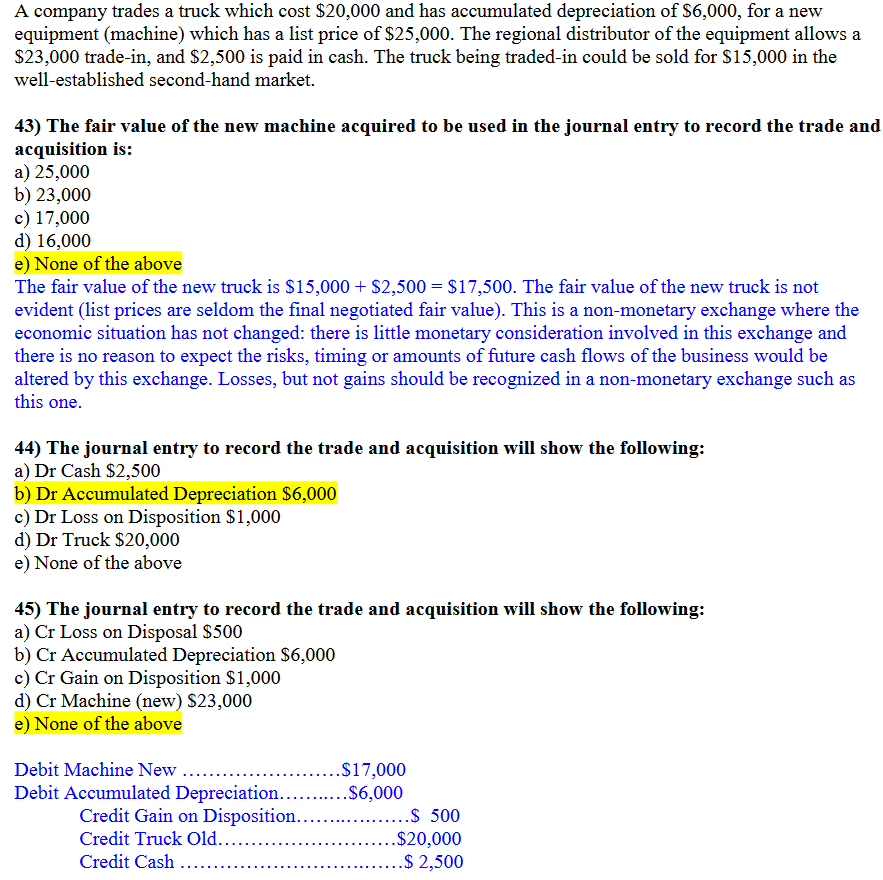

A company trades a truck which cost $20,000 and has accumulated depreciation of $6,000, for a new equipment (machine) which has a list price of $25,000. The regional distributor of the equipment allows a $23,000 trade-in, and $2,500 is paid in cash. The truck being traded-in could be sold for $15,000 in the well-established second-hand market.

A company trades a truck which cost $20,000 and has accumulated depreciation of $6,000, for a new equipment (machine) which has a list price of $25,000. The regional distributor of the equipment allows a $23,000 trade-in, and $2,500 is paid in cash. The truck being traded-in could be sold for $15,000 in the well-established second-hand market.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 12PB: Farm Fresh Agriculture Company purchased Sunny Side Egg Distribution for $400,000 cash when Sunny...

Related questions

Question

can you please explain these answers again simply

Transcribed Image Text:A company trades a truck which cost $20,000 and has accumulated depreciation of $6,000, for a new

equipment (machine) which has a list price of $25,000. The regional distributor of the equipment allows a

$23,000 trade-in, and $2,500 is paid in cash. The truck being traded-in could be sold for $15,000 in the

well-established second-hand market.

43) The fair value of the new machine acquired to be used in the journal entry to record the trade and

acquisition is:

a) 25,000

b) 23,000

c) 17,000

d) 16,000

e) None of the above

The fair value of the new truck is $15,000+ $2,500 = $17,500. The fair value of the new truck is not

evident (list prices are seldom the final negotiated fair value). This is a non-monetary exchange where the

economic situation has not changed: there is little monetary consideration involved in this exchange and

there is no reason to expect the risks, timing or amounts of future cash flows of the business would be

altered by this exchange. Losses, but not gains should be recognized in a non-monetary exchange such as

this one.

44) The journal entry to record the trade and acquisition will show the following:

a) Dr Cash $2,500

b) Dr Accumulated Depreciation $6,000

c) Dr Loss on Disposition $1,000

d) Dr Truck $20,000

e) None of the above

45) The journal entry to record the trade and acquisition will show the following:

a) Cr Loss on Disposal $500

b) Cr Accumulated Depreciation $6,000

c) Cr Gain on Disposition $1,000

d) Cr Machine (new) $23,000

e) None of the above

Debit Machine New ....

Debit Accumulated Depreciation...........$6,000

Credit Gain on Disposition..

Credit Truck Old....

Credit Cash ....

.$17,000

.$ 500

.$20,000

..$ 2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning