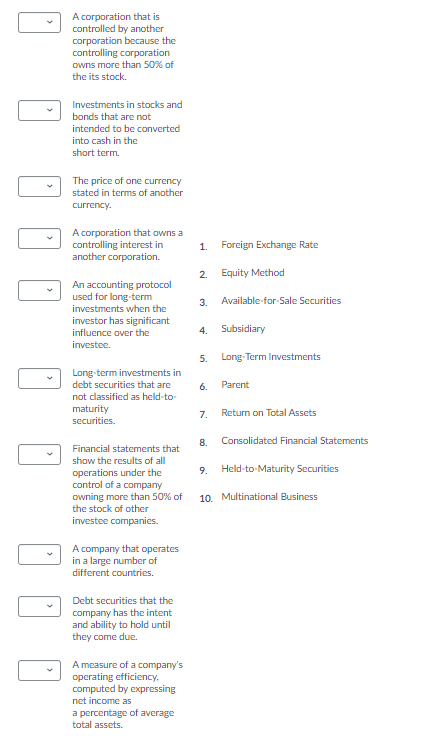

A corporation that is controlled by another corporation because the controlling corporation owns more than 50% of the its stock. Investments in stocks and bonds that are not intended to be converted into cash in the short term. The price of one currency stated in terms of another currency.

A corporation that is controlled by another corporation because the controlling corporation owns more than 50% of the its stock. Investments in stocks and bonds that are not intended to be converted into cash in the short term. The price of one currency stated in terms of another currency.

Chapter14: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 2STP

Related questions

Question

Transcribed Image Text:A corporation that is

controlled by another

corporation because the

controlling corporation

owns more than 50% of

the its stock.

Investments in stocks and

bonds that are not

intended to be converted

into cash in the

short term.

The price of one currency

stated in terms of another

currency.

A corporation that owns a

controlling interest in

another corporation.

1.

Foreign Exchange Rate

2.

Equity Method

An accounting protocol

used for long-term

3.

Available-for-Sale Securities

investments when the

investor has significant

influence over the

4.

Subsidiary

investee.

5.

Long-Term Investments

Long-term investments in

debt securities that are

6.

Parent

not classified as held-to-

maturity

7.

Return on Total Assets

securities.

8.

Consolidated Financial Statements

Financial statements that

show the results of all

Held-to-Maturity Securities

operations under the

control of a company

9.

owning more than 50% of

the stock of other

10. Multinational Business

investee companies.

A company that operates

in a large number of

different countries.

Debt securities that the

company has the intent

and ability to hold until

they come due.

A measure of a company's

operating efficiency,

computed by expressing

net income as

a percentage of average

total assets.

Expert Solution

Step 1

(a) Subsidiary.

The company which is owned and controlled by other company is called subsidiary company.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College