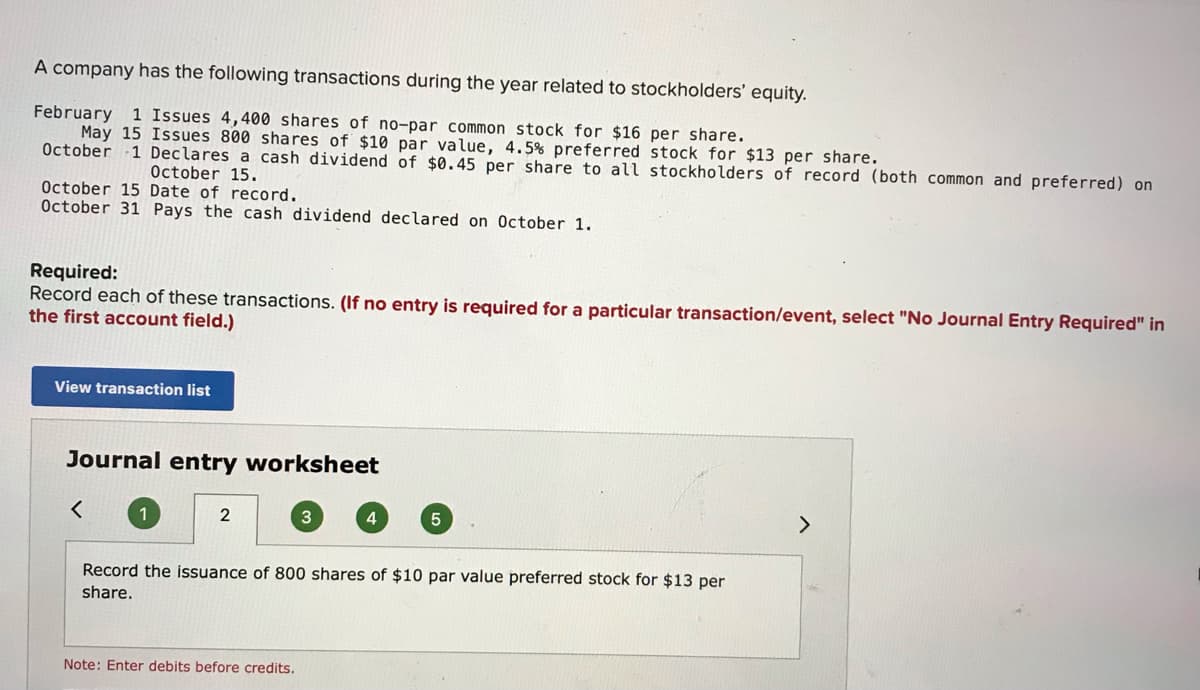

A company has the following transactions during the year related to stockholders' equity. February 1 Issues 4,400 shares of no-par common stock for $16 per share. May 15 Issues 800 shares of $10 par value, 4.5% preferred stock for $13 per share. October 1 Declares a cash dividend of $0.45 per share to all stockholders of record (both common and preferred) on October 15. October 15 Date of record. October 31 Pays the cash dividend declared on October 1. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the issuance of 800 shares of $10 par value preferred stock for $13 per share.

A company has the following transactions during the year related to stockholders' equity. February 1 Issues 4,400 shares of no-par common stock for $16 per share. May 15 Issues 800 shares of $10 par value, 4.5% preferred stock for $13 per share. October 1 Declares a cash dividend of $0.45 per share to all stockholders of record (both common and preferred) on October 15. October 15 Date of record. October 31 Pays the cash dividend declared on October 1. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the issuance of 800 shares of $10 par value preferred stock for $13 per share.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 4R: The following selected transactions and events occurred during 2013: a. Issued 200 shares of...

Related questions

Question

Transcribed Image Text:A company has the following transactions during the year related to stockholders' equity.

February 1 Issues 4,400 shares of no-par common stock for $16 per share.

May 15 Issues 800 shares of $10 par value, 4.5% preferred stock for $13 per share.

October 1 Declares a cash dividend of $0.45 per share to all stockholders of record (both common and preferred) on

October 15.

October 15 Date of record.

October 31 Pays the cash dividend declared on October 1.

Required:

Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in

the first account field.)

View transaction list

Journal entry worksheet

1

2

4.

Record the issuance of 800 shares of $10 par value preferred stock for $13 per

share.

Note: Enter debits before credits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning