A company with annual sales of $22,000,000 is considering changing its payment terms from net 40 to net 30 to encourage

A company with annual sales of $22,000,000 is considering changing its payment terms from net 40 to net 30 to encourage customers to pay more promptly. The company

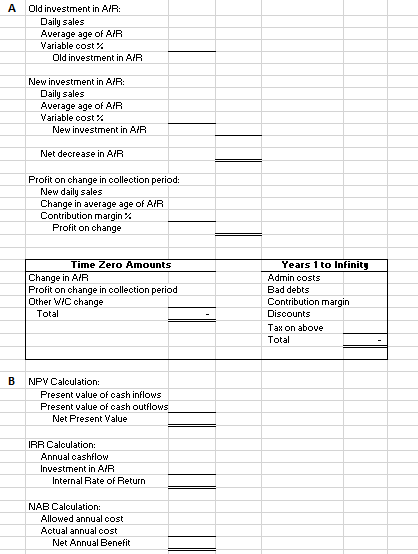

Part A: Calculate the incremental cash flows from accepting this proposal, and organize your cash flows into a cash flow spreadsheet.

Part B: Calculate the proposal's

Part C: Should the company shorten its payment terms?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images