A Company uses a job order costing system and allocates its manufacturing overhead costs based on direct labor costs. The Company's production costs for the year were: direct labor, $80,000; direct materials, $40,000; and factory overhead applied $20,000. The predetermined overhead rate was: O a. 4%. O b. 50%. O. 200%. O d. 25%. O e. 400.%.

A Company uses a job order costing system and allocates its manufacturing overhead costs based on direct labor costs. The Company's production costs for the year were: direct labor, $80,000; direct materials, $40,000; and factory overhead applied $20,000. The predetermined overhead rate was: O a. 4%. O b. 50%. O. 200%. O d. 25%. O e. 400.%.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter14: Decentralized Operations

Section: Chapter Questions

Problem 14.3E

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:17649928cmid 8751838pages6

wo ahttps//altemativet

4 SQUCOFFEE - Goog. B BCOM2911-Busines. D Sultan Caboos Univ. G Trading Platform C.

MIC)

E-LEARNING SERVICES SQU LIBRARIES -

Accounting C

SQU PORTAL ATTENDANCE

gerial Accounting - Spring21

murses / ACCT2121_yasserg Spring21 / Midterm Exam One / Midterm Exam One

Time left 1:51:50

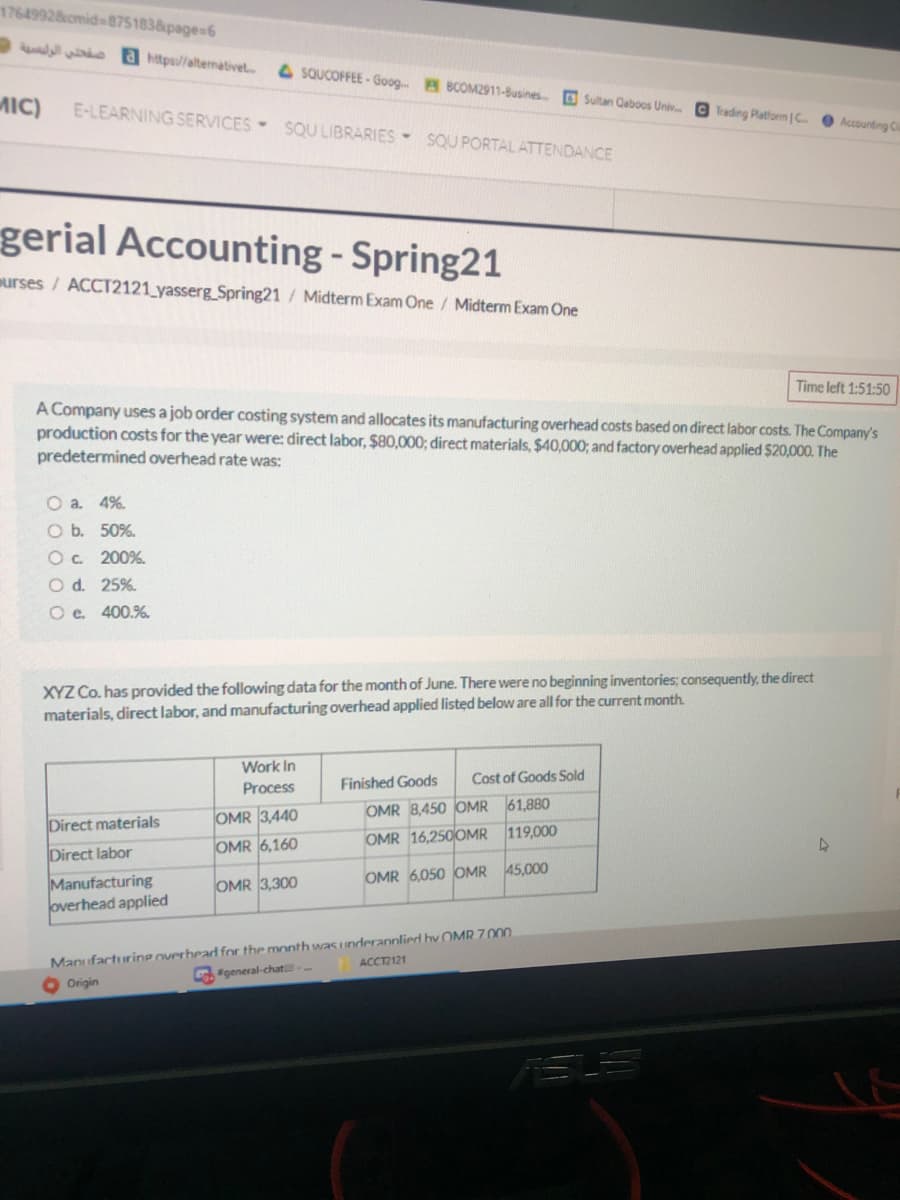

A Company uses a job order costing system and allocates its manufacturing overhead costs based on direct labor costs. The Company's

production costs for the year were: direct labor, $80,000; direct materials, $40,000; and factory overhead applied $20,000. The

predetermined overhead rate was:

O a. 4%.

O b. 50%.

Oc 200%.

O d. 25%.

O e. 400.%.

XYZ Co. has provided the following data for the month of June. There were no beginning inventories; consequently, the direct

materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Work In

Finished Goods

Cost of Goods Sold

Process

OMR 8,450 OMR

61,880

Direct materials

OMR 3,440

OMR 16,250OMR 119,000

Direct labor

OMR 6,160

45,000

OMR 6,050 OMR

Manufacturing

overhead applied

OMR 3,300

Manufacturing overheadfor the month was underannlied hy OMR7000

ACCT2121

G. general-chat

O Origin

Transcribed Image Text:attempt=17649928cmid38751838page=6

صفحتي الوليسية

a https//alternativet

SQUCOFFEE - Goog A BCOM2911-Busines

O Sultan Qaboos Univ..

ADEMIC)

G Trading Platform[C O Accounting Club

E-LEARNING SERVICES - SQU LIBRARIES SQU PORTAL ATTENDANCE

on

Time lert 1:51:30

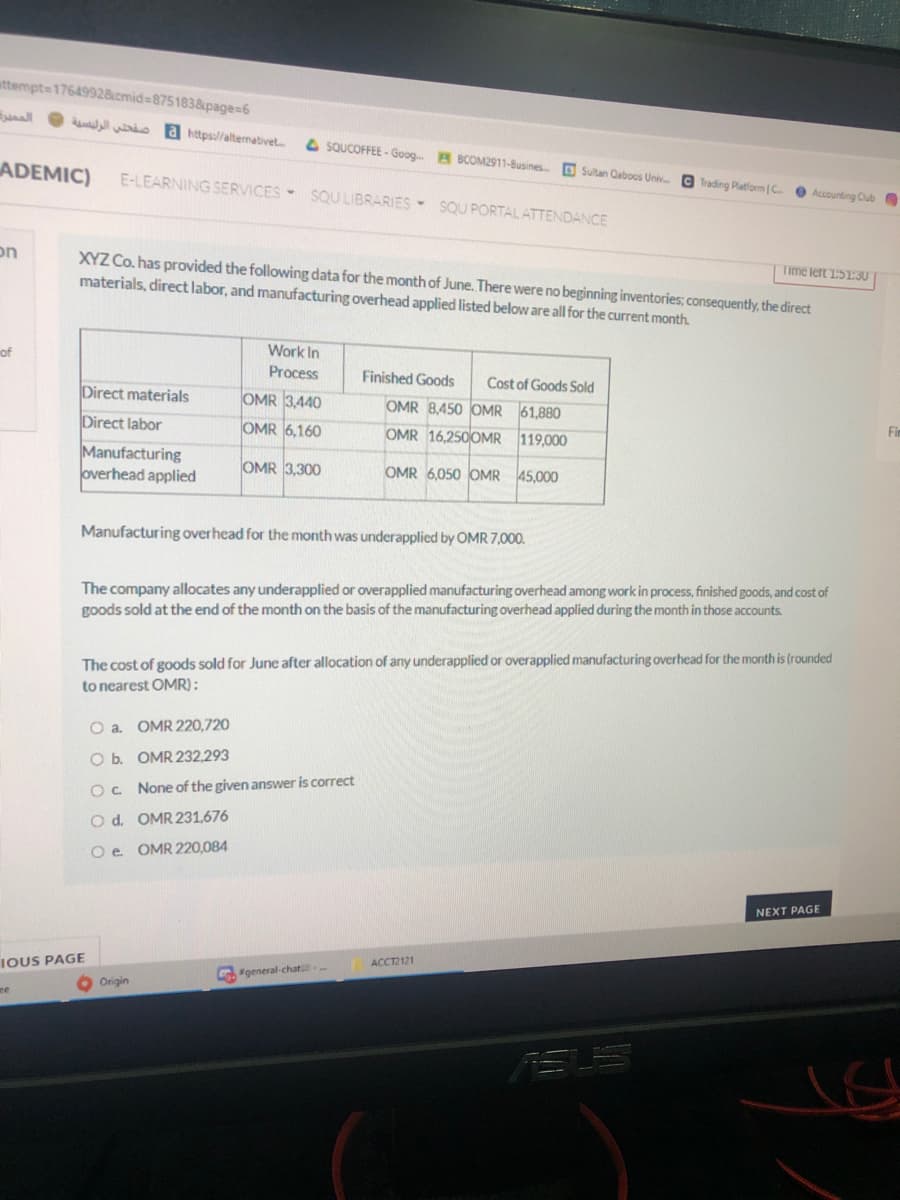

XYZ Co. has provided the following data for the month of June. There were no beginning inventories; consequently, the direct

materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Work In

of

Process

Finished Goods

Cost of Goods Sold

Direct materials

OMR 3,440

OMR 8,450 OMR 61,880

Direct labor

OMR 6,160

OMR 16,2500MR

Fim

119,000

Manufacturing

overhead applied

OMR 3,300

OMR 6,050 OMR

45,000

Manufacturing overhead for the month was underapplied by OMR 7,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of

goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

The cost of goods sold for June after allocation of any underapplied or overapplied manufacturing overhead for the month is (rounded

to nearest OMR):

O a OMR 220,720

O b. OMR 232.293

OC None of the given answer is correct

O d. OMR 231.676

Oe OMR 220,084

NEXT PAGE

ACCT2121

IOUS PAGE

G"general-chat

O Origin

ee

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning