A company needs to raise $880 million (This is the gross amount to be raised including the underwriting fee) f share offering. The underwriter provides best-effort underwriting service and charges 6% on the gross amount raised. Using this information answer parts a), b) and c) below a) If the share offering is successful, how much money would the company get? Round your answer to th nearest 0.01 million.

A company needs to raise $880 million (This is the gross amount to be raised including the underwriting fee) f share offering. The underwriter provides best-effort underwriting service and charges 6% on the gross amount raised. Using this information answer parts a), b) and c) below a) If the share offering is successful, how much money would the company get? Round your answer to th nearest 0.01 million.

Chapter3: The Financial Environment: Markets, Institutions And Investment Banking

Section: Chapter Questions

Problem 16PROB

Related questions

Question

7

Transcribed Image Text:Question 7 (

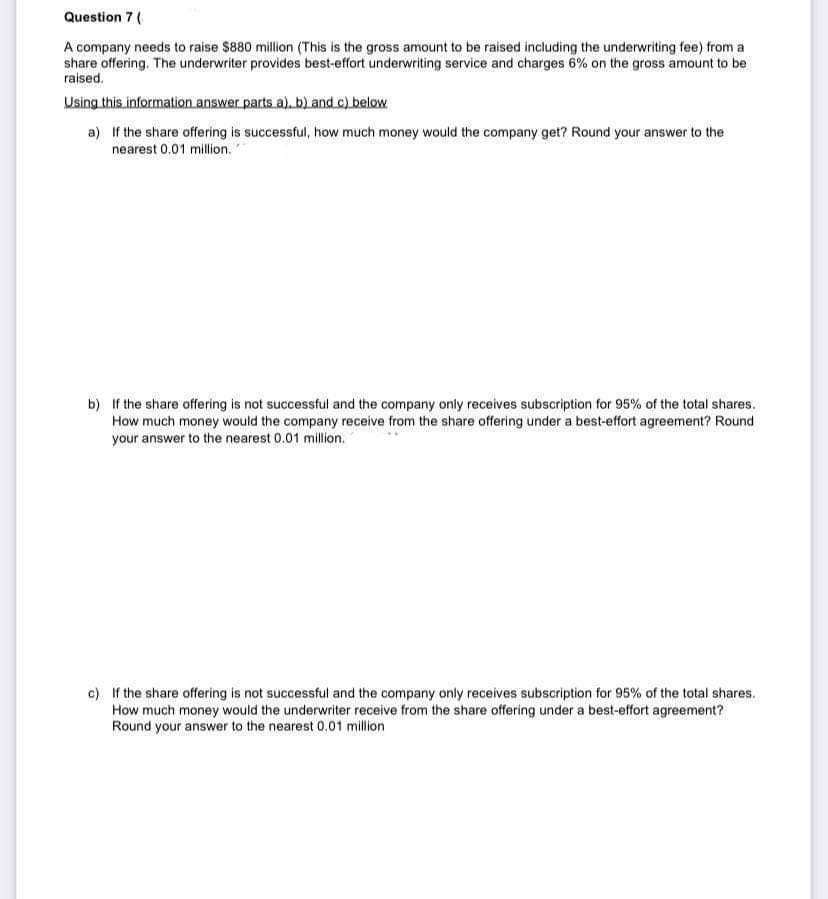

A company needs to raise $880 million (This is the gross amount to be raised including the underwriting fee) from a

share offering. The underwriter provides best-effort underwriting service and charges 6% on the gross amount to be

raised.

Using this information answer parts a), b) and c) below

a) If the share offering is successful, how much money would the company get? Round your answer to the

nearest 0.01 million.

b) If the share offering is not successful and the company only receives subscription for 95% of the total shares.

How much money would the company receive from the share offering under a best-effort agreement? Round

your answer to the nearest 0.01 million.

c) If the share offering is not successful and the company only receives subscription for 95% of the total shares.

How much money would the underwriter receive from the share offering under a best-effort agreement?

Round your answer to the nearest 0.01 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT