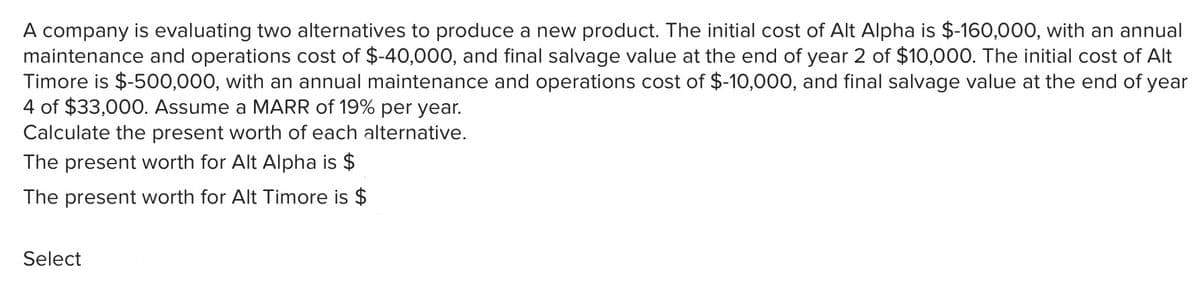

A company is evaluating two alternatives to produce a new product. The initial cost of Alt Alpha is $-160,000, with an annual $10,000. The initial cost of Alt maintenance and operations cost of $-40,000, and final salvage value at the end of year 2 Timore is $-500,000, with an annual maintenance and operations cost of $-10,000, and final salvage value at the end of year 4 of $33,000. Assume a MARR of 19% per year. Calculate the present worth of each alternative. The present worth for Alt Alpha is $ The present worth for Alt Timore is $ Select

A company is evaluating two alternatives to produce a new product. The initial cost of Alt Alpha is $-160,000, with an annual $10,000. The initial cost of Alt maintenance and operations cost of $-40,000, and final salvage value at the end of year 2 Timore is $-500,000, with an annual maintenance and operations cost of $-10,000, and final salvage value at the end of year 4 of $33,000. Assume a MARR of 19% per year. Calculate the present worth of each alternative. The present worth for Alt Alpha is $ The present worth for Alt Timore is $ Select

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 22P: The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500,...

Related questions

Question

WHY IS THE ANSWER WRONG ? HELP FIND THE CORRECT ANSWER FOR ALT ALPHA (not a graded assignment but for practice).

Present worth for Alt Timore :

-500,000 -10,000(P/A,19%,4) + 33,000(P/F,19%,4) = -509933 ---> Correct answer

Applying the same formula to find Present worth Alt Alpha :

-160,000 - 40,000(P/A,19%,2) + 10,000(P/F,19%,2) = -214818 ----> Wrong answer

Transcribed Image Text:A company is evaluating two alternatives to produce a new product. The initial cost of Alt Alpha is $-160,000, with an annual

maintenance and operations cost of $-40,000, and final salvage value at the end of year 2 of $10,000. The initial cost of Alt

Timore is $-500,000, with an annual maintenance and operations cost of $-10,000, and final salvage value at the end of year

4 of $33,000. Assume a MARR of 19% per year.

Calculate the present worth of each alternative.

The present worth for Alt Alpha is $

The present worth for Alt Timore is $

Select

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning