(a) Complete Table 2.6 and show that the total depletion allowance exceeds the original investment. (b) Calculate the PV and the IRR for this investment. Assume an interest rate of 20%.

(a) Complete Table 2.6 and show that the total depletion allowance exceeds the original investment. (b) Calculate the PV and the IRR for this investment. Assume an interest rate of 20%.

Chapter10: The Basics Of Capital Budgeting: Evaluating Cash Flows

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:TABLE 2.6

OIL INVESTMENT DETAILS

Year

12345

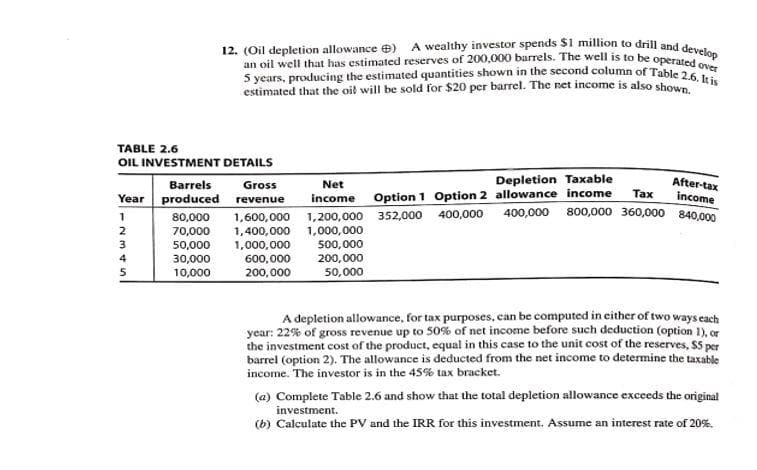

12. (Oil depletion allowance )

A wealthy investor spends $1 million to drill and develop

an oil well that has estimated reserves of 200,000 barrels. The well is to be operated over

5 years, producing the estimated quantities shown in the second column of Table 2.6. It is

estimated that the oil will be sold for $20 per barrel. The net income is also shown.

Barrels

Gross

produced revenue

30,000

10,000

80,000

70,000

50,000 1,000,000 500,000

200,000

50,000

1,600,000

400,000 1,000,000

Net

Depletion Taxable

income Option 1 Option 2 allowance income

400,000

400,000

1,200,000 352,000

600,000

200,000

After-tax

Tax

income

800,000 360,000 840,000

A depletion allowance, for tax purposes, can be computed in either of two ways each

year: 22% of gross revenue up to 50% of net income before such deduction (option 1), or

the investment cost of the product, equal in this case to the unit cost of the reserves, $5 per

barrel (option 2). The allowance is deducted from the net income to determine the taxable

income. The investor is in the 45% tax bracket.

(a) Complete Table 2.6 and show that the total depletion allowance exceeds the original

investment.

(b) Calculate the PV and the IRR for this investment. Assume an interest rate of 20%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning