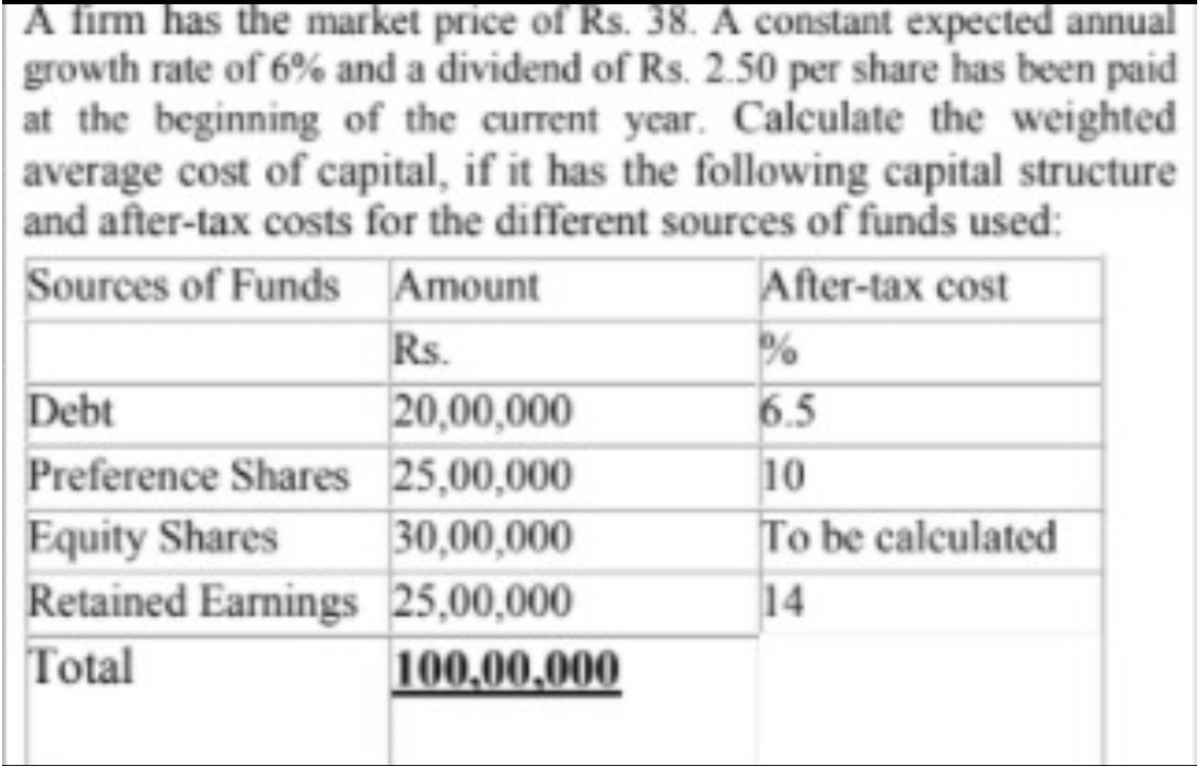

A fim has the market price of Rs. 38. A constant expected annual growth rate of 6% and a dividend of Rs. 2.50 per share has been paid at the beginning of the current year. Calculate the weighted average cost of capital, if it has the following capital structure and after-tax costs for the different sources of funds used: Sources of Funds Amount After-tax cost Rs. Debt 20,00,000 6.5 Preference Shares 25,00,000 10 Equity Shares Retained Earnings 25,00,000 30,00,000 To be calculated 14 Total 100,00,000

A fim has the market price of Rs. 38. A constant expected annual growth rate of 6% and a dividend of Rs. 2.50 per share has been paid at the beginning of the current year. Calculate the weighted average cost of capital, if it has the following capital structure and after-tax costs for the different sources of funds used: Sources of Funds Amount After-tax cost Rs. Debt 20,00,000 6.5 Preference Shares 25,00,000 10 Equity Shares Retained Earnings 25,00,000 30,00,000 To be calculated 14 Total 100,00,000

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 13EP

Related questions

Question

Transcribed Image Text:A fim has the market price of Rs. 38. A constant expected annual

growth rate of 6% and a dividend of Rs. 2.50 per share has been paid

at the beginning of the current year. Calculate the weighted

average cost of capital, if it has the following capital structure

and after-tax costs for the different sources of funds used:

Sources of Funds Amount

After-tax cost

Rs.

20,00,000

Preference Shares 25,00,000

Debt

6.5

10

Equity Shares

30,00,000

To be calculated

14

Retained Earnings 25,00,000

100,00,000

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning