a) Determine the profit from this investment in euro terms. b) Compute the rate of return on your investment in euro terms. c) How much of the return is due to the exchange rate movement?

a) Determine the profit from this investment in euro terms. b) Compute the rate of return on your investment in euro terms. c) How much of the return is due to the exchange rate movement?

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 33QA

Related questions

Question

Need all parts, don't attempt if you will not give solution for all parts

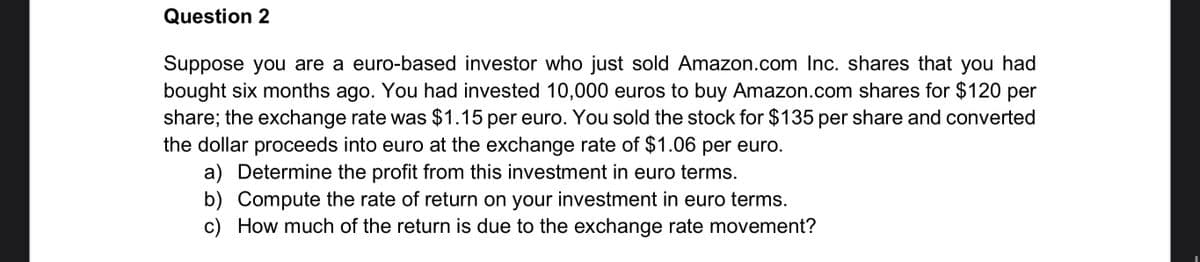

Transcribed Image Text:Question 2

Suppose you are a euro-based investor who just sold Amazon.com Inc. shares that you had

bought six months ago. You had invested 10,000 euros to buy Amazon.com shares for $120 per

share; the exchange rate was $1.15 per euro. You sold the stock for $135 per share and converted

the dollar proceeds into euro at the exchange rate of $1.06 per euro.

a) Determine the profit from this investment in euro terms.

b) Compute the rate of return on your investment in euro terms.

c) How much of the return is due to the exchange rate movement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning