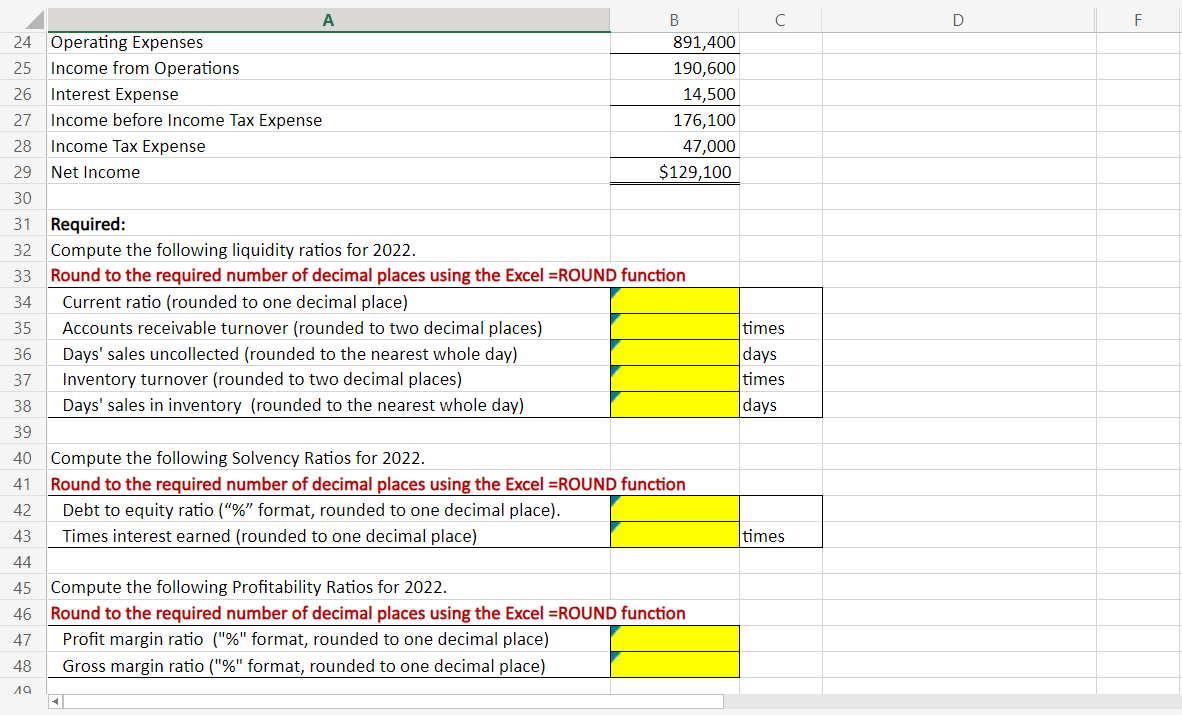

A Current ratio (rounded to one decimal place) Accounts receivable turnover (rounded to two decimal places) Days' sales uncollected (rounded to the nearest whole day) Inventory turnover (rounded to two decimal places) Days' sales in inventory (rounded to the nearest whole day) 24 Operating Expenses 25 Income from Operations 26 Interest Expense 27 Income before Income Tax Expense 28 Income Tax Expense 29 Net Income 30 31 Required: 32 Compute the following liquidity ratios for 2022. 33 Round to the required number of decimal places using the Excel =ROUND function 34 35 36 37 38 39 40 Compute the following Solvency Ratios for 2022. 41 Round to the required number of decimal places using the Excel =ROUND function 42 43 44 45 Compute the following Profitability Ratios for 2022. 46 Round to the required number of decimal places using the Excel =ROUND function Profit margin ratio ("%" format, rounded to one decimal place) 47 48 Gross margin ratio ("%" format, rounded to one decimal place) 19 B Debt to equity ratio ("%" format, rounded to one decimal place). Times interest earned (rounded to one decimal place) 891,400 190,600 14,500 176,100 47,000 $129,100 C times days times days times D F

A Current ratio (rounded to one decimal place) Accounts receivable turnover (rounded to two decimal places) Days' sales uncollected (rounded to the nearest whole day) Inventory turnover (rounded to two decimal places) Days' sales in inventory (rounded to the nearest whole day) 24 Operating Expenses 25 Income from Operations 26 Interest Expense 27 Income before Income Tax Expense 28 Income Tax Expense 29 Net Income 30 31 Required: 32 Compute the following liquidity ratios for 2022. 33 Round to the required number of decimal places using the Excel =ROUND function 34 35 36 37 38 39 40 Compute the following Solvency Ratios for 2022. 41 Round to the required number of decimal places using the Excel =ROUND function 42 43 44 45 Compute the following Profitability Ratios for 2022. 46 Round to the required number of decimal places using the Excel =ROUND function Profit margin ratio ("%" format, rounded to one decimal place) 47 48 Gross margin ratio ("%" format, rounded to one decimal place) 19 B Debt to equity ratio ("%" format, rounded to one decimal place). Times interest earned (rounded to one decimal place) 891,400 190,600 14,500 176,100 47,000 $129,100 C times days times days times D F

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.4P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Reference cells, instead of entering values.

Example: =B3+C3

Transcribed Image Text:24 Operating Expenses

25 Income from Operations

26 Interest Expense

27 Income before Income Tax Expense

28 Income Tax Expense

Net Income

35

36

37

38

39

40

41

42

43

44

45

46

47

48

19

B

29

30

31 Required:

32 Compute the following liquidity ratios for 2022.

33 Round to the required number of decimal places using the Excel =ROUND function

34

Current ratio (rounded to one decimal place)

Accounts receivable turnover (rounded to two decimal places)

Days' sales uncollected (rounded to the nearest whole day)

Inventory turnover (rounded to two decimal places)

Days' sales in inventory (rounded to the nearest whole day)

891,400

190,600

14,500

176,100

47,000

$129,100

Compute the following Solvency Ratios for 2022.

Round to the required number of decimal places using the Excel =ROUND function

Debt to equity ratio ("%" format, rounded to one decimal place).

Times interest earned (rounded to one decimal place)

<|

Compute the following Profitability Ratios for 2022.

Round to the required number of decimal places using the Excel =ROUND function

Profit margin ratio ("%" format, rounded to one decimal place)

Gross margin ratio ("%" format, rounded to one decimal place)

C

times

days

times

days

times

D

F

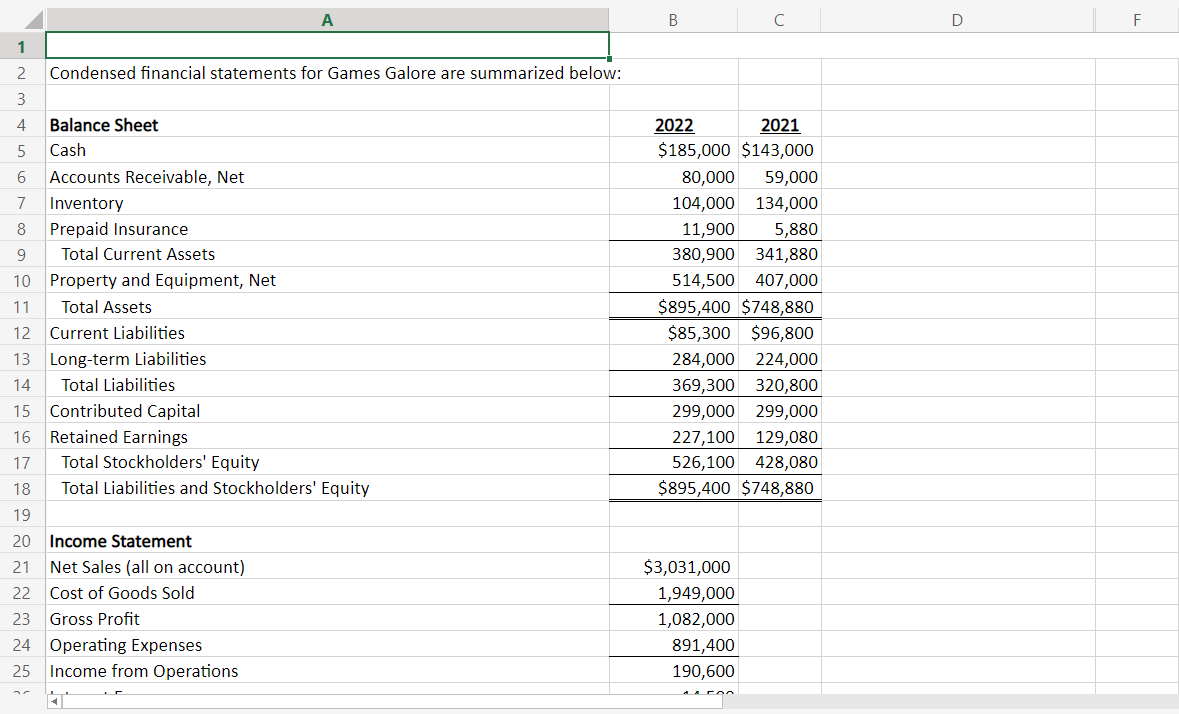

Transcribed Image Text:1

2

3

4 Balance Sheet

5

Cash

6 Accounts Receivable, Net

7 Inventory

8

Prepaid Insurance

9

Total Current Assets

10

Property and Equipment, Net

11

Total Assets

12 Current Liabilities

13

14

15

Contributed Capital

16 Retained Earnings

17

18

19

20

21

22

23 Gross Profit

24 Operating Expenses

25

Condensed financial statements for Games Galore are summarized below:

Long-term Liabilities

Total Liabilities

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

Income Statement

Net Sales (all on account)

Cost of Goods Sold

Income from Operations

ET

B

C

2022

2021

$185,000 $143,000

80,000 59,000

104,000 134,000

11,900

5,880

380,900 341,880

514,500 407,000

$895,400 $748,880

$85,300 $96,800

284,000 224,000

369,300 320,800

299,000 299,000

227,100 129,080

526,100 428,080

$895,400 $748,880

$3,031,000

1,949,000

1,082,000

891,400

190,600

D

F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning