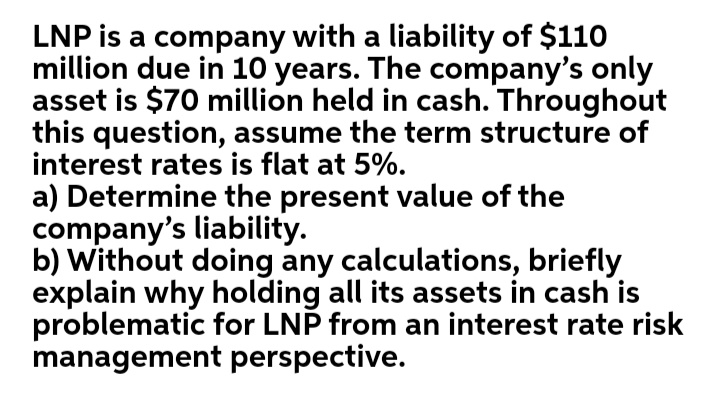

a) Determine the present value of the company's liability. b) Without doing any calculations, briefly explain why holding all its assets in cash is problematic for LNP from an interest rate risk management perspective.

Q: Multiple Choice Are revenues. Increase income. Are liabilities. Are not allowed under GAAP. Require…

A: When a company receives money in advance of earning it, the accounting entry is a debit to the asset…

Q: When considering the discount rate to use for discounting cash flows of an entire company, we can…

A: The discount rate is the loan cost used to decide the current worth of future incomes in a…

Q: Statement of projected future cash flows is least likely be required by SECP for a company filing…

A: Company refers to a business entity which is established by group of people. It is an artificial…

Q: An SME does not need to present a statement of cash flows. True or false

A: statement of cash flows shows the cash inflows and cash outflows to and from the organization. It's…

Q: If the total asset is smaller than total liabilities and equity on the balance sheet, what does that…

A: If total asset is smaller than total liabilities and equity then it means there is surplus of…

Q: The present value of cash flows in Investment A is lower than the present value of cash flows in…

A: Discount rate is very important FACTOR in calculating the present value of cash flow. Particularly…

Q: Which of the following would not be considered a cash flow from "operating" ?activities اخترأحد…

A: Note: Since you have posted multiple questions, we will solve the first question for you. To get the…

Q: Liquidity is simply: a. another term for current liabilities O b. another term for cash O c. a…

A: Definition: Liquidity means how quickly you can get your hands on your cash. In simpler terms,…

Q: Liquidity is the ability of a company to meet its needs for cash in the short and long term. True O…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: In preparing a cash flow statement which of the following is a cash inflow? A. Issue of Debentures…

A: When Company issues the debenture, then the debenture holder has to pay the amount for the…

Q: 1. Explain how capital reduces banking risks. Discuss the importance of cash flows and economic…

A: Capital reduces banking risks: It reduces banking risk by protecting against insolvency. It is used…

Q: True or false, the financing activities section of the statement of cash flows reflects the cash…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Why might the riskiness of cash flow from the residual value of the real estate differ from the…

A: It is nothing but the salvage value or scrap value of an asset. It speaks to the measure of…

Q: A disadvantage of using the payback period to compare investmentalternatives is that it;

A: Payback period: The payback period is the time period required to recover the initial investment of…

Q: /hich of the following statements is false? O a. Assets must always equal the sum of liabilities and…

A: Assets can be classified as current assets or long term assets and represented in the balance sheet.

Q: Which of the following would be considered a cash outflow for investing activities? a. cash paid to…

A: The correct option is: (d) Cash paid to purchase equipment

Q: True/false Under IFRS, the discount rate should reflect risks for which future cash flow…

A: False Refer step 2 for explanation

Q: D. True or false, the financing activities section of the statement of cash flows reflects the cash…

A: Statement of Cash Flows explains the differences between the net income and cash and cash equivalent…

Q: Which of the following statements is incorrect? Cash fund that is being held specifically for the…

A: Lets understand the basics. Cash or cash equivalent is an item which are either cash or either…

Q: What sorts of questions about future cash flows do investors and creditors use the income statement…

A: This question explains about the cash flows , investors and creditors use the income statement

Q: Which of the following returns is consistent with contractual cash flows that are SPPI? I. Return…

A: The Solely Payment of Principal and Interest test requires that the contractual terms of the…

Q: Which of the following returns is consistent with contractual cash flows that are solely payments of…

A: IFRS 9 provides guidance of SPPI. The SSPI test decides that whether financial instruments are…

Q: which m

A: Given: To explain the considerations of companies choosing a marketable security to investing in an…

Q: Which of the following would not be considered a cash flow from "operating" activities? Select one a…

A: Under indirect method, there were three sections to be reported under cash flow statement. 1.…

Q: Note payments reduce cash and are related to long-term debt. Do these facts automatically lead to…

A: The interest payments on note payments usually reduce the cash balance of the company as they are…

Q: What is a discounted cash flow approach to fair market value estimation, and what are some of the…

A:

Q: Why are cash balances in excess of those needed to financebusiness operations viewed as relatively…

A:

Q: Which of the following is not a purpose of cash flows statement. Select one: O a. They predict net…

A: Cash flow statement is a part of financial statements which shows how did a company used the cash…

Q: The main reason why there should be cash in a company is for speculation. False or true?

A: The question is related to True or False.

Q: Achieving profitability will automatically assure sufficient amounts of cash. True or false?

A: Profitability is the ability of the company to earn a profit. Profit is an amount of revenue over…

Q: why discounted cash flow methods are preferred to the more traditional techniques of payback and…

A: Before knowing the reason of preference for the use of any method, let us see the basic description…

Q: a)What is the basic principle in determining the price of a financial asset? b)Why is it difficult…

A: Financial assets include cash, securities, shares, mutual funds, and bank deposits. Financial assets…

Q: ations a

A: The growth or decrease in the quantity of money a firm, organisation, or individual has is referred…

Q: Would the move to a JIT system have a one-time or recurring impact on operating cash flow?

A: JIT inventory system: JIT system is a method adopted by manufacturers with an objective of…

Q: Identify the cash flow activity involve when an entity sold equipment at book value Options: • Not…

A: Solution: when an entity sold equipment at book value, it receives cash for sale of equipment and…

Q: What is the principal disadvantage of the direct method of reporting cash flows from operating…

A: Cash flows from operating activities is an important section of cash flow statement which shows all…

Q: Which statement characterizes the time value of money concept? A) The future value of a present…

A: Present value means worth of a dollar today Future value worth of a dollar in future.

Q: What might RR do to reduce its target cash balance without harming operations?

A: Target cash balance can be defined as the ideal cash level that a company seeks to hold in reserve…

Q: Identify which of the following is not one of the five core principles of money and banking?…

A: The answer of which of the following is not the core principle of money and banking is -

Q: What are the key factors that can lead to an under/overstatement of the cash balance

A: Cash balance is the balance appearing in the Cash edger or Cash Books after all income and…

Q: An assumption inherent in a company’s IFRS statement of financial position is that companies recover…

A: IFRS are the international financial reporting standards which describes the rules and principles…

Q: The spreadsheet and statement of cash flows do not reflect this transaction. The spreadsheet…

A: The journal entry for unrealized increase in fair value of available-for-sale securities is recorded…

Q: Which of the following transactions involve the movement of cash? O A provision for obsolete stocks.…

A: Cash is a current asset which is having the highest liquidity. It is readily available means mostly…

Q: Which of the following is NOT an acceptable basis on which to measure an expense? A cash outflow. O…

A: Measurement of expenses defines a projection of expenses to be incurred in a time frame or for an…

Q: What are the strenghts and weaknesses of the Discounted Cash Flow methods

A: Cash flow is the movement of money from a particular investment. Discounted cash flows mean…

Step by step

Solved in 2 steps

- LNP is a company with a liability of $110 million due in 10 years. The company’s only asset is $70 million held in cash. Throughout this question, assume the term structure of interest rates is flat at 5%. Determine the present value of the company’s liability. Without doing any calculations, briefly explain why holding all its assets in cash is problematic for LNP from an interest rate risk management perspective.Your company’s assets have an unlevered value of 25,456,890 USD and the perpetual annual unlevered cash produced is 1,750,000 USD. The Company decides to go through with a recapitalization, after which the debt-to-equity ratio (which the company decides to keep constant) is equal to 2.5. What is the value of debt if the interest rate is 2.45% and the tax rate is 36%?Connor Corp. has an EBIT of $970,000 per year that is expected to continue in perpetuity. The unlevered cost of equity for the company is 12 percent, and the corporate tax rate is 21 percent. The company also has a perpetual bond issue outstanding with a market value of $1.91 million. What is the value of the company? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g., 1,234,567.)

- ABC Inc. has a total annual cash requirement of P9,075,000 which are to be paid uniformly. ABC has the opportunity to invest the money at 24% per annum. The company spends, on the average, P40 for every cash conversion to marketable securities. What is the optimal cash conversion size? A.P60,000B.P45,000C.P55,000D.P72,500Xanu Company's current value of operations is $4,079 million, with $679 million due to free cash flows occurring in Years 1 to 5, and 3,400 million due to free cash flows beyond Year 5 (the horizon date). What percent of value is due to expected long-term cash flows occurring beyond the horizon date?Muffin’s Masonry, Inc.’s, balance sheet lists net fixed assets as $19 million. The fixed assets could currently be sold for $29 million. Muffin’s current balance sheet shows current liabilities of $8.0 million and net working capital of $7.0 million. If all the current accounts were liquidated today, the company would receive $7.50 million cash after paying the $8.0 million in current liabilities. What is the book value of Muffin’s Masonry’s assets today and the market value of these assets? (Enter your answer in millions of dollars rounded to 2 decimal places.) current assets fixed assets total

- Maddux Corporation has EBIT of $725,000 per year that is expected to continue in perpetuity. The unlevered cost of equity for the company is 11 percent and the corporate tax rate is 24 percent. The company also has a perpetual bond issue outstanding with a market value of $1.6 million. What is the value of the company? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) The CFO of the company informs the company president that the value of the company is $4.9 million. Is the CFO correct?Morrow Corp. has an EBIT of $875,000 per year that is expected to continue in perpetuity. The unlevered cost of equity for the company is 14 percent and the corporate tax rate is 25 percent. The company also has a perpetual bond issue outstanding with a market value of $2.3 million. What is the value of the company? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89)Maddux Corporation has an EBIT of $865, 000 per year that isexpected to continue in perpetuity. The unlevered cost of equity forthe company is 13 percent and the corporate tax rate is 24 percent.The company also has a perpetual bond issue outstanding with amarket value of $2.25 million. What is the value of the company? (Do not round intermediate calculations and enter your answer indollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) The CFO of the company informs the companypresident that the value of the company is $4.8 million. Is the CFOcorrect?

- WOPPERS PLC, which currently has negligible cash holdings, expects to have to make a series of cash payments totalling $3 000 000 over the forthcoming year. These will become due at a steady rate and can be met by making periodic sales from existing holdings of short-term securities. According to the company’s financial advisors, the most likely average percentage rate of return on these securities is 9% over the forthcoming year, although this estimate is highly uncertain. Whenever the company sells securities, it incurs a transaction fee (T) of $50. Calculate the optimal cash balance for the company What is the optimal number of times Welders should sell securities? . Determine the cost of holding cash resulting from this policy.Simile Inc. has a total annual cash requirement of P9,075,000 which are to be paid uniformly. Simile has the opportunity to invest the money at 24% per annum. The company spends, on the average, P40 for every cash conversion to marketable securities. What is the Total Conversion Cost?SLMA Corp. for the last ten years, has earned and had cash flows of about P600,000 every year. As per the predictions of the company'searnings, the same cash flow would continue for the foreseeable future. The expenses for the business every year is about P500,000only. Based on the available public information a P4 million Treasury bond has a prevailing return of P40,000 quarterly. Using Capitalization of Earnings approach, assuming SLMA would sell 20% of its shareholdings, what will be the minimum selling price? a. 2,500,000 b. 500,000 c. 1,500,000 d. 1,000,000