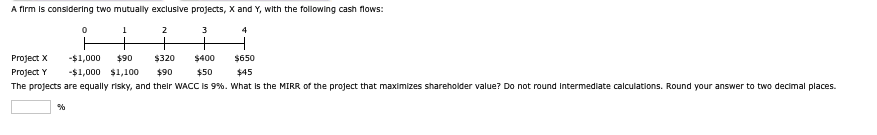

A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 + + + ㅓ Project X Project Y -$1,000 $90 -$1,000 $1,100 $320 $90 $400 $50 $650 $45 The projects are equally risky, and their WACC is 9%. What is the MIRR of the project that maximizes shareholder value? Do not round intermediate calculations. Round your answer to two decimal places. %

Q: Too Young, Incorporated, has a bond outstanding with a coupon rate of 6.7 percent and semiannual…

A:

Q: Compute the nominal annual rate of interest for the following simple annuity due. Future Value…

A: Let's dissect the computation in detail: 1. Rent Payment: In this annuity, the rent payment is the…

Q: These three put options are all written on the same stock. One has a delta of −0.6, one a delta of…

A: Delta GivenΔ1 = -0.6Δ2 = -0.7Δ3 = -0.2 Assign the delta values to strike price.Whichever has the…

Q: None

A: Pro Forma Employee Stock Option (ESO) Obligation on Dec 31, 2019Unfortunately, we cannot directly…

Q: Nikul

A: Current Dividend, D0 = $2.05Dividend grow by 20% for the next 5 years.D1 = $2.05*1.20 = $2.460D2 =…

Q: NPV. Grady Precision Measurement Tools has forecasted the following sales and costs for a new GPS…

A: 1. Annual Revenue Calculation: Annual sales volume ( times ) Price per unit 46,000 units times…

Q: am. 112.

A: The objective of this question is to calculate the value of a stock today based on the Gordon Growth…

Q: A fire station fields emergency calls from its community with an expected rate of 10 emergencies per…

A: To solve this problem, we can use the exponential distribution since it models the time between…

Q: You are attempting to value a call option with an exercise price of $105 and one year to expiration.…

A: We can use the two-state stock price model to value the call option under the following…

Q: A call option with X = $55 on a stock priced at S = $60 is sells for $12. Using a volatility…

A: Part 2: Explanation:Step 1: Calculate d1 and d2 using the Black-Scholes formula:\[d_1 =…

Q: has come out with an even better product. As a result, the firm projects an ROE of 20%, and it will…

A: Part 2: Explanation:Step 1: Calculate the growth rate (g):\[ g = ROE \times Plowback ratio = 20%…

Q: what are some factors that need to reflect in the Income statement? How should it be project these…

A: The objective of this question is to identify the key factors that need to be reflected in an income…

Q: During a 12-month period, a company is permitted to issue new securities through crowdfunding up to…

A: A corporation may offer up to $5 million in new securities through crowdfunding in a 12-month…

Q: : McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $15 per set…

A: The problem pertains to the determination of the sensitivity of the NPV with respect to the changes…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7)years. The…

A: Free Cash Flow (FCF) is a measure used in finance to represent the cash generated by a business or…

Q: Corporate Finance You begin working at an investment bank with a group of analysts, and you are all…

A: Using a 40% Growth Rate for Amazon's DCF Model: A Critical Assessment There are drawbacks to the…

Q: None

A: You're absolutely right. While directly calculating the expected return on Wallet Drug Company's…

Q: None

A: Step 1:a.Short-term investment fund (A) mean = 2.00% Standard deviation = 0.30% Intermediate-term…

Q: (Break-even analysis) You have developed the income statement in the popup window, E, for the Hugo…

A: a) calculation of Firm's Break-even in sales dollars:= Fixed Cost of the firm/Contribution margin…

Q: 1 Given the following conditional value table, deter- mine the appropriate decision under…

A: When considering decisions under uncertainty, various criteria can guide the choice-making process.…

Q: Consider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal…

A: Part 2: Explanation:Step 1: Calculate the weight of A in the portfolio. - Weight of A = $35,000 /…

Q: Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are…

A:

Q: Show graphically and in a table the profit and futures price relationships at expiration for the…

A: Profit and Futures Price Relationships at ExpirationThis analysis will show the profit and loss at…

Q: Question 9 2 pts An investor borrowed $10,000 to buy shares of stock of a chain of retail gift…

A: Simple Interest = Principal * Rate * Time where, Principal = $10,000Rate = 9%Time = 120/360So simple…

Q: Use the Black-Scholes formula for the following stock: Time to expiration 6 months Standard…

A:

Q: Finance Alc raised £x in a 2:5 Rights Issue. Pre-rights share capital comprised y £1nv shares, and…

A:

Q: Vijay

A: Approach to solving the question:1. Calculate FCFF for each year using the provided financial data…

Q: Judy's Boutique just paid an annual dividend of $3.13 on its common stock. The firm increases its…

A: The cost of equity represents the rate of return that investors require from a company's stock in…

Q: Bhupatbhai

A: Answer image: Here is the quote for the Lake Lead Group:FieldValueStock (Div)Lake Lead…

Q: please answer both correctly:

A: Referenceshttps://www.investopedia.com/terms/c/capitalbudgeting.asphttps://www.investopedia.com/term…

Q: Bhupatbhai

A:

Q: Nikul

A: Step 1:Given:Probability of healthy economy (p₁) = 0.6Probability of soft economy (p₂) =…

Q: Kale Inc. forecasts the free cash flows (in millions) shown below. Assume the firm has zero…

A: Using the provided information:FCF0=−40 millionFCF1=150 millionWACC=11%g=4%We can now calculate…

Q: A project has an IRR of 10%. It has the following cash flows where X is the initial outlay (i.e.,…

A: Calculate the NPV of the project as follows:Formula sheet:Notes:To understand the calculation of the…

Q: Lakoniskok equipment has an investment opportunity

A: Investment refers to the allocation of resources, typically money or capital, with the expectation…

Q: 45. You are evaluating a stock selling for $30 per share. Over the investment period (1 year) you…

A: Step 1: Step 2: Step 3: Step 4:

Q: After reviewing the compounding model your kindergartener has a follow-up question about effective…

A: The objective of the question is to calculate the effective annual rate (EAR) for different…

Q: Business has been good for Keystone Control Systems, as indicated by the six-year growth in earnings…

A: d. To compute the cost of new common stock (Kn), we use the dividend growth model…

Q: A portfolio manager summarizes the input from the macro and micro forecasters in the following…

A: Portfolio returns:Portfolio return refers to the overall performance of an investment collection…

Q: Bunkhouse Electronics is a recently incorporated firm that makes electronic entertainment systems.…

A: Part a: Cost of Equity using the Capital asset pricing model (CAPM): Given information: Beta = 1.33…

Q: To vacation with his family, Mr. Velasco obtains a loan of $60,000 to be paid in 7 monthly…

A: Let's create an amortization table for Mr. Velasco's loan. Here are the details:Loan amount:…

Q: Carnes Cosmetics Co.'s stock price is $44, and it recently paid a $1.25 dividend. This dividend is…

A: Step 1: Calculate Future DividendsGiven:- Initial dividend, ( D_0 = $1.25 )- Annual growth rate for…

Q: The current futures price is 100 + 4 In the first period, the futures price can either go up 40% or…

A: Let's examine each stage in greater detail: 1. At the conclusion of the first period, compute the…

Q: 22. Portfolio Expected Return You have $250,000 to invest in a stock portfolio. Your choices are…

A: Step 1: Step 2: Step 3: Step 4:

Q: 6. Create a spreadsheet modeling trajectories of geometric Brownian motion starting at 50 with…

A: The objective of the question is to create a spreadsheet model for geometric Brownian motion and use…

Q: Fill in the missing numbers for the following income statement. (Do not round intermediate…

A: Step 1: To complete the missing amounts in the income statement, here is its detailed solution:…

Q: give me the right answer only ASAP Suppose we are thinking about replacing an old computer with…

A: Certainly! Let's break down the calculations and explanations for each part:**a-1. Calculate the EAC…

Q: Corporate Finance If a company is profitable and pays taxes, why is the cost of its debt rd(1-t),…

A: Why Profitable, Tax-Paying Companies Enjoy a Lower Cost of Debt (rd(1-t)) For prosperous enterprises…

Q: Project L requires an initial outlay at t = 0 of $47,000, its expected cash inflows are $8,000 per…

A: The objective of the question is to calculate the payback period of Project L. The payback period is…

Step by step

Solved in 2 steps

- A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 Project X -$1,000 $90 $320 $430 $700 Project Y -$1,000 $1,000 $100 $45 $55 The projects are equally risky, and their WACC is 10%. What is the MIRR of the project that maximizes shareholder value? Do not round intermediate calculations. Round your answer to two decimal places.Finance A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 Project X -$1,000 $110 $280 $430 $750 Project Y -$1,000 $900 $110 $55 $50 The projects are equally risky, and their WACC is 9%. What is the MIRR of the project that maximizes shareholder value? Do not round intermediate calculations. Round your answer to two decimal places. %A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: Project S -$1,000 $899.96 $240 $15 $5 Project L -$1,000 $10 $250 $380 $843.66 The company's WACC is 10.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.

- Queens Soliderate is considering two mutually exclusive projects. The firm, which has a 12% cost of capital, has estimated its cash flows as shown in the following table. Project A Project B Initial investment (CF0) $130,000 $85,000 Year (t) Cash inflows (CFt) 1 $25,000 $40,000 2 35,000 35,000 3 45,000 30,000 4 50,000 10,000 5 55,000 5,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability. Required to answer. Single line text.A firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows: Time Cash Flow Cash Flow Y C $95,000 -$70.000 35,000 40.000 55,000 40,000 3 60.000 40.000 40.000 10.000 9% , what is the EAA of the project that adds the most value to the firm? Do not round intermediate calculations, Round vour answer Proiects and Y are equally risky and may be reneated indefinitely, If the firm's WACC. the nearest dollar , whose EAA -s Choose Project -Select-A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 Project X -$1,000 $90 $320 $430 $700 Project Y -$1,000 $1,000 $100 $45 $55 The projects are equally risky, and their WACC is 10%. What is the MIRR, Payback Period or Discount Payback Period of project X and project Y. Note: DO NOT SOLVE ON EXCEL

- The Webex Corporation is trying to choose between the following two mutually exclusive designprojects: Year Net Cash Flow Project - I($) Net Cash Flow Project - II($) 0 (53,000) (16,000) 1 27000 9100 2 27000 9100 3 27000 9100 (a) If the required return is 10% and the company applies the Profitability Index decision rule,which project should the firm accept?(b) If the company applies the Net Present Value decision rule, which project should it take?(c) Explain why your answers in (a) and (b) are different(d) Calculate the Internal Rate of Return of both projects.Thomas Company is considering two mutually exclusive projects. The firm, which has a cost of capital of 14%, has estimated its cash flows as shown in the following table: Project A Project B Initial investment (CF0) $150,000 $83,000 Year (t) Cash inflows (CFt) 1 $20,000 $45,000 2 $35,000 $25,000 3 $40,000 $35,000 4 $50,000 $10,000 5 $70,000 $15,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability.A company is considering mutually exclusive projects. The free cash flows associated with these projects are as follows: Project A Project B Initial outlay -$100,000 -$100,000 Year 1 $32,000 $0 Year 2 $32,000 $0 Year 3 $32,000 $0 Year 4 $32,000 $0 Year 5 $32,000 $200,000 The required rate of return on these projects is 11%. They are of equal risk. What is each project’s MIRR? Which project should be chosen? Is it possible for conflicts to exist between NPV and IRR when independent projects are being evaluated? Explain your answer

- UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFs ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360 Question: Find the crossover rate. (answer in excel format and show spreadsheet inputs)The Weiland Computer Corporation is trying to choose between the following mutually exclusive design projects, P1 and P2:Year 0123 Cash flows (P1) -$53,000 27,000 27,000 27,000 Cash flow (P2) -$16,000 9,100 9,100 9,100a. If the discount rate is 10 percent and the company applies the profitability index (PI) decision rule, which project should the firm accept?b. If the firm applies the Net Present Value (NPV) decision rule, which project should it take?c. Are your answers in (a) and (b) different? Explain why?Bell Manufacturing is attempting to choosethe better of two mutually exclusive projects for expanding the firm’s warehousecapacity. The relevant cash flows for the projects are shown in the following table.The firm’s cost of capital is 15%. project X project Y initial investment 500000 325000 year cash inflow cash inflow 1 100000 140000 2 120000 120000 3 150000 95000 4 190000 70000 5 250000 50000 a. Calculate the IRR to the nearest whole percent for each of the projects. b. Assess the acceptability of each project on the basis of the IRRs found in part a. c. Which project, on this basis, is preferred? (solve using excel)