otherwise identical butlevered firm has $60…

A: The question is based on the concept of MM model of corporate valuation with levered firm. Formula…

Q: A firm has an net operating profit of P300,000, interest of P35,000, and a tax rate of 25%. The firm…

A: WACC = (Ke*Wk) + (Kd*(1-t)*Wd) Where Ke = Cost of equity Kd = Cost of debt Wk = weight of equity…

Q: The company estimates that it can issue debt at a rate of rd = 10%, and its tax rate is 25%. It can…

A: Formula:

Q: You were hired as a consultant to ABC Company, whose target capital structure is 35% debt, 15%…

A: The Weighted average cost of capital(WACC) is the average cost of capital, in which each category of…

Q: firm has a capital budget of $30 million, net income of $35 million, and a targetcapital structure…

A: Given, Capital Budget = $30 million Net Income =$35 million Target Capital Structure, Debt = 45%…

Q: LCG Distribution Company is in the process of setting its target capital structure. The CFO believes…

A:

Q: Southern Timber Company expects to have an EBIT of $10 million in the coming year, and its EBIT is…

A: According to M&M Model the value of levered firm will be sum of value of unlevered firm plus tax…

Q: Kahn Inc. has a target capital structure of 50% common equity and 50% debt to fund its $12 billion…

A: Price of share = Dividend1Cost of equity - growth rate Return on equity = net inocome equity×100

Q: a firm has an asset base with a market value of 5.3 million. ITs debt is worth 2.5 million. if 0.2…

A: Weighted average cost of capital can be used to estimate the rate which should be provided to…

Q: Widgets Inc has an expected EBIT of $64,000 in perpetuity and a tax rate of 35 percent. The firm has…

A: The question is based on assumptions of MM proposition I with taxes, the value of firm may increase…

Q: Tiger Valley Inc recently had you estimate the cost of each of its capital sources. The firm…

A: The weighted average cost of capital computes the weighted cost of sourcing funds from different…

Step by step

Solved in 2 steps

- A firm with a corporatewide debt-to-equity ratio of 1:2,an after-tax cost of debt of 7%, and a cost of equity capital of 15% is interested in pursuing a foreign project. Thedebt capacity of the project is the same as for the company as a whole, but its systematic risk is such that therequired return on equity is estimated to be about 12%.The after-tax cost of debt is expected to remain at 7%.What is the project’s weighted average cost of capital? Howdoes it compare with the parent’s WACC?Bob-Bye, Inc. has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The WACC is to be measured by using the following weights:: 40% long term debt, 10% preferred stock, and 50% common stock equity (retained earnings,new common stock or both). The firm’s tax is 30%. Debt: The firm can sell for P980, a 10-year, P1,000 par value bond paying annual interest at 13% coupon rate. A flotation cost of 3% of the par value is required in addition to the discount of P20 per bond. Preferred Stock: 8 percent (annual divided) preferred stock having a par value of P100 can be sold for P65. An additional fee of P2 per share must be paid to the underwriters. Common Stock: The firm’s common stock is currently selling for P50 per share. The dividend expected to be paid at the end of the coming year is P4 per share.. Its dividend payments which have been approximately 60% of earnings per share in each of the past 5…A firm is financed with a mix of risk-free debt (currently valued at £800,000) and equity (which has a current market value of £1,200,000). The risk-free rate is 8%, the firm's cost of equity capital is 14%. What is the firm's weighted average cost of capital (to the nearest 0.01%) (i) with no taxation and (ii) if the firm's marginal tax rate is 40% and debt interest payments are tax deductible.? Select an answer and submit. For keyboard navigation, use the up/down arrok keys to select an answer. a (i) 11.60% and (ii) 10.32% b (i) 10.40% and (ii) 8.48% (i) 11.60% and (ii) 8.48% d. None of the above. (1) 10.40% and (11) 10.32% Unanswered Save

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 10% preferred stock, and 60% common stock equity (retained earnings, new common�� stock, or both). The firm's tax rate is 23%. Debt : The firm can sell for $1030 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock: 9.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92.An additional fee of $2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, D0, that the company just recently made.…

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 10% preferred stock, and 60% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 23%. Debt : The firm can sell for $1030 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock: 9.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92.An additional fee of $2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, D0, that the company just recently made.…Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…

- altamonte telecommunications has a target capital structure that consist of 45% debt and 55% equity. the company anticipates that its capital budget for the upcoming year will be $1,000,000. if altamonte reports net income of $1,200,000 and it follows a residual dividend payout policy, what will be its dividend payout ratio?Shoobee, Inc. has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average of capital. The WACC it to be measured by using the following weights: 50% long term, 10% preferred stock, and 40% common stock equity (retained earnings, new common stock issuance, or both). The firm tax is 25%. Debt: The firm can sell for P980, a 10-year, P1,000 par value bond paying annual interest at 13% coupon rate. A flotation cost of 3% of the par value is required in addition to the discount of P20 per bond. Preferred stock: 8 percent (annual dividend) preferred stock having a par value of P100 can be sold for P65. An additional fee of P2.00 per share must be paid to the underwriters. Common stock: The firm’s common stock is currently selling for P50 per share. The recent dividend paid was P4.00 per share. Its dividend payments which have approximately 60% of earnings per share in each past 6 years follows: Year Dividend 2021 P4.00 2020 3.75…Widgets Inc has an expected EBIT of $64,000 in perpetuity and a tax rate of 35 percent. The firm has$95,000 in outstanding debt at an interest rate of 8.5 percent, and its unlevered cost of capital is 15percent. What is the value of the firm according to M&M Proposition I with taxes? Should the companychange its debt–equity ratio if the goal is to maximize the value of the firm? Explain.