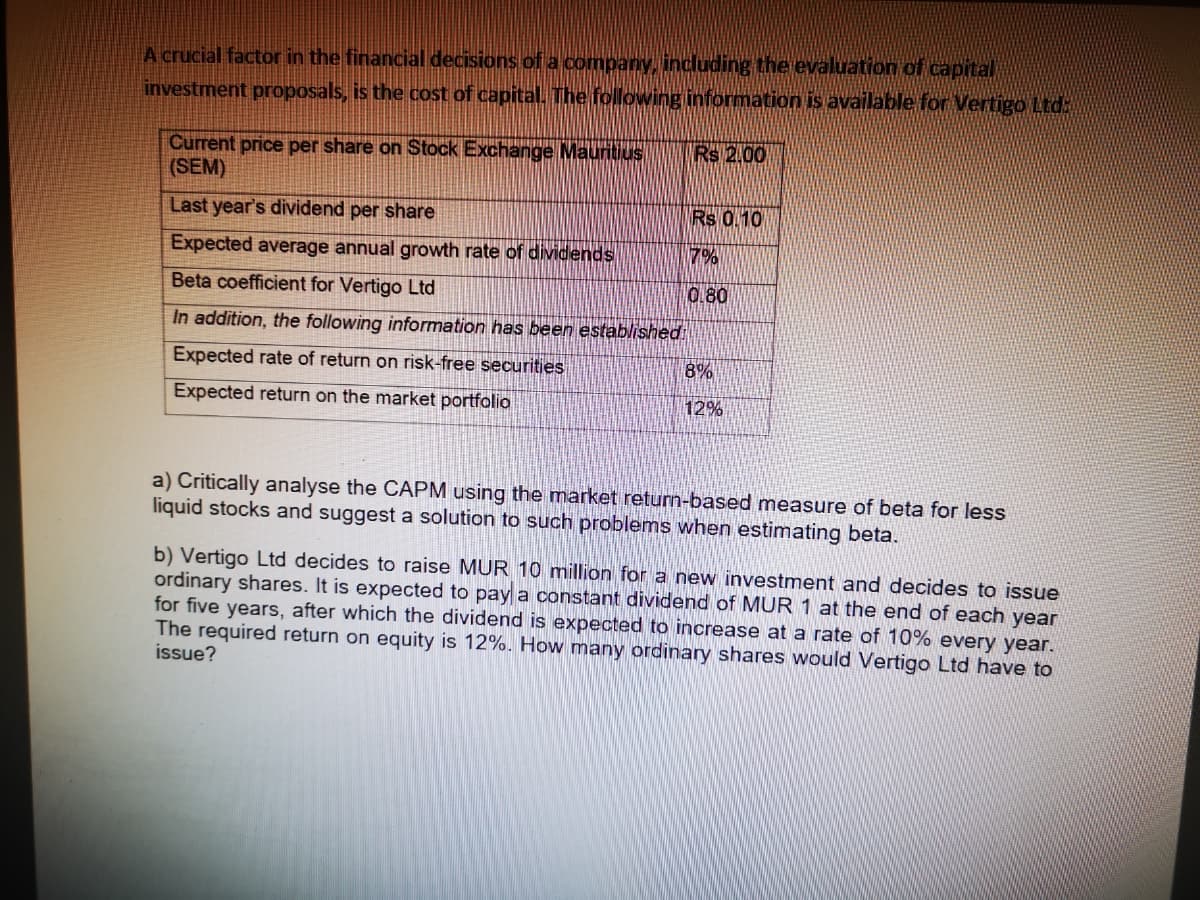

A crucial factor in the financial decisions of a company, including the evaluation of capital investment proposals, is the cost of capital. The following information is available for Vertigo Ltd: Current price per share on Stock Exchange Mauritius (SEM) Last year's dividend per share Expected average annual growth rate of dividends Beta coefficient for Vertigo Ltd In addition, the following information has been established: Expected rate of return on risk-free securities Expected return on the market portfolio Rs 2.00 Rs 0.10 7% 0.80 8% 12% a) Critically analyse the CAPM using the market return-b liquid stocks and suggest a solution to such problems when estimating beta. sed measure of beta for less b) Vertigo Ltd decides to raise MUR 10 million for a new investment and decides to issue ordinary shares. It is expected to pay a constant dividend of MUR 1 at the end of each year for five years, after which the dividend is expected to increase at a rate of 10% every year. The required return on equity is 12%. How many ordinary shares would Vertigo Ltd have to issue?

A crucial factor in the financial decisions of a company, including the evaluation of capital investment proposals, is the cost of capital. The following information is available for Vertigo Ltd: Current price per share on Stock Exchange Mauritius (SEM) Last year's dividend per share Expected average annual growth rate of dividends Beta coefficient for Vertigo Ltd In addition, the following information has been established: Expected rate of return on risk-free securities Expected return on the market portfolio Rs 2.00 Rs 0.10 7% 0.80 8% 12% a) Critically analyse the CAPM using the market return-b liquid stocks and suggest a solution to such problems when estimating beta. sed measure of beta for less b) Vertigo Ltd decides to raise MUR 10 million for a new investment and decides to issue ordinary shares. It is expected to pay a constant dividend of MUR 1 at the end of each year for five years, after which the dividend is expected to increase at a rate of 10% every year. The required return on equity is 12%. How many ordinary shares would Vertigo Ltd have to issue?

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 4AP

Related questions

Question

Transcribed Image Text:A crucial factor in the financial decisions of a company, including the evaluation of capital

investment proposals, is the cost of capital. The following information is available for Vertigo Ltd.

Current price per share on Stock Exchange Mauritius

(SEM)

Last year's dividend per share

Expected average annual growth rate of dividends

Beta coefficient for Vertigo Ltd

In addition, the following information has been established:

Expected rate of return on risk-free securities

Expected return on the market portfolio

Rs 2.00

Rs 0.10

17%

0.80

8%

12%

a) Critically analyse the CAPM using the market return-based measure of beta for less

liquid stocks and suggest a solution to such problems when estimating beta.

b) Vertigo Ltd decides to raise MUR 10 million for a new investment and decides to issue

ordinary shares. It is expected to pay a constant dividend of MUR 1 at the end of each year

for five years, after which the dividend is expected to increase at a rate of 10% every year.

The required return on equity is 12%. How many ordinary shares would Vertigo Ltd have to

issue?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT