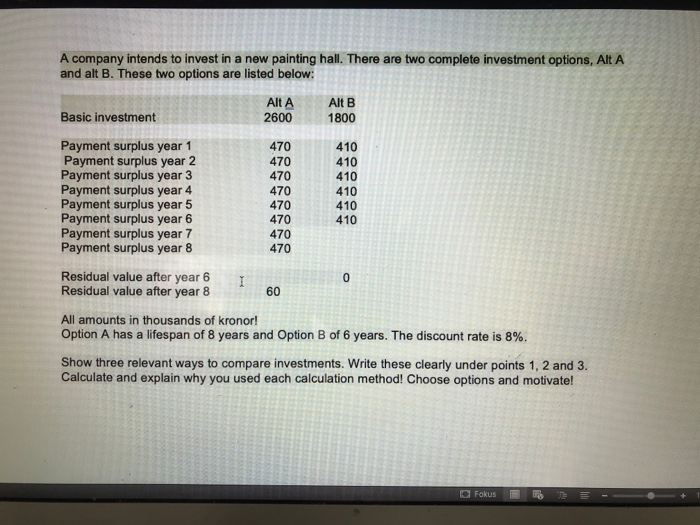

A company intends to invest in a new painting hall. There are two complete investment options, Alt A and alt B. These two options are listed below: Alt A 2600 Alt B Basic investment 1800 Payment surplus year 1 Payment surplus year 2 Payment surplus year 3 Payment surplus year 4 Payment surplus year 5 Payment surplus year 6 Payment surplus year 7 Payment surplus year 8 470 470 470 470 470 470 410 410 410 410 410 410 470 470 Residual value after year 6 I Residual value after year 8 60 All amounts in thousands of kronor! Option A has a lifespan of 8 years and Option B of 6 years. The discount rate is 8%. Show three relevant ways to compare investments. Write these clearly under points 1, 2 and 3. Calculate and explain why you used each calculation method! Choose options and motivate!

A company intends to invest in a new painting hall. There are two complete investment options, Alt A and alt B. These two options are listed below: Alt A 2600 Alt B Basic investment 1800 Payment surplus year 1 Payment surplus year 2 Payment surplus year 3 Payment surplus year 4 Payment surplus year 5 Payment surplus year 6 Payment surplus year 7 Payment surplus year 8 470 470 470 470 470 470 410 410 410 410 410 410 470 470 Residual value after year 6 I Residual value after year 8 60 All amounts in thousands of kronor! Option A has a lifespan of 8 years and Option B of 6 years. The discount rate is 8%. Show three relevant ways to compare investments. Write these clearly under points 1, 2 and 3. Calculate and explain why you used each calculation method! Choose options and motivate!

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 52P

Related questions

Question

solve this early with explanation.

Transcribed Image Text:A company intends to invest in a new painting hall. There are two complete investment options, Alt A

and alt B. These two options are listed below:

Alt A

2600

Alt B

Basic investment

1800

Payment surplus year 1

Payment surplus year 2

Payment surplus year 3

Payment surplus year 4

Payment surplus year 5

Payment surplus year 6

Payment surplus year 7

Payment surplus year 8

470

470

470

470

470

470

410

410

410

410

410

410

470

470

Residual value after year 6

I

Residual value after year 8

60

All amounts in thousands of kronor!

Option A has a lifespan of 8 years and Option B of 6 years. The discount rate is 8%.

Show three relevant ways to compare investments. Write these clearly under points 1, 2 and 3.

Calculate and explain why you used each calculation method! Choose options and motivate!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College