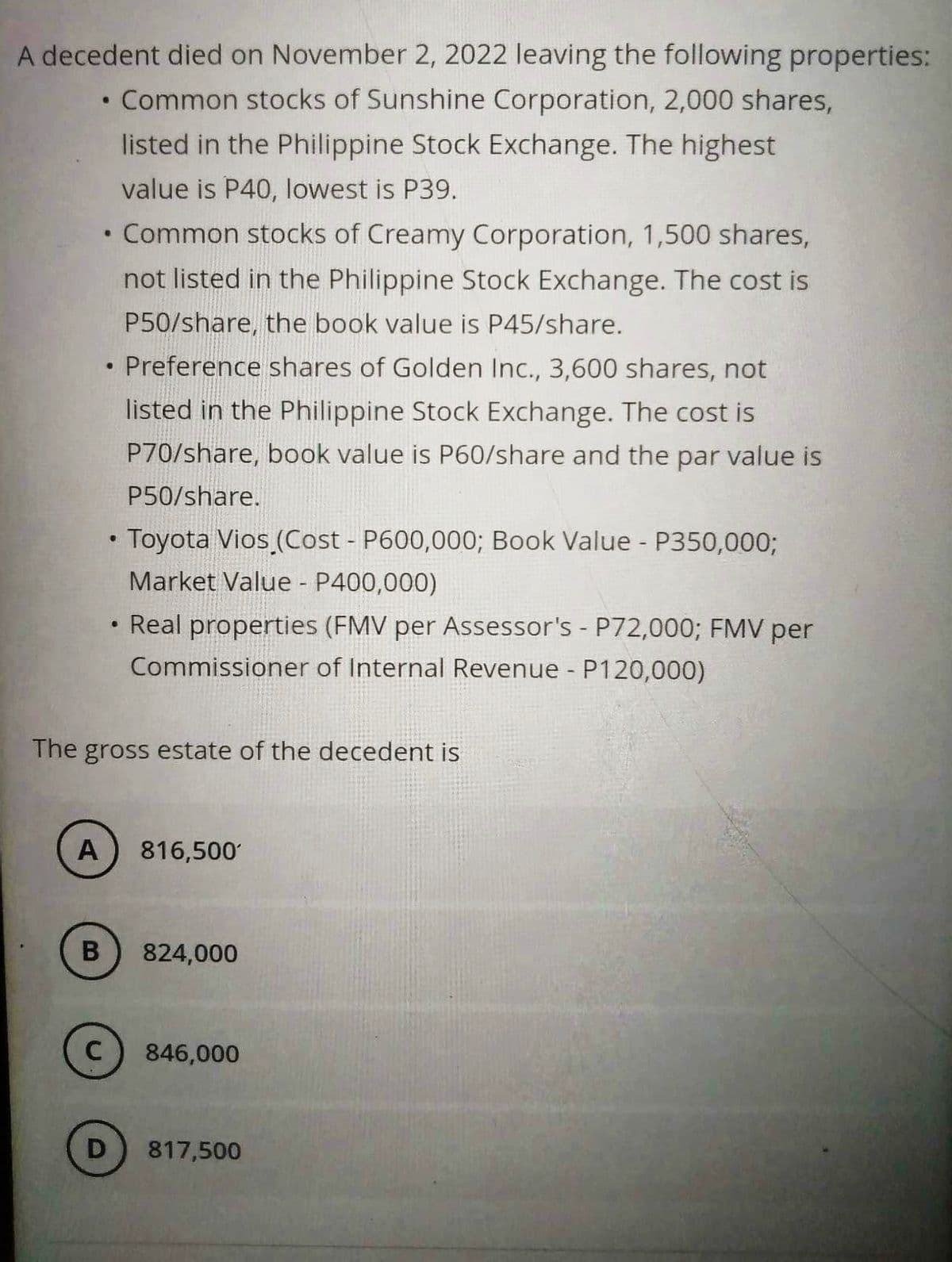

A decedent died on November 2, 2022 leaving the following properties Common stocks of Sunshine Corporation, 2,000 shares, listed in the Philippine Stock Exchange. The highest value is P40, lowest is P39. ● A ● B ● ● D ● Common stocks of Creamy Corporation, 1,500 shares, not listed in the Philippine Stock Exchange. The cost is P50/share, the book value is P45/share. Preference shares of Golden Inc., 3,600 shares, not listed in the Philippine Stock Exchange. The cost is P70/share, book value is P60/share and the par value is P50/share. The gross estate of the decedent is Toyota Vios (Cost - P600,000; Book Value - P350,000; Market Value - P400,000) Real properties (FMV per Assessor's - P72,000; FMV per Commissioner of Internal Revenue - P120,000) 816,500 824,000 846,000 817,500

A decedent died on November 2, 2022 leaving the following properties Common stocks of Sunshine Corporation, 2,000 shares, listed in the Philippine Stock Exchange. The highest value is P40, lowest is P39. ● A ● B ● ● D ● Common stocks of Creamy Corporation, 1,500 shares, not listed in the Philippine Stock Exchange. The cost is P50/share, the book value is P45/share. Preference shares of Golden Inc., 3,600 shares, not listed in the Philippine Stock Exchange. The cost is P70/share, book value is P60/share and the par value is P50/share. The gross estate of the decedent is Toyota Vios (Cost - P600,000; Book Value - P350,000; Market Value - P400,000) Real properties (FMV per Assessor's - P72,000; FMV per Commissioner of Internal Revenue - P120,000) 816,500 824,000 846,000 817,500

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 14DQ

Related questions

Question

What is the correct answer to the problem? Identify the gross estate of the decedent and show the solution.

Transcribed Image Text:A decedent died on November 2, 2022 leaving the following properties:

Common stocks of Sunshine Corporation, 2,000 shares,

listed in the Philippine Stock Exchange. The highest

value is P40, lowest is P39.

●

A

B

●

C

●

●

D

●

The gross estate of the decedent is

Common stocks of Creamy Corporation, 1,500 shares,

not listed in the Philippine Stock Exchange. The cost is

P50/share, the book value is P45/share.

Preference shares of Golden Inc., 3,600 shares, not

listed in the Philippine Stock Exchange. The cost is

P70/share, book value is P60/share and the par value is

P50/share.

Toyota Vios (Cost - P600,000; Book Value - P350,000;

Market Value - P400,000)

Real properties (FMV per Assessor's - P72,000; FMV per

Commissioner of Internal Revenue - P120,000)

816,500

824,000

846,000

817,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you