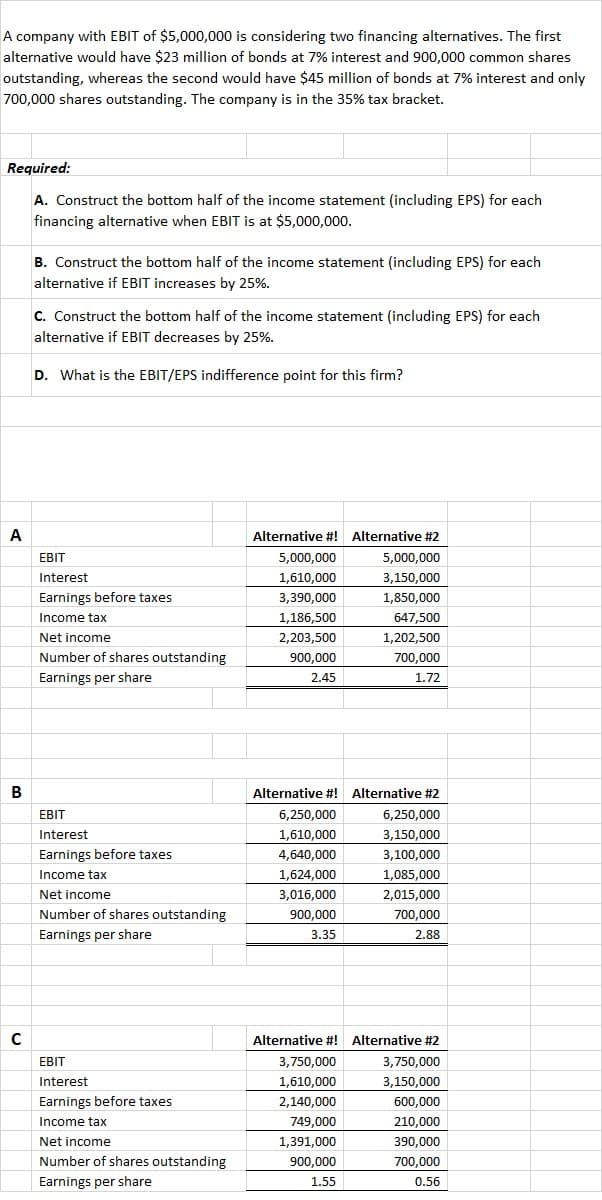

A company with EBIT of $5,000,000 is considering two financing alternatives. The first alternative would have $23 million of bonds at 7% interest and 900,000 common shares outstanding, whereas the second would have $45 million of bonds at 7% interest and only 700,000 shares outstanding. The company is in the 35% tax bracket. Required: A. Construct the bottom half of the income statement (including EPS) for each financing alternative when EBIT is at $5,000,000. B. Construct the bottom half of the income statement (including EPS) for each alternative if EBIT increases by 25%. c. Construct the bottom half of the income statement (including EPS) for each alternative if EBIT decreases by 25%. D. What is the EBIT/EPS indifference point for this firm?

A company with EBIT of $5,000,000 is considering two financing alternatives. The first alternative would have $23 million of bonds at 7% interest and 900,000 common shares outstanding, whereas the second would have $45 million of bonds at 7% interest and only 700,000 shares outstanding. The company is in the 35% tax bracket. Required: A. Construct the bottom half of the income statement (including EPS) for each financing alternative when EBIT is at $5,000,000. B. Construct the bottom half of the income statement (including EPS) for each alternative if EBIT increases by 25%. c. Construct the bottom half of the income statement (including EPS) for each alternative if EBIT decreases by 25%. D. What is the EBIT/EPS indifference point for this firm?

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 4P

Related questions

Concept explainers

Question

100%

Please help with the formulas that are used in this problem. Thanks!

Transcribed Image Text:A company with EBIT of $5,000,000 is considering two financing alternatives. The first

alternative would have $23 million of bonds at 7% interest and 900,000 common shares

outstanding, whereas the second would have $45 million of bonds at 7% interest and only

700,000 shares outstanding. The company is in the 35% tax bracket.

Required:

A. Construct the bottom half of the income statement (including EPS) for each

financing alternative when EBIT is at $5,000,000.

B. Construct the bottom half of the income statement (including EPS) for each

alternative if EBIT increases by 25%.

C. Construct the bottom half of the income statement (including EPS) for each

alternative if EBIT decreases by 25%.

D. What is the EBIT/EPS indifference point for this firm?

A

Alternative #! Alternative #2

EBIT

5,000,000

5,000,000

Interest

1,610,000

3,150,000

Earnings before taxes

3,390,000

1,850,000

Income tax

1,186,500

647,500

Net income

2,203,500

1,202,500

Number of shares outstanding

900,000

700,000

Earnings per share

2.45

1.72

В

Alternative #! Alternative #2

ЕBIT

6,250,000

6,250,000

Interest

1,610,000

3,150,000

Earnings before taxes

4,640,000

3,100,000

Income tax

1,624,000

1,085,000

Net income

3,016,000

2,015,000

Number of shares outstanding

900,000

700,000

Earnings per share

3.35

2.88

Alternative #! Alternative #2

EBIT

3,750,000

3,750,000

Interest

1,610,000

3,150,000

Earnings before taxes

2,140,000

600,000

Income tax

210.000

749,000

1,391,000

Net income

390,000

Number of shares outstanding

900,000

700,000

Earnings per share

1.55

0.56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning