(a) Explain the following as used in IAS 19 Employee Benefits: (1) The term 'defined benefit pension plan'. (ii) The basis to be adopted in measuring scheme assets.

(a) Explain the following as used in IAS 19 Employee Benefits: (1) The term 'defined benefit pension plan'. (ii) The basis to be adopted in measuring scheme assets.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 6E

Related questions

Question

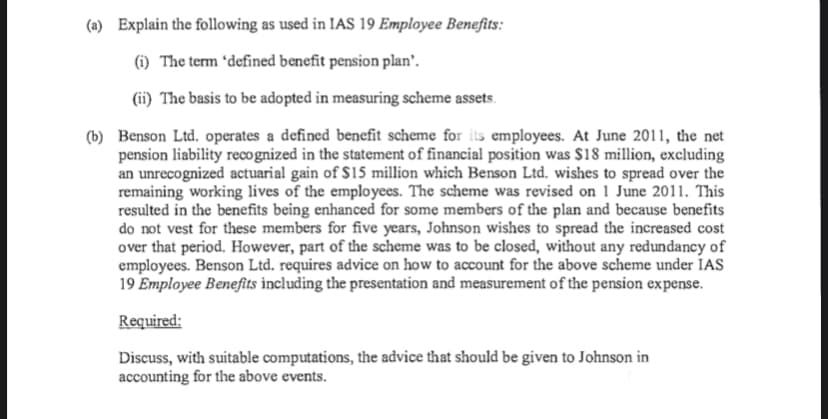

Transcribed Image Text:(a) Explain the following as used in IAS 19 Employee Benefits:

(i) The term 'defined benefit pension plan'.

(ii) The basis to be adopted in measuring scheme assets.

(b) Benson Ltd. operates a defined benefit scheme for its employees. At June 2011, the net

pension liability reco gnized in the statement of financial position was $18 million, excluding

an unrecognized actuarial gain of $15 million which Benson Ltd. wishes to spread over the

remaining working lives of the employees. The scheme was revised on 1 June 2011. This

resulted in the benefits being enhanced for some members of the plan and because benefits

do not vest for these members for five years, Johnson wishes to spread the increased cost

over that period. However, part of the scheme was to be closed, without any redundancy of

employees. Benson Ltd. requires advice on how to account for the above scheme under IAS

19 Employee Benefits including the presentation and measurement of the pension expense.

Required:

Discuss, with suitable computations, the advice that should be given to Johnson in

accounting for the above events.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning