A company issued bonds with a par value of $250,000 and a maturity of 25 y Bonds pay interest every six months based on a nominal interest rate of 8% p issuance of the bonds the market rate (yield) is 10%: a. What will be the selling price of the bonds? b. If after 15 years the company retires the bonds, paying the amount of $225 gain or loss on debt retirement? Go back and assume that the market rate is 5.75%. a. What will be the selling price of the bonds?

A company issued bonds with a par value of $250,000 and a maturity of 25 y Bonds pay interest every six months based on a nominal interest rate of 8% p issuance of the bonds the market rate (yield) is 10%: a. What will be the selling price of the bonds? b. If after 15 years the company retires the bonds, paying the amount of $225 gain or loss on debt retirement? Go back and assume that the market rate is 5.75%. a. What will be the selling price of the bonds?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 21E

Related questions

Question

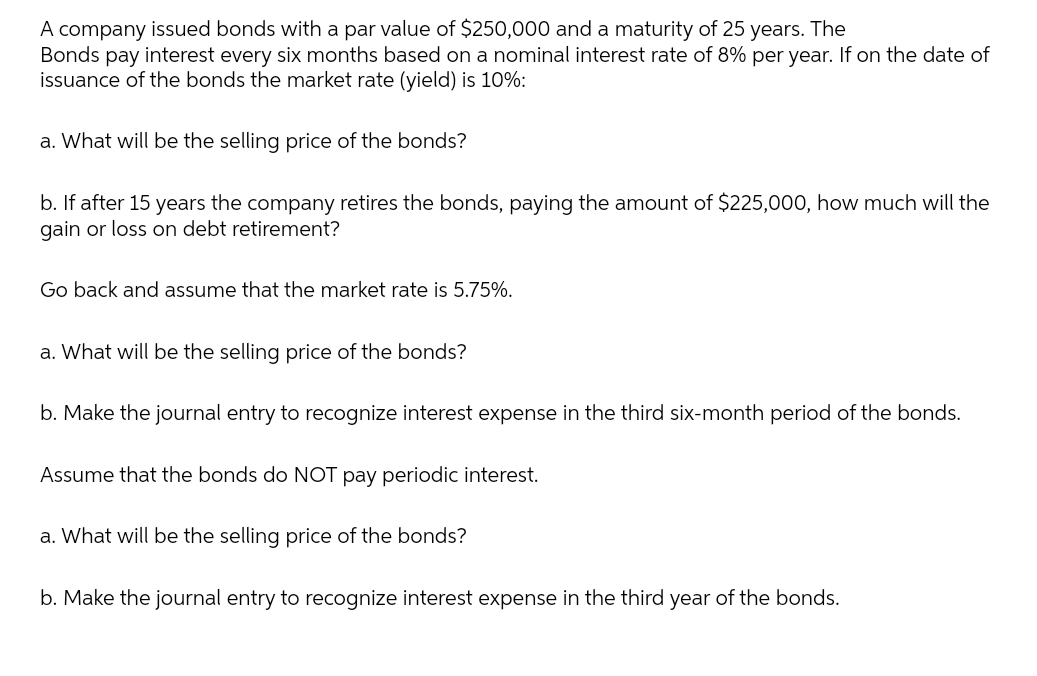

Transcribed Image Text:A company issued bonds with a par value of $250,000 and a maturity of 25 years. The

Bonds pay interest every six months based on a nominal interest rate of 8% per year. If on the date of

issuance of the bonds the market rate (yield) is 10%:

a. What will be the selling price of the bonds?

b. If after 15 years the company retires the bonds, paying the amount of $225,000, how much will the

gain or loss on debt retirement?

Go back and assume that the market rate is 5.75%.

a. What will be the selling price of the bonds?

b. Make the journal entry to recognize interest expense in the third six-month period of the bonds.

Assume that the bonds do NOT pay periodic interest.

a. What will be the selling price of the bonds?

b. Make the journal entry to recognize interest expense in the third year of the bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning