A $5,500 bond that carries a 3.00% coupon rate payable semi-annually is purchase years before maturity when the yield rate was 5.00% compounded semi-annually.

A $5,500 bond that carries a 3.00% coupon rate payable semi-annually is purchase years before maturity when the yield rate was 5.00% compounded semi-annually.

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 56SE: To get the best loan rates available, the Riches want to save enough money to place 20% down on a...

Related questions

Question

Help me please

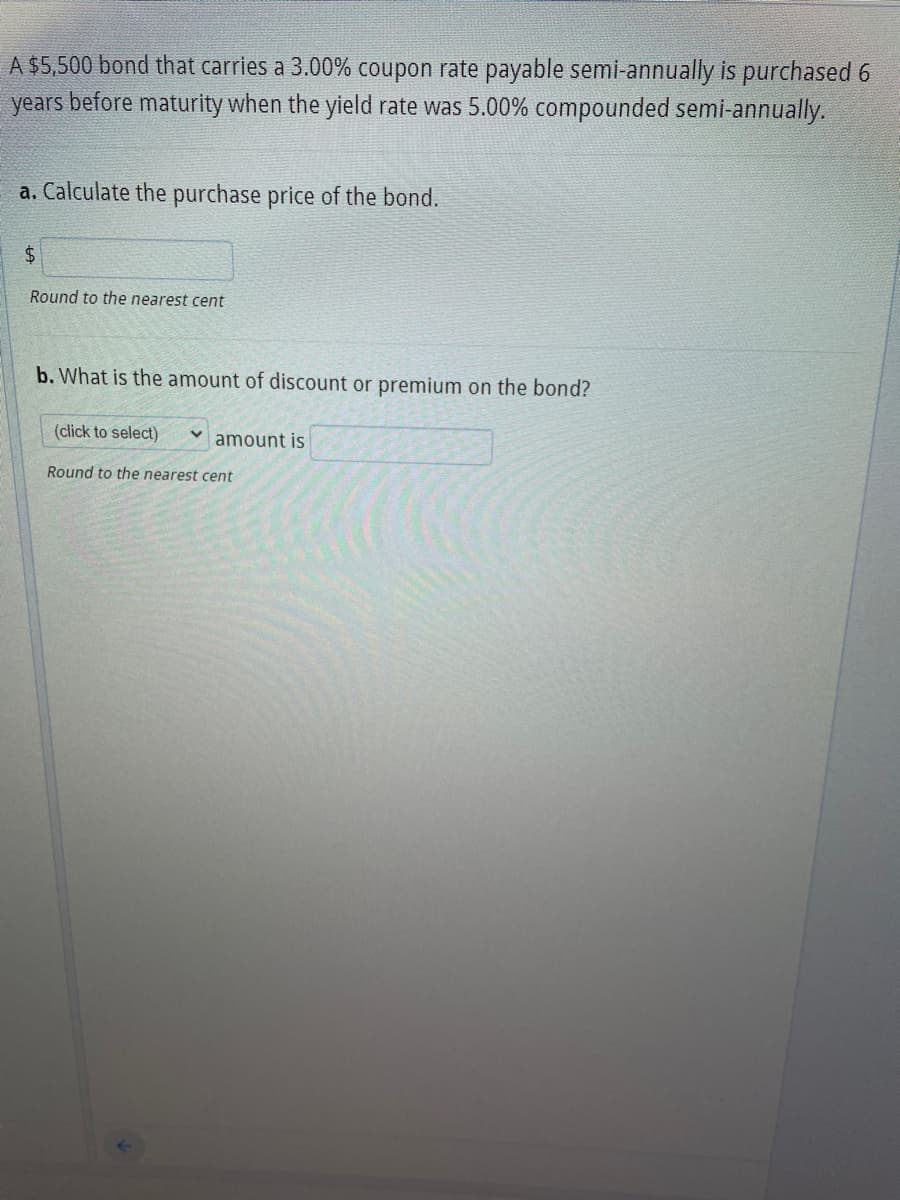

Transcribed Image Text:A $5,500 bond that carries a 3.00% coupon rate payable semi-annually is purchased 6

years before maturity when the yield rate was 5.00% compounded semi-annually.

a. Calculate the purchase price of the bond.

$

Round to the nearest cent

b. What is the amount of discount or premium on the bond?

(click to select) V amount is

Round to the nearest cent

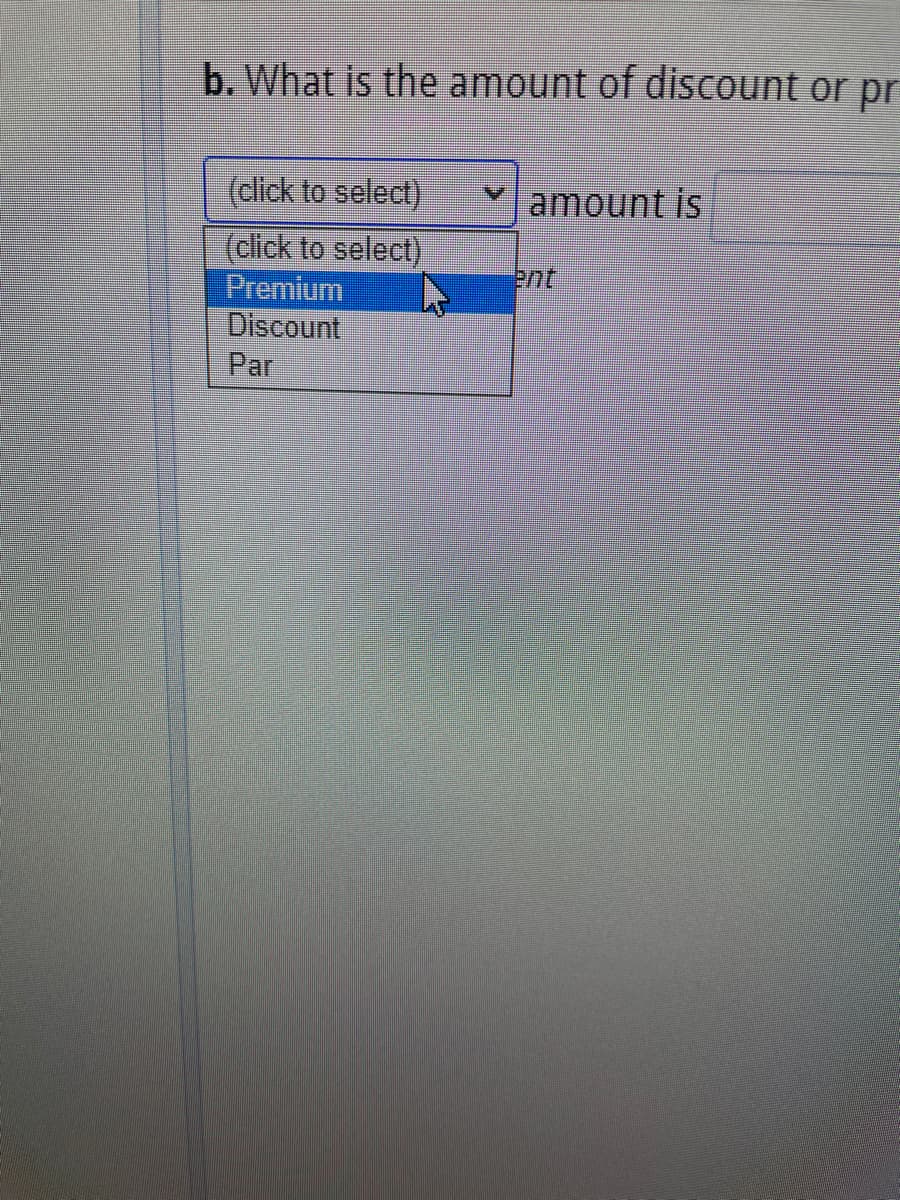

Transcribed Image Text:b. What is the amount of discount or pr

(click to select)

(click to select)

Premium

Discount

Par

amount is

ent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you