A firm is evaluating the acquisition of an asset that costs $68,200 and requires $3,930 in installation costs. If the firm depreciates the asset under MACRS, using a five year recovery period, see table attached: Determine the depreciation charge for each year.

A firm is evaluating the acquisition of an asset that costs $68,200 and requires $3,930 in installation costs. If the firm depreciates the asset under MACRS, using a five year recovery period, see table attached: Determine the depreciation charge for each year.

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 7BCRQ

Related questions

Question

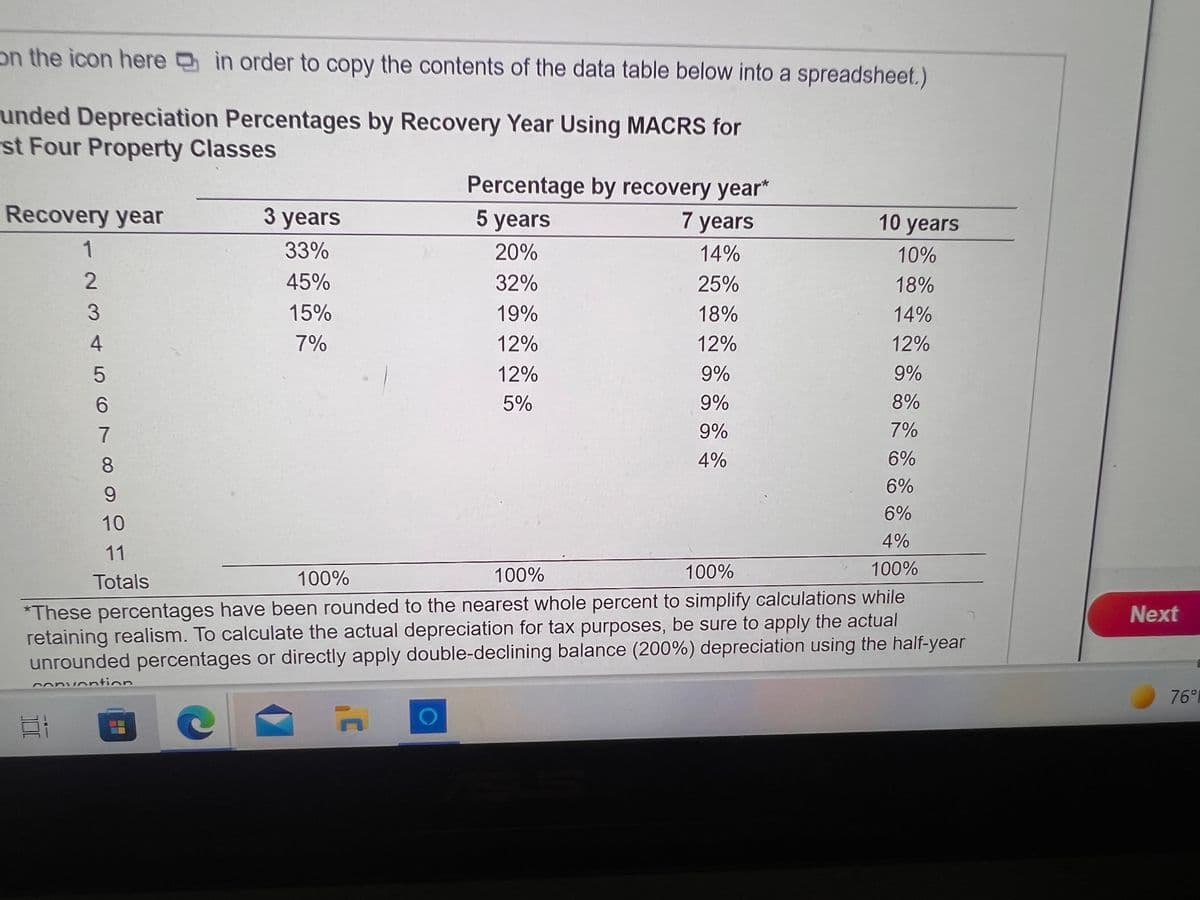

A firm is evaluating the acquisition of an asset that costs $68,200 and requires $3,930 in installation costs. If the firm depreciates the asset under MACRS, using a five year recovery period, see table attached:

Determine the

Transcribed Image Text:on the icon here in order to copy the contents of the data table below into a spreadsheet.)

unded Depreciation Percentages by Recovery Year Using MACRS for

st Four Property Classes

Percentage by recovery year*

Recovery year

3 years

5 years

7 years

10 years

1

33%

20%

14%

10%

45%

32%

25%

18%

15%

19%

18%

14%

7%

12%

12%

12%

12%

9%

9%

5%

9%

8%

9%

7%

4%

6%

6%

6%

10

4%

11

100%

100%

100%

100%

Totals

*These percentages have been rounded to the nearest whole percent to simplify calculations while

retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual

unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year

Next

convontion

76°

2 3 4 5 67 8 9 은

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT