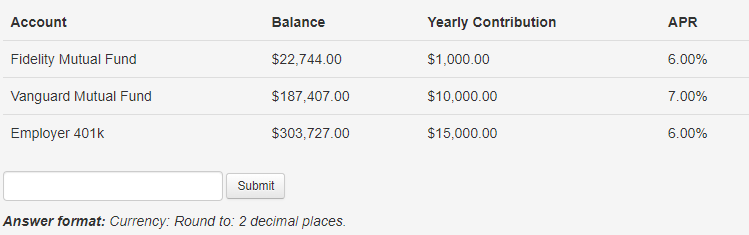

A couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 22.00 years and pool the money into a savings account that pays 4.00% APR. They plan on living for 30.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal?

A couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 22.00 years and pool the money into a savings account that pays 4.00% APR. They plan on living for 30.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal?

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter3: Data Visualization

Section: Chapter Questions

Problem 6P: The file MutualFunds contains a data set with information for 45 mutual funds that are part of the...

Related questions

Question

A couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 22.00 years and pool the money into a savings account that pays 4.00% APR. They plan on living for 30.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal?

Transcribed Image Text:Account

Fidelity Mutual Fund

Vanguard Mutual Fund

Employer 401k

Balance

$22,744.00

$187,407.00

$303,727.00

Submit

Answer format: Currency: Round to: 2 decimal places.

Yearly Contribution

$1,000.00

$10,000.00

$15,000.00

APR

6.00%

7.00%

6.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning