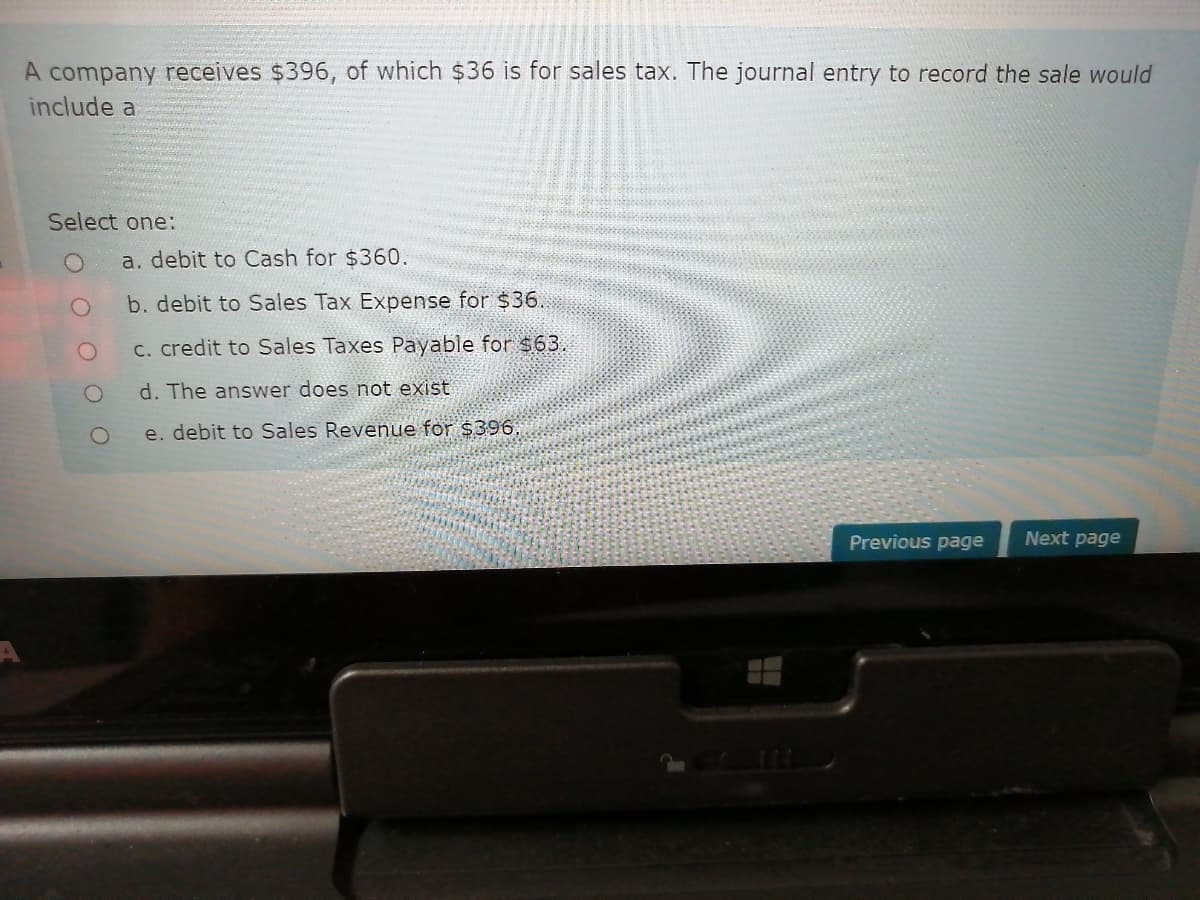

A company receives $396, of which $36 is for sales tax. The journal entry to record the sale would include a Select one: a. debit to Cash for $360. b. debit to Sales Tax Expense for $36. C. credit to Sales Taxes Payable for $63. d. The answer does not exist e. debit to Sales Revenue for $396.

A company receives $396, of which $36 is for sales tax. The journal entry to record the sale would include a Select one: a. debit to Cash for $360. b. debit to Sales Tax Expense for $36. C. credit to Sales Taxes Payable for $63. d. The answer does not exist e. debit to Sales Revenue for $396.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PA: Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the...

Related questions

Question

Transcribed Image Text:A company receives $396, of which $36 is for sales tax. The journal entry to record the sale would

include a

Select one:

a. debit to Cash for $360.

b. debit to Sales Tax Expense for $36.

C. credit to Sales Taxes Payable for $63.

d. The answer does not exist

e. debit to Sales Revenue for $396,

Previous page

Next page

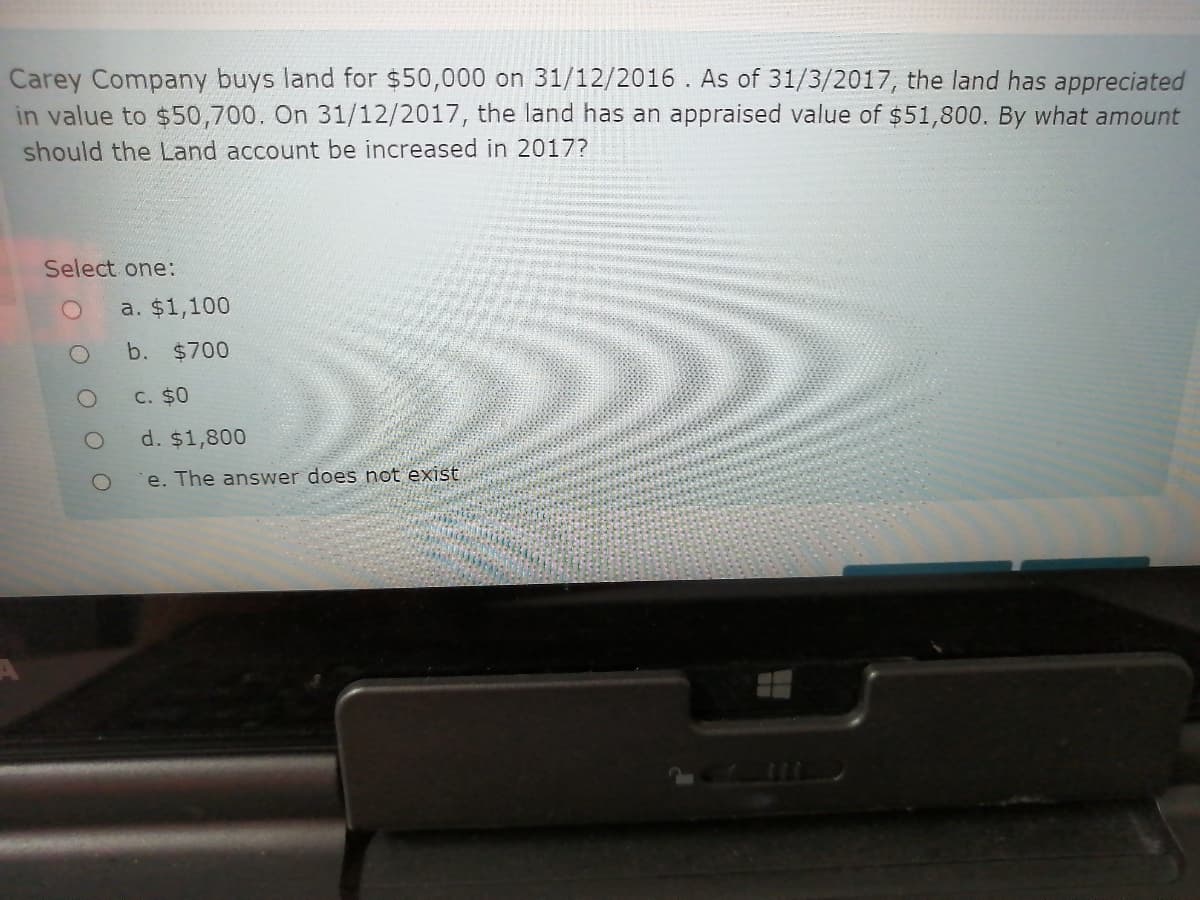

Transcribed Image Text:Carey Company buys land for $50,000 on 31/12/2016 . As of 31/3/2017, the land has appreciated

in value to $50,700. On 31/12/2017, the land has an appraised value of $51,800. By what amount

should the Land account be increased in 2017?

Select one:

a. $1,100

b. $700

C. $0

d. $1,800

e. The answer does not exist

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning