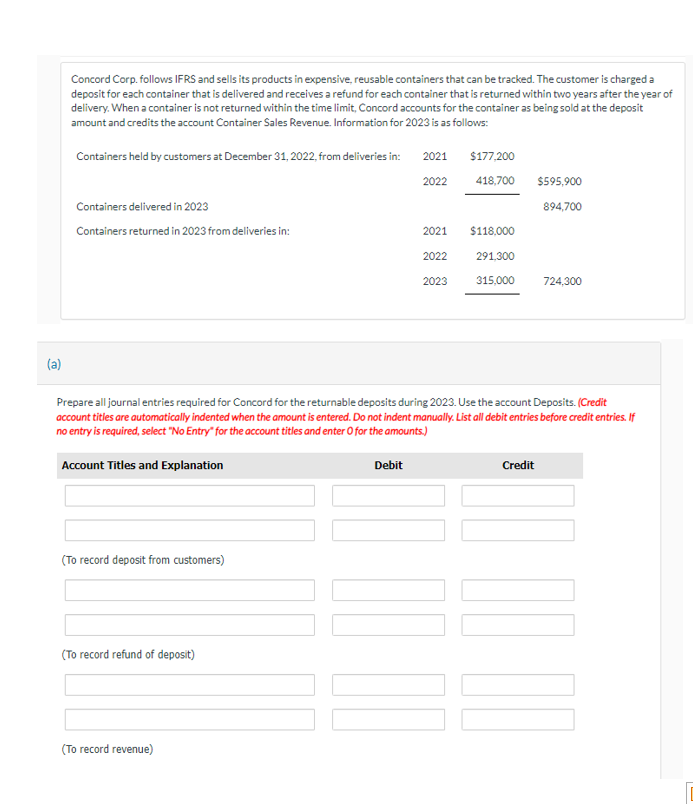

(a) Concord Corp. follows IFRS and sells its products in expensive, reusable containers that can be tracked. The customer is charged a deposit for each container that is delivered and receives a refund for each container that is returned within two years after the year of delivery. When a container is not returned within the time limit, Concord accounts for the container as being sold at the deposit amount and credits the account Container Sales Revenue. Information for 2023 is as follows: Containers held by customers at December 31, 2022, from deliveries in: 2021 2022 Containers delivered in 2023 Containers returned in 2023 from deliveries in: $177,200 418,700 2021 $118,000 2022 291,300 315,000 2023 $595,900 894,700 724,300 Prepare all journal entries required for Concord for the returnable deposits during 2023. Use the account Deposits. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

(a) Concord Corp. follows IFRS and sells its products in expensive, reusable containers that can be tracked. The customer is charged a deposit for each container that is delivered and receives a refund for each container that is returned within two years after the year of delivery. When a container is not returned within the time limit, Concord accounts for the container as being sold at the deposit amount and credits the account Container Sales Revenue. Information for 2023 is as follows: Containers held by customers at December 31, 2022, from deliveries in: 2021 2022 Containers delivered in 2023 Containers returned in 2023 from deliveries in: $177,200 418,700 2021 $118,000 2022 291,300 315,000 2023 $595,900 894,700 724,300 Prepare all journal entries required for Concord for the returnable deposits during 2023. Use the account Deposits. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 24E: Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January...

Related questions

Question

Transcribed Image Text:(a)

Concord Corp. follows IFRS and sells its products in expensive, reusable containers that can be tracked. The customer is charged a

deposit for each container that is delivered and receives a refund for each container that is returned within two years after the year of

delivery. When a container is not returned within the time limit, Concord accounts for the container as being sold at the deposit

amount and credits the account Container Sales Revenue. Information for 2023 is as follows:

Containers held by customers at December 31, 2022, from deliveries in: 2021

2022

Containers delivered in 2023

Containers returned in 2023 from deliveries in:

Account Titles and Explanation

(To record deposit from customers)

(To record refund of deposit)

(To record revenue)

Prepare all journal entries required for Concord for the returnable deposits during 2023. Use the account Deposits. (Credit

account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Debit

$177,200

418,700

2021 $118,000

2022

291,300

315,000

2023

$595,900

894,700

Credit

724,300

10000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT