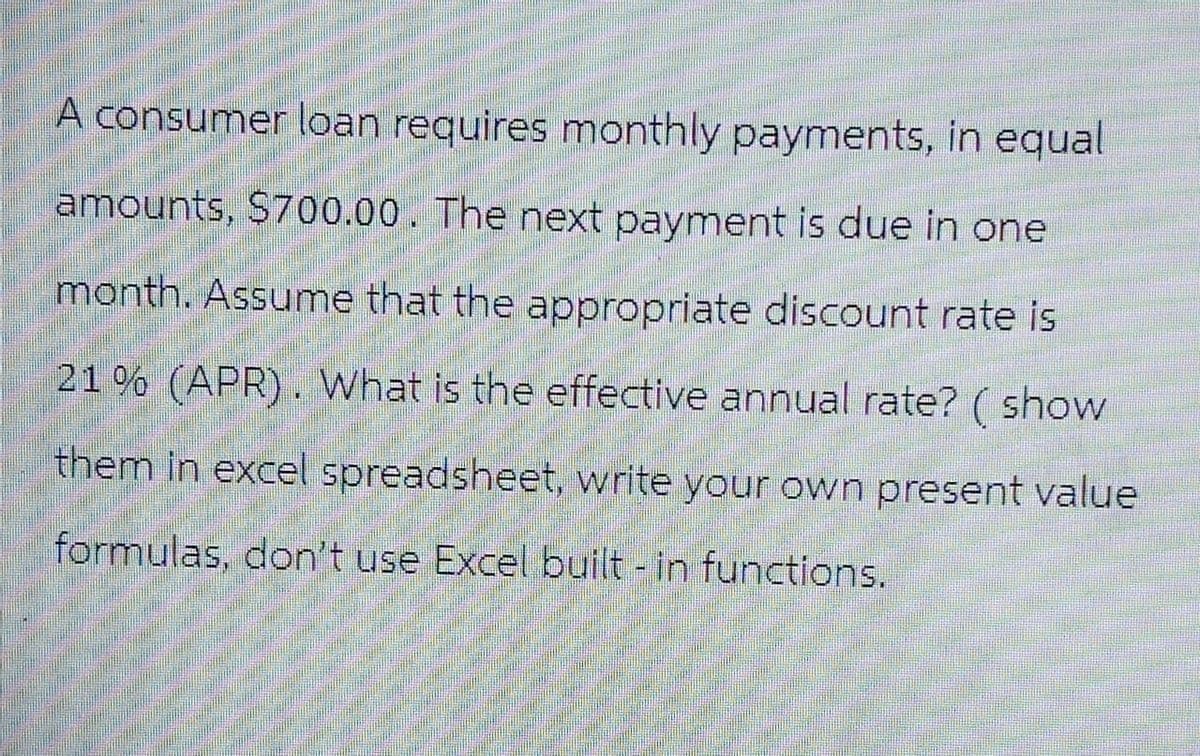

A consumer loan requires monthly payments, in e amounts, $700.00. The next payment is due in or month. Assume that the appropriate discount rate 21% (APR). What is the effective annual rate? (s

Q: You've collected the following information from your favorite financial website. 52-Week Price Lo…

A: Winter Sports information:Dividend yield = 1.9%Dividend = 1.57PE ratio = 15.5growth rate =4%actual…

Q: Rader Railway is determining whether to purchase a new rail setter, which has a base price of…

A: NPV is also known as Net Present Value.. It is a capital budgeting technique which helps in decision…

Q: Michael is an accountant who works as a teacher on weekends. Here is his income from W-2 and 1099…

A: Total Income of a person includes income and earning from all sources of income. It can be any major…

Q: Kerrie Glass, Inc. had a 'days in inventory' of 5. Cost of goods sold was $6,643. If the company had…

A: Days in Inventory =(Inventory / Cost of goods sold) x 365=>5 = (Inventory / $6,643) x…

Q: There is another security, C, whose payoff at t=1 is equal to $300 in the weak state and$600 in the…

A: Here,Payoff in Weak State of Security C at t=1 is $300Payoff in Strong State of Security C at t=1 is…

Q: andra has just signed a 7-year lease for her new business. The full annual lease amount is due at…

A: Annual lease=$25918Period=n=7years.Interest rate=8%Growth rate=4%

Q: A 30-year fully amortizing mortgage loan was made 10 years ago for $75,000 at 6 percent interest.…

A: A debt is a source of capital that is borrowed by institutions at a predetermined rate of interest,…

Q: Marcel Co. is growing quickly. Dividends are expected to grow at a rate of 0.15 for the next 4…

A: Current price of stock is the price which can be paid for purchase of the stock. It is also called…

Q: Socram Company is expected to have EPS in the upcoming year of $5.00. The expected R 0%. An…

A: EPS of the company=$5.0Retention ratio=0.42ROE=10%Required rate=15%

Q: the simple is valid and all portfolios are priced correct hich of the situations below is possible?…

A: Capital Asset Pricing Model:It is a financial model that estimates an investment's or asset's…

Q: Problem 2-9 (Algo) Find the after-tax return to a corporation that buys a share of preferred stock…

A: After tax rate of return is calculated dividing after tax net income by initial investment or cost.…

Q: ZZ Industries: Price 34.36 Calls: Strike Symbol Last Chg Bid Ask 30.00 ZZBF 4.30 1.07 4.30 4.40…

A: Number of shares = 300Strike price = $32.50Ask price = .01

Q: A stock has a current price of $50, an annual dividend of $4 per share, and the current rate R is…

A: Current Price of Stock = p = $50Dividend = d = $4Rate of Return = r = 10%Growth Rate = g = ?

Q: Company A wants to calculate its WACC. It has just issued a 18-year, 8% coupon, non-callable bond at…

A: The objective of the question is to calculate the Weighted Average Cost of Capital (WACC) for…

Q: Suppose we observe the following rates: 1R1 = 4.1%, 1R2 = 4.9%, and E(21) = 4.1%. If the liquidity…

A: 1R1 = 4.1%1R2 = 4.9%E(2r1) = 4.1%

Q: You have been managing a $5 million portfolio that has a beta of 2.00 and a required rate of return…

A: The beta of a portfolio refers to the measure of the volatility that the portfolio faces in…

Q: The balance sheet provides a snapshot of the financial condition of a company. Investors and…

A: ----------

Q: Suppose that JPMorgan Chase sells call options on $1.10 million worth of a stock portfolio with beta…

A: Here,Worth of CallOptions is $1,100,000Beta is 1.45Option Delta is 0.52Current Worth of the Stock is…

Q: Knight Inventory Systems, Inc., has announced a rights offer. The company has announced that it will…

A: Here,No. of Right is 3Price before ex right date is $80Price after ex right date is $60Subscription…

Q: Rottweiler Obedience School's December 31,2021, balance sheet showed net fixed assets of $1,810,000,…

A: Net capital spending can be calculated by adding depreciation expenses to change in net fixed…

Q: Mary started a new job and wants to verify her net pay has been computed correctly. Her gross pay…

A: Net pay represents a person's gross income minus various deductions. Gross income is the total…

Q: It costs a risk neutral firm £800 to set up a factory (fixed cost). The factory can produce one unit…

A: To determine whether the firm should invest now, we calculate the Net Present Value (NPV) of the…

Q: McCann Company has identified an investment project with the following cash flows. Year 1 234 Cash…

A: Cash Flow for Year 1 = cf1 = $900Cash Flow for Year 2 = cf2 = $1000Cash Flow for Year 3 = cf3 =…

Q: Use graphical approximation techniques to answer the question. When would an ordinary annuity…

A: Future value:The term "future value" refers to the expected value of an investment at a future…

Q: Assume you will get 20 rental payments paid over 20 years at the beginning of each year. Initially,…

A: Discount rate is the rate of interest that is the required rate of return on the investment that an…

Q: Nicole forecasts the following amounts for the first year of operations, ending December 31, 2020:…

A: The objective of the question is to prepare a forecasted income statement for Nicole's Getaway Spa…

Q: Problem 3-13 Internal Growth Rate (LG3-6) Last year, Lakesha's Lounge Furniture Corporation had an…

A: Internal growth rate refers to that growth rate of sales for a company that will not need any form…

Q: Derek plans to retire on his 65th birthday. However, he plans to work part-time until he turns…

A: A retirement goal is a financial target an individual sets to achieve a comfortable and financially…

Q: Problem 6.25 Suppose that A(1) $110, A(2) = $121, and A(10) $259.37. (a) Find the effective rate of…

A: Alternatively,

Q: Secondary Mortgage Purchasing Company (SMPC) wants to buy your mortgage from the local savings and…

A: A loan is a sum of money that is borrowed, typically from a financial institution, and is expected…

Q: James Clark is a currency trader with Wachovia. He notices the following quotes: Spot exchange rate…

A: IRP theory holds that the interest rate difference between two countries is equal to the difference…

Q: JD Sdn Bhd has developed a new industrial detergent that can be used in motor vehicle garages. It…

A: The objective of the question is to evaluate the financial feasibility of a project by calculating…

Q: One year ago, your company purchased a machine used in ma acturing for $105 00. You have learned…

A: Old machine cost = $105,000New machine cost = $150,000CCA = 40%, tax rate = 40%EBITDA for old…

Q: The income statement for Duffy's Pest Control shows that depreciation expense was $190 million, EBIT…

A: A measure of a company's liquidity and the time it takes to turn cash into cash is called working…

Q: QUESTION 10 Beatrice owns two investments, A and B, that have a combined total value of $28,100.00.…

A: Future value is the amount that existing assets are worth at a specific future date after they have…

Q: If you want to have $23,000 for a down payment for a house in six years, what amount would you need…

A: The present value of money refers to the concept that a dollar received in the future is worth less…

Q: A company invests $600,000 in a project with the following net cash flows: Year 1: $130,000 • Year…

A: Payback period is the period in which investment will we recovered through cash inflow. It is a…

Q: An investment, which is worth $57,023.00 and has an expected return of 17.00 percent, is expected to…

A: Investment = $57,023Expected rate of return = 17%Annual Cash Flow = Investment × Expected rate of…

Q: The IPO Investment Bank has the following financing outstanding. Debt: 20,000 bonds with a coupon…

A: Weighted average cost of capital(WACC) is the average cost of capital, which can be calculated by…

Q: You just finished the first quarter managing a portfolio for a client. The initial investment was…

A: The alpha of a portfolio refers to the measure of excess return that the portfolio provides over its…

Q: Determining Bond Prices, Interest Rates, and Financial Statement Effects Deere & Company's 2018 10-K…

A: Interest rates have declinedReason : The price and Interest rates are inversely related to the price…

Q: Cisco, Inc., has a proposal from the Engineering Planning Division to invest Cisco retained earnings…

A: The time value of money is a concept in finance that takes into account the effect of compounding…

Q: Sinaloa Appliance, Incorporated, a private firm that manufactures home appliances, has hired you to…

A: FirmBetaDebtEquityiRobot0.92$0$3,140Middleby's1.87$756$7,470National Presto0.12$0$827Newell…

Q: You want to have a million dollars in the bank when you retire. You think you can save $5 000 this…

A: A deposit is required for n years, then F = g = 2%I = 5%F = 1 Million A = $5000

Q: 6. Loan Amortization Assume that your aunt sold her house on December 31, and to help close the sale…

A: The objective of the question is to calculate the total amount of interest paid during the first…

Q: Rader Railway is determining whether to purchase a new rail setter, which has a base price of…

A: Setter base price = $425,000Install cost = $44,000MACRS-3 year class of assetsSalvage value =…

Q: 43. The Bluebird Company has a $10,000 liability it must pay three years from today. The company is…

A: Present Value is the current price of future value which will be received in near future at some…

Q: Question 2 A lower bond rating directly translates into a higher, higher interest b. lower, higher…

A: Understanding the relationship between bond ratings and interest rates is crucial to financial…

Q: A zera coupon bond with promised payment of $100 to be paid in 5 years has price equal to$80. What…

A: A bond refers to an instrument used by the issuing organization to raise debt capital from…

Q: The O'Sullivan's family had a business income of $57,230, royalty income of $410, capital gains from…

A: Capital gains are the profit you make when you sell an asset, such as a stock or real estate, for…

Step by step

Solved in 3 steps with 1 images

- Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of 50,000. First City has offered Hawley the alternatives listed here. Calculate the effective annual interest rate for each alternative. Which alternative has the lowest effective annual interest rate? a. A 12% annual rate on a simple interest loan, with no compensating balance required and interest due at the end of the year b. A 9% annual rate on a simple interest loan, with a 20% compensating balance required and interest due at the end of the year c. An 8.75% annual rate on a discounted loan, with a 15% compensating balance d. Interest figured as 8% of the 50,000 amount, payable at the end of the year, but with the loan amount repayable in monthly installments during the yearCray Computing needs a 8-month loan for $300,000. Its bank quotes a simple interest rate of 12% on the loan. What is the annual percentage rate (APR)? What is the period rate if there is a compensating balance requirement of 40% of the loan amount?Please show how to solve this in Excel using Excel formulas and please show the spreadsheet so I can understand better. Suppose Tommy borrows $500,000 at 4% for 15 years and monthly payments. The annual percentage rate (APR) on the loan is 4.5%. What amount of discount points was charged if there was $4,500 origination cost?

- You want to buy a new sports coupe for $74,900, and the finance office at the dealership has quoted you a loan with an APR of 7.3 percent for 36 months to buy the car. a. What will your monthly payments be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the effective annual rate on this loan? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)You want to buy a new sports coupe for $75,200, and the finance office at the dealership has quoted you a loan with an APR of 7.6 percent for 48 months to buy the car. What will your monthly payments be? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. What is the effective annual rate on this loan? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Using the information provided please show all work and formulas in excel ! Suppose that you have two loan choices with monthly payments (a) What is the incremental borrowing cost of $30,000 for loan 1 over loan 2 if you hold the loan for the entire term and there are no origination costs for the two loans? (b) What is the incremental borrowing cost of $30,000 for loan 1 over loan 2 if you hold the loan for only 6 years (72 months) and there are no origination costs for the two loans?

- An annuity pays $200 at the end of each period for 10 periods. Set up the CFs in an Excel spreadsheet. The current value of this stream of CFs is $1,544. What is the implied discount rate? Solve the problem using the following approaches: a. Use trial and error or Goal Seek in Excel (tab Data/What-if-Analysis). b. Use the excel built-in function RATE.ABC is deciding to give a cash discount of 1% if the customers pay on the tenth day. It originally offers a credit term of n/30. Without the cash discount, credit sales would be P6750000 with an average age of inventory of 27 days. With the cash discount, credit sales are forecasted to increase by15%, collections within the discount period is 40% and the average age will be 22 days. The variable cost rate is 60% while the effective interest rate that ABC uses for forecasting is 8%. Using the 360-day year, how much is the net benefit or cost of the new policy?Banks sometimes quote interest rates in the form of “add-on interest.” In this case, if a 1-year loan is quoted with an interest rate of 8.0% and you borrow $1,000, then you pay back $1,080. But you make these payments in monthly instalments of $108 each. a) What is the true APR on this loan? (want to learn via Excel) b) What is the effective annual rate on the loan?

- A department store has it’s own credit card facilities, for which it charges interest at a rateof 4% each month. Calculate the annual percentage rate (APR). Explain why this is not thesame as charging an annual interest rate of 48% and what is APR.b) A proposed investment costs $1500 today. The expected revenue flow is $ 3000 at theend of year 1, and $10,000 at the end of year 2. Find the internal rate of return, correct totwo decimal places. The market interest rate is 15%. Would you recommend thisinvestment? Explain the reason for your recommendation.Assume you take out a car loan of $8,600 that calls for 48 monthly payments of $300 each. a. What is the APR of the loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Use a financial calculator or Excel.) b. What is the effective annual interest rate on the loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)If you borrow $9000 at an annual percentage rate (APR) of r (as a decimal) from a bank, and if you wish to pay off the loan in 3 years, then your monthly payment M (in dollars) can be calculated using: M = 9000 (er/12-1) / 1 - e-3r 1) Describe what M (0.035) would represent in terms of the loan, APR, and time. 2) If you are only able to afford a max monthly payment of $300, describe how you could use the above formula to figure out what the highest interest rate the bank could offer you and you would still be able to afford the monthly payments. In addition, determine the maximum interest rate that you could afford.