A company’s capital structure consists solely of debt and common equity. It can issue debt at 15 percent interest rate, and its common stock is expected to pay a $5 dividend per share next year. The stock’s price is currently $40, its dividend is expected to grow at a constant rate of 3 percent per year; its tax rate is 30 percent and its weighted average cost of capital (WACC) is 14 percent. 1. Calculate the after-tax cost of debt and the cost of common equity. 2. What percentage of the company’s capital structure consists of common equity?

A company’s capital structure consists solely of debt and common equity. It can issue debt at 15 percent interest rate, and its common stock is expected to pay a $5 dividend per share next year. The stock’s price is currently $40, its dividend is expected to grow at a constant rate of 3 percent per year; its tax rate is 30 percent and its weighted average cost of capital (WACC) is 14 percent. 1. Calculate the after-tax cost of debt and the cost of common equity. 2. What percentage of the company’s capital structure consists of common equity?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 5MC

Related questions

Question

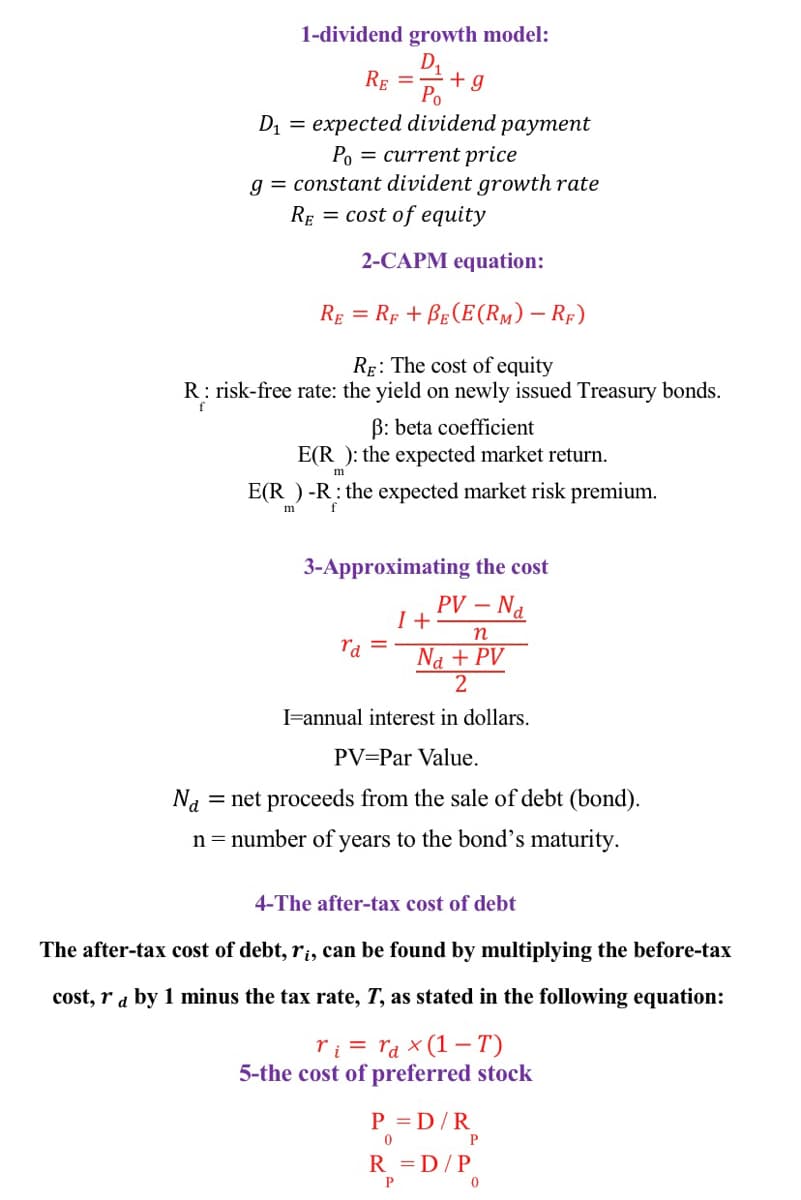

(Please, use these formulas that are in the image only).

A company’s capital structure consists solely of debt and common equity. It can issue debt at 15 percent interest rate, and its common stock is expected to pay a $5 dividend per share next year. The stock’s price is currently $40, its dividend is expected to grow at a constant rate of 3 percent per year; its tax rate is 30 percent and its weighted average cost of capital (WACC) is 14 percent.

1. Calculate the after-tax cost of debt and the cost of common equity.

2. What percentage of the company’s capital structure consists of common equity?

Transcribed Image Text:1-dividend growth model:

D1

RE =

Po

D1 = expected dividend payment

Po = current price

g = constant divident growth rate

RE = cost of equity

2-CAPM equation:

RE = Rp + BE (E(RM) – RF)

Rg: The cost of equity

R: risk-free rate: the yield on newly issued Treasury bonds.

f

B: beta coefficient

E(R ): the expected market return.

E(R ) -R: the expected market risk premium.

m

3-Approximating the cost

PV –.

I +

– Na

n

ra

Na + PV

IFannual interest in dollars.

PV=Par Value.

Na

= net proceeds from the sale of debt (bond).

n = number of years to the bond's maturity.

4-The after-tax cost of debt

The after-tax cost of debt, r¡, can be found by multiplying the before-tax

cost, r a by 1 minus the tax rate, T, as stated in the following equation:

ri = ra x (1 – T)

5-the cost of preferred stock

P = D/R

R = D/P

P

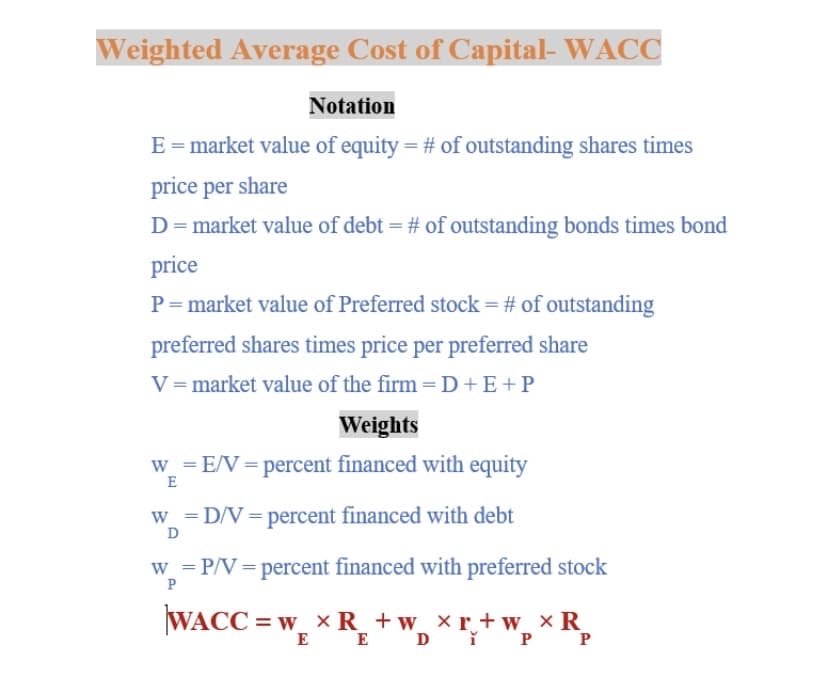

Transcribed Image Text:Weighted Average Cost of Capital- WACC

Notation

E = market value of equity = # of outstanding shares times

price per share

D=market value of debt = # of outstanding bonds times bond

price

P= market value of Preferred stock = # of outstanding

preferred shares times price per preferred share

V= market value of the firm = D +E+P

Weights

W = E/V=percent financed with equity

E

W_ =D/V=percent financed with debt

w = P/V = percent financed with preferred stock

WACC = w x R_ +w_ xr+w × R

E E D ĭ P P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning