a) Current Ratio b) Quick Ratio c) Inventory to Working Capital

Q: From the following information of Axis Limited compute the Replacement Cost Value / Net Substantial…

A: Replacement cost or replacement value refers to the price that it would cost to replace an existing…

Q: 11. Sell or process further. In producing Ergon, $20 per ton. The company is considering combining…

A: The decision to sell a product now or process it further to get more revenue is known as "sell or…

Q: Barclays Company is preparing the company's statement of cash flows for the fiscal year just ended.…

A: DIVIDEND PAYABLE Dividends payable are dividends that a company's board of directors has…

Q: In which 2 ways can you create a customized template for a project in the Work menu in QuickBooks…

A: When you want to do project through quickbooks than you have create templates in the quickbook but…

Q: Ma1. On the Form 7202, in what section are the dates of work missed due to COVID-19 entered?…

A: As per IRS, Form 7202 is used for entering sick leaves and family leaves for certain self-employed…

Q: KA. GG Shipping is a shipping line which treats its ships as complex non-current assets. The cost…

A: Introduction A firm's revenues, expenses, and profitability over period are represented on an income…

Q: Journey's Umbrella Factory. • Sales Forecast for Q4 in 2022: Selling price = $20 per umbrella •…

A: Direct Labour Hours: The amount of direct labour required to create one unit of a product is…

Q: Which 2 options are benefits of using the Close the books feature? It can prevent users from…

A: Lets understand the basics. Close the books feature is a feature of the QuickBooks which locks the…

Q: can I have a proper memo-based answer script with appropriate discussion and cases as well as works…

A: Answer: The term of responsibility refers to the ethical and legal obligation of an individual or…

Q: The following facts relate to Whispering Corporation. Deferred tax liability, January 1, 2020,…

A: Taxable Income Taxable Income is defined as the income on which tax rates are calculated as per the…

Q: Question 8 From QuickBooks Online Accountant, where can you search for apps by specialty or business…

A: Accounting is the detailed process of recording, summarising and analysing. This is for the purpose…

Q: Question 26 Not yet answered Marked out of 2 Flag question Equipment with a cost of $160,000,…

A: Annual depreciation expense (Straight-line)=Cost of asset-Residual valueUseful life

Q: Choose the response that accurately completes the following sentence. Paid family leave provided by…

A: Paid Family Leave (PFL) allows for employees to take paid time off work to care for family members…

Q: young cou

A: A loan is being renegotiated in the middle so that interest rates can be brought down and repayment…

Q: Canyon Dental Services is a specialized dental practice whose only service is filling cavities.…

A: Variable Cost :— It is the cost that changes with change in cost driver. Variable cost per unit is…

Q: Suggest an appropriate ‘Activity Level’ for the following budgets: (a) Manufacturing…

A: In the process of preparation of budget, the activity level for each type of budget must be…

Q: You are considering investing RM61000 in new equipment. You estimate that the net cash flows will be…

A: Annual capital cost is nothing but depreciation calculated by the straight-line method. The salvage…

Q: Direct Labor Cost Budget Ace Racket Company manufactures two types of tennis rackets, the Junior and…

A: Labor Budgets help in the planning of the number of hours and amount of payment staff will generate…

Q: Sylvio owns a large fitness centre - Sandy Bay Fitness Club. To become a member of the fitness…

A: In this question, we need to prepare: Sales budget for the year ending 31 July 2022. Labour Budget…

Q: S, K and P are in a Partnership business as Machinery Manufacturers. They share Profits as 4:3:3.…

A: Dr Trading And Profit and loss A/ c…

Q: proached by the financial institutions Databank Financial Services Limited and Blackstar holdings…

A: Audit - An audit is defined as "an impartial review of financial data of any entity, whether…

Q: Verrett Corporation is a manufacturer that uses job-order costing. The company has supplied the…

A: Job order costing is a costing method which is used to determine the cost of manufacturing each…

Q: Static Budget versus Flexible Budget The production supervisor of the Machining Department for…

A: Variable Cost :— It is the cost that changes with change in cost driver. Variable cost per cost…

Q: On January 1, 2018, Parent Co. acquired 80% of the ordinary shares of Subsidiary Co. for P1,000,000.…

A: Consolidation - When an asset oscillates between a well-defined pattern of trading levels, it is…

Q: Case 3: DREXLER CORPORATION Information concerning Drexler Corporation's intangible assets is as…

A: "Since you have posted a question with multiple subparts, we will solve the first three subparts for…

Q: The LoLev Corporation's equity has a beta of 1.4. Its debt has a beta of 0.2. Its debt-to-value…

A: This problem involves calculating the discount rate and equity beta of a corporation using the…

Q: 5 0x 6 LOX7 20 8.Irish Company uses the periodic inventory method and had the following inventory…

A: FIFO Method :— Under this method, First Beginning Inventory and old purchases is used for output or…

Q: Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath…

A: Introduction:- CVP analysis is used to identify the changes in costs and volume affect a company's…

Q: Prepare trading account by current cost accounting method and current purchasing power method.

A: Current cost accounting method is a method in which a seperate value is found out for each item and…

Q: Asumme the company has always used a ‘traditional’ incremental approach towards building its budgets…

A: Answer:- Budget meaning:- The projection of future income and expenses is done with the help of…

Q: a. b. C. The annual budgeted conversion costs for a lean cell are $124,440 for 1,700 production…

A: In order to record a business transaction in the accounting records of the company, a journal entry…

Q: CSV of 110,000 and an ACB of 45,000, He Assigns Bohman owns a whole Life INS palicey with a the…

A: Given in the question: Bahman is the owner and is holding the life insurance policy. The policy has…

Q: 2. You expect to deposit the following cash flows at the end of years 1 through 5, ($1,000; $4,000;…

A: Specified Question #2:— Time Value of Money :— According to this concept, value of money in…

Q: What is enterprise risk management (ERM)? Multiple Choice a process by which compliance with laws…

A: Business entities adopt different strategies to manage unforeseen and unexpected situations arising…

Q: Question 12 By default, all QuickBooks Online company files have tags turned on, but they can be…

A: QuickBooks is an Accounting Software. It allows to keep a track of financial transactions like…

Q: Question 6 As an accountant user, where can you access and begin reclassifying transactions? + New >…

A: Reclassification of transactions refers to transferring an amount from one Ledger to the other…

Q: Modern Lighting Inc. manufactures lighting fixtures, using lean manufacturing methods. Style Omega…

A: Lean manufacturing seems to be a production process that emphasizes waste minimization, client value…

Q: Tobin's Frozen Pizza Inc. has determined from its production budget the following estimated…

A: Direct Material Budget :— This budget is prepared to estimate the units and cost of direct material…

Q: Which of the following options are examples of an implicit transaction? (Select all that apply.)…

A: Implicit transactions are ones that do not entail any particular triggering activity, whereas…

Q: 9. The ROCE equation can be calculated by dividing operating profit with capital employed. What does…

A: Accounting ratios are an important tool for analysing financial statements. It is a comparison of…

Q: Financial statement analysis is useful for determining the market price of a company's stock O…

A: There are two types of analysis used by investors. One is financial analysis and the other is…

Q: An auditor would not perform an audit without issuing an audit engagement letter. Define and…

A: A professional firm and its client's legal relationship is outlined in an engagement letter. The…

Q: P Ltd. issues 40,000, 7½% Preference shares if $100 each redeemable after 6 years at a premium of 5%…

A: Cost of preference share capital is that part of cost of capital in which we calculate the amount…

Q: Problem 2 worth) Ticketprint Corporation owns a small printing pres that prints tickets for…

A: Every organization designs a costing system to understand the nature and amount of business…

Q: Prepare journal entries to record each of the following purchases transactions of a merchandising…

A: Journal is a book in which all the transactions of a business are recorded for the first time. The…

Q: Total 1. Following are the details of Mr. X's business income for the year ended 2014 Cash at Bank…

A: Trading and industrial wealth refer to the assets and resources that are used in a business or…

Q: Average Rate of Return Determine the average rate of return for a project that is estimated to yield…

A: The average rate of return is the average annual amount of cash flow generated over the life of an…

Q: Assets are recorded at puchase price Questions Financial information is useful Some information is…

A: Accounting principles are the rules and guidelines that companies and other bodies must follow when…

Q: The Statement of Comprehensive Income for the year ended 31 December 2014 Sales Revenue Cost of…

A: The two entities being consolidated are Parent plc and Subsidy plc. The statement of comprehensive…

Q: Why don’t all companies use the same MANAGERIAL accounting systems? The systems are required to…

A: Management accounting refers to the accounting method which creates the reports, statements and…

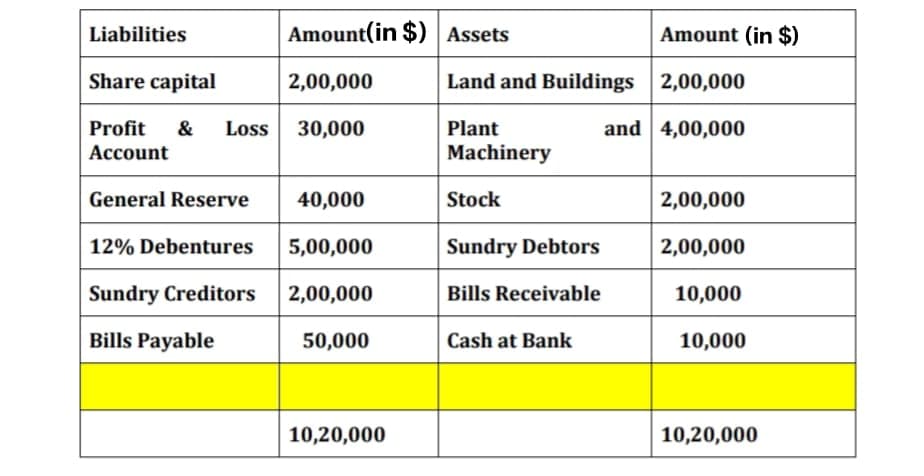

From the following information compute the following ratios:

a) Current Ratio

b) Quick Ratio

c) Inventory to Working Capital

d) Debt to Equity Ratio

e) Proprietary Ratio

Step by step

Solved in 4 steps

- Brief ExerciseRatio Analysis Valiant Corporation has $1,800,000 in total liabilities, $800,000 of which arc current. Valiant has $400,000 of cash and cash equivalents, $300,000 of other current assets, and $2,000,000 in property, plant, and equipment. Required: Calculate Valiants debt to equity ratio.l-Itihad Corporation Balance SheetDecember 31, 2019AssetsLiability & EquityCurrent AssetsCurrent LiabilityCash$5,000Accounts payable22,000Short term securities10,000Accrual Account8,000Account Receivables30,000Short term debt6,000Inventory32,000Total Current Liability36,000Long-term debt40,000Total Current Assets77,000TotalLiability76,000Long term AssetsEquityNet Property & equipment70,000CommonStocks64,000Retained earnings17,000Total Equity81,000Total Liability and Equity157,000Other assts 10000Total Assets157,000Sur Corporation Income StatementDecember 31, 2019Other Financial information of Sur corporation December 31, 2019Net sales (revenue)$150,000· Average Number of Common shares outstanding 16,000 Shares· Market price of Common share $3.5Cost of goods sold80,000Gross profit70,000Operating expenses30,000EBIT- (Operating profit)40,000Interest expense10,000EBT- ( Earnings before taxes)30,000Income tax 10,000Net Income (net profit)20,000You have to find the following ratios…Pip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:a. Calculate the Goodwillb. Calculate the pricec. Record the purchase of the Pip Paw Patrol on the books of the BUYER, assume they issued100,000 shares of $2 par value common stock and paid $40,000 in legal and accounting fees and$50,000 in stock issuance costs to their broker.d. Record the sale of the company on the books of the seller.

- Pip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:a. Calculate the Goodwillb. Calculate the pricePip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:c. Record the purchase of the Pip Paw Patrol on the books of the BUYER, assume they issued100,000 shares of $2 par value common stock and paid $40,000 in legal and accounting fees and$50,000 in stock issuance costs to their broker.d. Record the sale of the company on the books of the sellerCalculate the following for Co. XYZ: c. Average collection period (365 days) d. Times interest earned Assets: Cash and marketable securities $400,000Accounts receivable 1,415,000Inventories 1,847,500Prepaid expenses 24,000Total current assets $3,686,500Fixed assets 2,800,000Less: accumulated depreciation 1,087,500Net fixed assets $1,712,500Total assets $5,399,000Liabilities: Accounts payable $600,000Notes payable 875,000Accrued taxes Total current liabilities $1,567,000Long-term debt 900,000Owner's equity Total liabilities and owner's equity Co. XYZ Income Statement: Net sales (all credit) $6,375,000Less: Cost of goods sold 4,375,000Selling and administrative expense 1,000,500Depreciation expense 135,000Interest expense Earnings before taxes $765,000Income taxes Net income Common stock dividends $230,000Change in retained earnings

- Given : Total Assets :120.000,Long Term Liabilities : 20.000,Current Assets :80.000, and,Current Liabilities : 60.000Net Profits : 24.000Choose the incorrect Answera) Total Liabilities / Total Sources : 0,67b) Total Debt / Equity :1c) Current Ratio: 1,33d) Return on assets : 0,20The following data apply to A.L Kaiser & Company ($ million) : Cash and Equivalents $ 100.00Fixed Assets $ 283.50Sales $1,000.00Net Income $ 50.00Quick Ratio $ 2.0xCurrent Ratio 3.0xDSO 40.0 DaysROE 12.0% Kaiser has no preferred stock - Only common equity, current liabilities, and long-term debt.a. Find Kaiser's (1) Account Receivable, (2) Current Liabilities, (3) Current Assets, (4) Total Assets, (5) ROA, (6) common equity, and (7) long-term debt b. In part (a), you should found Kaiser's accounts receivable (A/R) to be $111.1 million. If Kaiser could reduce its DSO from 40 days to 30 days while holding other things constant, how much cash would it generate? if this cash were used to buy back common stock (at book value) and thereby reduce the amount of common equity, how would this action affect the company's (1) ROE, (2) ROA, and (3) total deby/total assets ratio?The following data were taken from the statement of affairs of RCFE Corp:Bonds payable without security: P800,000Stockholders' equity: 450,000Accounts payable: 350,000Salaries: 50,000Taxes: 75,000Trustee expenses: 45,000Loss on realization: 550,000How much is the total free assets?

- Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00 8,910.00 Accruals 5,635.00 6,187.00 Additional paid in capital 19,527.00 13,950.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,974.00 18,270.00 Current portion long-term debt 500 500 Depreciation expense 975.00 976.00 Interest expense 1,278.00 1,155.00 Inventories 3,048.00 6,717.00 Long-term debt 16,569.00 22,919.00 Net fixed assets 75,968.00 73,882.00 Notes payable 4,045.00 6,584.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,870.00 34,759.00 Sales 46,360 45,347.00 Taxes 350 920 What is the firm's cash flow from operations? What is the firm's dividend payment in the current year? What is the firm's net income in the current year?