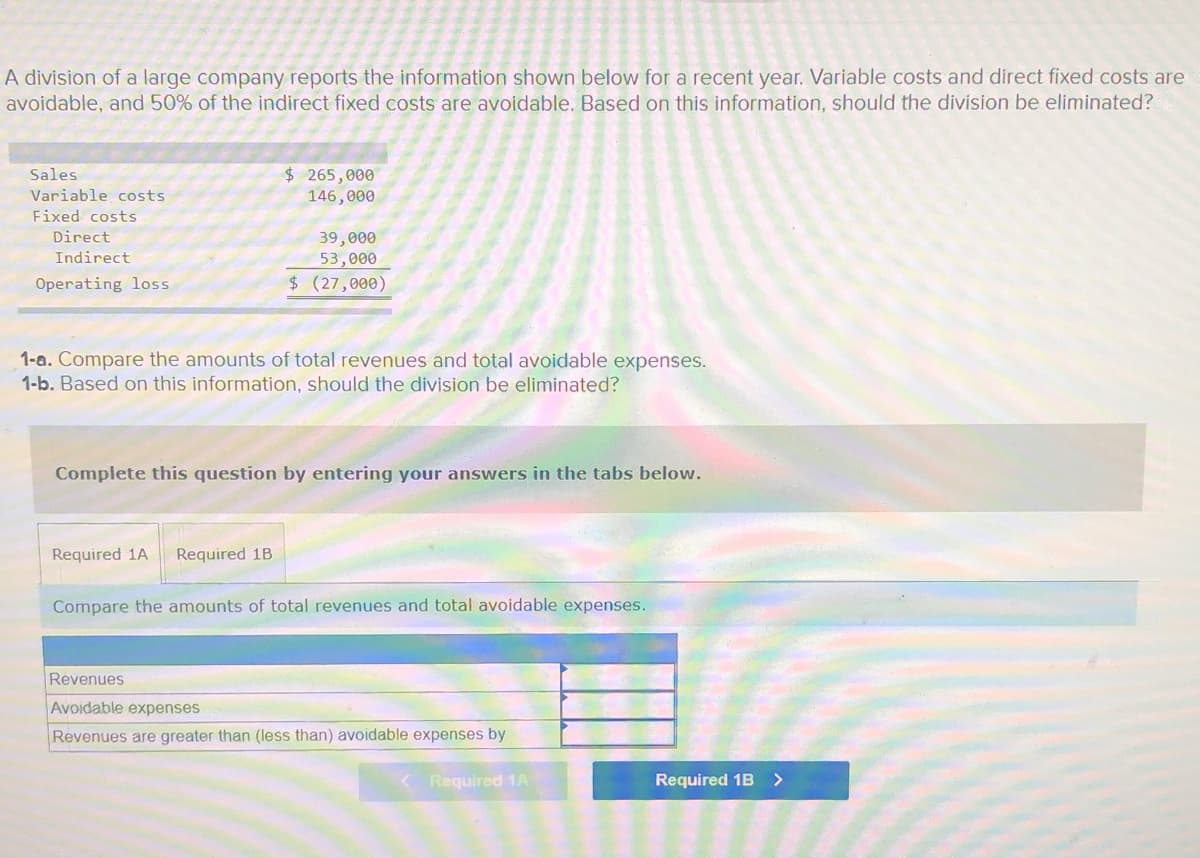

A division of a large company reports the information shown below for a recent year. Variable costs and direct fixed costs are avoidable, and 50% of the indirect fixed costs are avoidable. Based on this information, should the division be eliminated? $265,000 146,000 Sales Variable costs Fixed costs Direct 39,000 53,000 $(27,000) Indirect Operating loss 1-a. Compare the amounts of total revenues and total avoidable expenses. 1-b. Based on this information, should the division be eliminated?

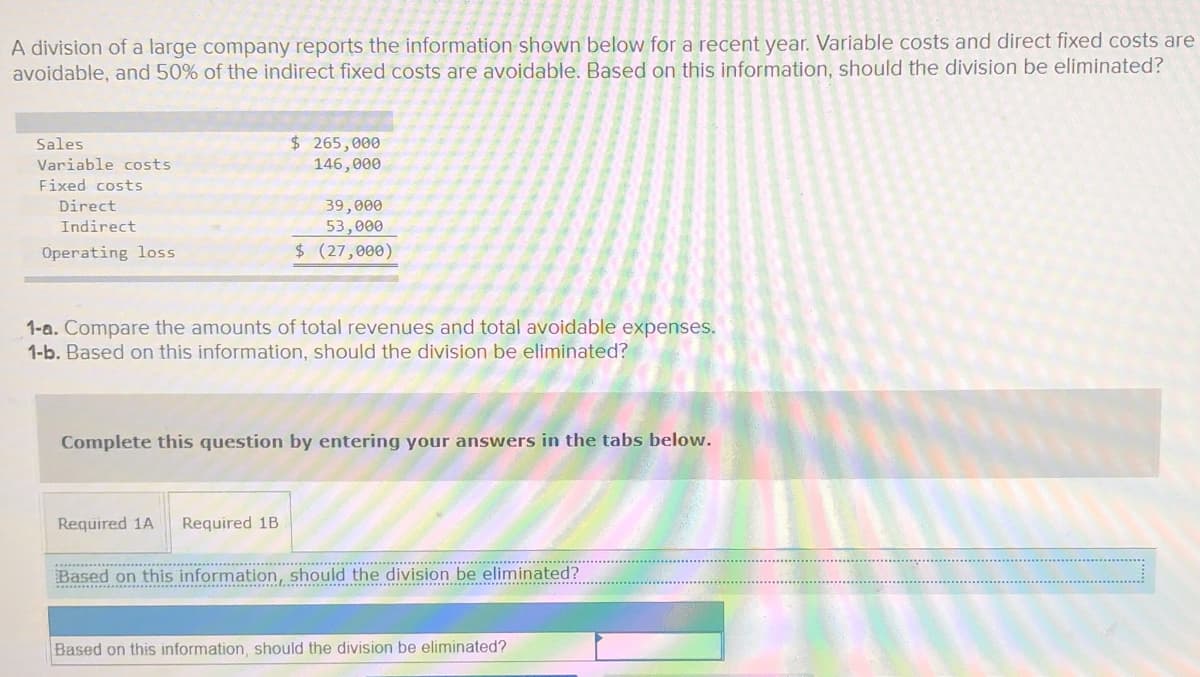

A division of a large company reports the information shown below for a recent year. Variable costs and direct fixed costs are avoidable, and 50% of the indirect fixed costs are avoidable. Based on this information, should the division be eliminated? $265,000 146,000 Sales Variable costs Fixed costs Direct 39,000 53,000 $(27,000) Indirect Operating loss 1-a. Compare the amounts of total revenues and total avoidable expenses. 1-b. Based on this information, should the division be eliminated?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter25: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2BE

Related questions

Question

Transcribed Image Text:A division of a large company reports the information shown below for a recent year. Variable costs and direct fixed costs are

avoidable, and 50% of the indirect fixed costs are avoidable. Based on this information, should the division be eliminated?

$ 265,000

146,000

Sales

Variable costs

Fixed costs

Direct

39,000

53,000

Indirect

Operating loss

$(27,000)

1-a. Compare the amounts of total revenues and total avoidable expenses.

1-b. Based on this information, should the division be eliminated?

Complete this question by entering your answers in the tabs below.

Required 1A

Required 1B

Compare the amounts of total revenues and total avoidable expenses.

Revenues

Avoidable expenses

Revenues are greater than (less than) avoidable expenses by

Required 1A

Required 1B >

Transcribed Image Text:A division of a large company reports the information shown below for a recent year. Variable costs and direct fixed costs are

avoidable, and 50% of the indirect fixed costs are avoidable. Based on this information, should the division be eliminated?

$ 265,000

146,000

Sales

Variable costs

Fixed costs

Direct

39,000

53,000

$ (27,000)

Indirect

Operating loss

1-a. Compare the amounts of total revenues and total avoidable expenses.

1-b. Based on this information, should the division be eliminated?

Complete this question by entering your answers in the tabs below.

Required 1A

Required 1B

Based on this information, should the division be eliminated?

...... .....................................

Based on this information, should the division be eliminated?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning