A debt of $28,400 is repaid by payments of $2,980 made at the end of every six months. Interest is 5.43% compounded quarterly. (a) What is the number of payments needed to retire the debt? (b) What is the cost of the debt for the first four years? (c) What is the interest paid in the eighth payment period? (d) Construct a partial amortization schedule showing details of the first three payments, the last throe payments, and totals. (a) The number of the semi-annual payments is 12 (Round the final answer up to the nearest whole number. Round all intormediato values to six decimal places as needed.) (b) The cost of the debt for the first four years is $ (Round the final answer to the nearost cent as needed. Round all intermediate values to six decimal places as noeded.)

A debt of $28,400 is repaid by payments of $2,980 made at the end of every six months. Interest is 5.43% compounded quarterly. (a) What is the number of payments needed to retire the debt? (b) What is the cost of the debt for the first four years? (c) What is the interest paid in the eighth payment period? (d) Construct a partial amortization schedule showing details of the first three payments, the last throe payments, and totals. (a) The number of the semi-annual payments is 12 (Round the final answer up to the nearest whole number. Round all intormediato values to six decimal places as needed.) (b) The cost of the debt for the first four years is $ (Round the final answer to the nearost cent as needed. Round all intermediate values to six decimal places as noeded.)

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

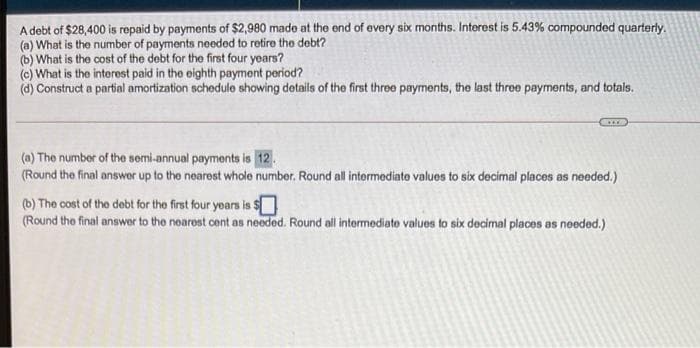

Transcribed Image Text:A debt of $28,400 is repaid by payments of $2,980 made at the end of every six months. Interest is 5.43% compounded quarterly.

(a) What is the number of payments needed to retire the debt?

(b) What is the cost of the debt for the first four years?

(e) What is the interest paid in the eighth payment period?

(d) Construct a partial amortization schedule showing details of the first three payments, the last three payments, and totals.

(a) The number of the semi-annual payments is 12.

(Round the final answer up to the nearest whole number. Round all intormediato values to six decimal places as needed.)

(b) The cost of the debt for the first four years is $

(Round the final answer to the noarest cent as needed. Round all intermediate values to six decimal places os needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning