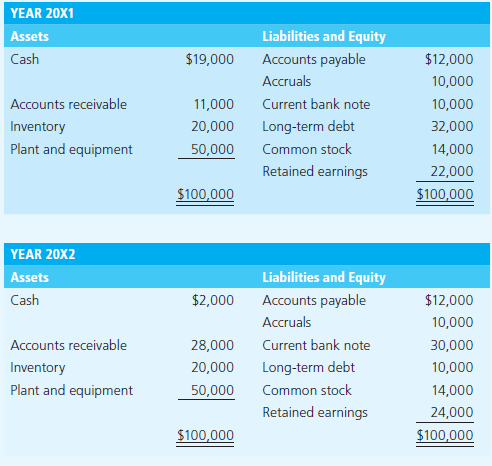

A firm’s balance sheets for the last two years are as follows (refer to image): Sales in 20X1 were $250,000. Sales in 20X2 were $250,000. If the firm earned $5,000 during 2012, what proportion of those earnings were distributed?

Q: In its recent income statement, Smith Software Inc. reported $28 million of net income, and in its…

A: Net income refers to the portion of revenue left after deducting all the expenses from the revenue.…

Q: A firm has liabilities of ₱30,000 and owner’s capital of ₱90,000. Find the percentage of total…

A: Answer 1) Calculation of proportion of Total Liabilities to Total Assets Total Liabilities to Total…

Q: During the past year, a company had cash flow to stockholders, an operating cash flow, and net…

A: Cash flow to creditors = Operating cash flow - change in working capital - Net capital spending -…

Q: The Harrison Bicycle Company had the following operating results for 2021-2022. In addition, the…

A: Cash flow statement is very important as it gives company a clear picture about its cash…

Q: Ak Kramer Inc.'s income statement shows sales of $1,000, cost of goods sold of $400,pre-interest…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: As of December 31, 2015, Lincolnshire Company had assets of $1,850,000 and liabilities of $570,000.…

A: As per accounting equation, Assets = Liabilities + Owner's Equity Or Owner's Equity =assets -…

Q: Sandhill construction company earned $439,000 during the year ended June 30, 2017. After paying out…

A: Retained earnings refer to the amount earned by the organization till the date of preparation of the…

Q: The table that follows summarizes the financial performances of four companies in the year 2012.…

A: Return on equity (ROE): This financial ratio evaluates a company’s efficiency in using stockholders’…

Q: Henderson Company had beginning-of-the-year total assets of $360,000 and total liabilities of…

A: Part -1.The accounting equation works for the question is as under:Total assets = Total liabilities…

Q: The balance sheet of ATLF, Inc. reports total assets of $1,950,000 and $2,050,000 at the beginning…

A: Profit margin ratio is calculating by dividing the net income by net sales.

Q: Analyzing the quality of firm earnings) Kabutell, Inc. had net income of ,$ 800,000 cash flow…

A: a) Quality of Earning Ratio=Cashflow from operations/ Net income =500,000/800,000=0.625= 62.5% hence…

Q: Below is selected balance sheet and income statement information from Brahtz & Company. 2014 2013 $…

A: Ratios help in analyzing the actual position of the company whether the company is able to meet the…

Q: In 2016, the Allen corporation had sales of $67 million, total assets of $42 million, and total…

A: Sales = 67,000,000 Assets = 42,000,000 Liabilities = 19,000,000 Interest Rate = 6.3% Tax Rate = 35%…

Q: Tibbs Inc. had the following data for the most recent year: Net income = $300; Net operating profit…

A: Return on Invested capital is the return or net income after taxes earned on the invested capital…

Q: A company has the following items for the fiscal year 2020: Revenue = 10 million EBIT = 4 million…

A: The question is related to Ratio Analysis. The Net Profit Margin is calculated with the help of…

Q: The current ratio for 2019 (rounded) is: Multiple Choice 2.5 3.6 1.8 4.1

A: Current assets in 2019 = $1266000 Current liabilities in 2019 = $508000

Q: The following data were taken from the financial statements of Howard Corporation for the year ended…

A: Solution:- Introduction:- The following formula used to calculate return on assets as follows;-…

Q: n its most recent financial statements, Del-Castillo Inc. reported $65 million of net income and…

A: Here, we need to find the amount of dividend paid to shareholders. The formula to calculate the…

Q: On December 31, 2015, the net assets of Martinez Manufacturing amounted to $40,000. Net income…

A: Net Assets on Dec 31, 2015 = Net Assets on Jan 1, 2015 + Net Income - Dividend paid + Issued Common…

Q: The management of Oriole Company is trying to decide whether it can increase its dividend. During…

A: Formula: Free cash flow = Net cash provided by operating activities - Dividends paid - Capital…

Q: solution star industries has published its annual account. it indicates that during the year the…

A: Operating cash flows refers to the flows of the cash (inflows and outflows both) in the business…

Q: Paladin Furnishings generated $4 million in sales during 2018, andits year-end total assets were…

A: The question is based on the concept of Additional funds needed (AFN) and Self sustaining growth…

Q: The Crane Company has disclosed the following financial information in its annual reports for the…

A: Cash flow from operating activities is the cash inflow and outflow which has resulted from the…

Q: At the beginning of the year, Addison Company's assets are $256,000 and its equity is $192,000.…

A: Equity represents the amount of capital owned by the shareholders of the company. It is basically,…

Q: TSW Inc. had the following data for last year: Net income = $800; Net operating profit after taxes…

A: The formula used is shown:

Q: Laflamme Inc. had the following operating results for 2018: sales $30,660, cost of goods sold =…

A:

Q: At year-end 2016, total assets for Arrington Inc. were $2 million and accounts payable were…

A: AFN = Additional Fund Needed

Q: Last year, McGinley Company had total equity of $600,000, a return on assets of 10%, and a return on…

A: Return on equity=Net IncomeShareholder's equity0.15=NI6,00,000Net Income=$90,000

Q: In its recent income statement, Smith Software Inc. reported $11 million of net income, and in its…

A: Retained earning means from the total profits and available…

Q: Henderson Company had beginning-of-the-year total assets of $360,000 and total liabilities of…

A: Stockholder equity = Total assets - Total liabilitiesStockholder's equity = 360000-216000 =…

Q: Mazaya Company started the year with total assets of RO.360,000 and total liabilities of…

A: Option D is the answer:

Q: At the beginning of 2010, a corporation had assets of $270,000 and liabilities of $160,000. During…

A: The answer is option B, ($130,000) For explanation Refer step2

Q: In 2016, the Allen Corporation had sales of $62 million, total assets of $47 million, and total…

A: Given the following information: Sales: $62,000,000 Total assets: $47,000,000 Total liabilities:…

Q: A company's sales in 2020 were $3.7 million and its total spontaneous assets were $9.7 million. Also…

A: Given:Company sales in 2020 were $3.7 millionAssets=$9.7 millionLiabilities consists of:Wages…

Q: Green Caterpillar Garden Supplies Inc. reported sales of $890,000 at the end of last year, but this…

A: Data given: So= Current sales = $890,000 ∆S/ So= % change in sales = 7% PM= Profit Margin = 24%…

Q: The balance sheets of HR, Inc. reports total stockholders' equity of $550,000 and $750,000 at the…

A: Return on Equity = Net incomeTotal stockholders' equity

Q: In its Year 6 annual report, Sally Inc. reported net earnings of $4,242 million and dividends paid…

A: Forecast dividends on the basis of last year dividend to sales ratio

Q: Volbeat Corp. shows the following information on its 2015 income statement: sales = $255,000; costs…

A: Given that: sales = $255,000 costs = $156,000 other expenses = $7,900 depreciation expense = $15,600…

Q: The Malia Corporation had sales in 2015 of $65 million, total assets of $42 million, and total…

A: Given the following information: Sales: $65 million Total assets: $42 million Total liabilities:…

Q: The Harrison Bicycle Company had the following operating results for 2021-2022. In addition, the…

A: The value of equity is determined by deducting total liabilities from the total assets. The…

A firm’s balance sheets for the last two years are as follows (refer to image):

Sales in 20X1 were $250,000. Sales in 20X2 were $250,000.

If the firm earned $5,000 during 2012, what proportion of those earnings

were distributed?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- PROBLEM 8:Tomas Co. has the following balance sheet as of December 31, 2021.Current assets 180,000.00Fixed assets 120,000.00Total assets 300,000.00Accounts payable 40,000.00Accrued liabilities 20,000.00Notes payable 50,000.00Other Long-term debt 75,000.00Total Equity 115,000.00Total liabilities and equity 300,000.00 In 2021, Tomas Co. reported sales of P1,500,0000, net income of P30,000, and dividends of P18,000. The company expected its sales to increase by 20% by next year and its retention ratio will remain at 40%. Assume that Tomas Co. is operating at full capacity and it uses the AFN approach in determining the amount of external financing needed.How much is the sales for 2022? Using Problem 8, how much is the increase in retained earnings for the purpose of computing the AFN? Using Problem 8, how much external funds needed for the year 2022?Financial statement of ABC 31/12/2020 Notes receivable 20,000 Share capital (180,000stocks/face value 2€) 360,000 Taxes payable 15,000 Retained earnings ? Reservations and contributions payable 25,000 Mortgage loan 100,000 Notes in delay 15,000 Cash desk 40,000 Notes payable 25,000 Demand deposit 100,000 Goods 50,000 Securities 20,000 Packaging materials 17,000 Participations 34,500 Suppliers 20,000 Building (estimated life 20years/residual value 20,000) 220,000 Deposit-advanced payment of suppliers 5,000 Depreciated buildings 50,000 Deposit-advanced payment of customers 20,000 Furniture (estimated life 10years/residual value 1,000) 40,000 Customers 15,000 Depreciated furniture 39,000 Debtors 30,000 Economic unit 30,000 Difference above par 30,000 Track (estimated life 10years/residual value5,000) 70,000 Depreciated track value 58,500 Prepaid insurance 3,000 Negotiable promissory notes…Problem #1 The following balance sheet and income statement data is given: 31-Dec Yr 2021 Yr 2020 Cash $4,300 $3,700 Accounts receivable (net) 22,000 23,400 Inventories 10,000 7,000 Plant assets (net) 75,000 86,000 Total assets 111,300 120,100 Accounts payable 12,370 11,100 Bonds payable 70,000 70,000 Total liabilities 82,370 81,100 Common stock, $10 par 65,000 59,000 Paid-in capital 10,000 10,000 Retained earnings 24,300 20,600 Total stockholders’ equity 99,300 89,600 Net credit sales 100,000 Cost of goods sold 60,350 Gross profit 39,650 Net income 14,000 REQUIRED: Compute the following ratios for 2021. NOTE: Copy and paste the information below into the answer box first and then show your calculation steps for this problem to receive credits. (1) Accounts receivable turnover=____________________ (2) Inventory turnover=__________________ (3) Accounts payable…

- Question One Njenge Bank has the following balance sheet (in millions) with the risk weights in parentheses. Assets Liabilities and Equity Cash K20 Deposits K175 OECD Interbank deposits K25 Subordinated debt (2.5 years) K3 Mortgage loans K70 Cumulative preferred stock K5 Consumer loans K70 Equity K2 Total Assets K185 Total Liabilities & Equity K185 In addition, the bank has K30 million in performance-related standby letters of credit (SLCs), and K300 million in six-year interest rate swaps. Credit conversion factors…l-Itihad Corporation Balance SheetDecember 31, 2019AssetsLiability & EquityCurrent AssetsCurrent LiabilityCash$5,000Accounts payable22,000Short term securities10,000Accrual Account8,000Account Receivables30,000Short term debt6,000Inventory32,000Total Current Liability36,000Long-term debt40,000Total Current Assets77,000TotalLiability76,000Long term AssetsEquityNet Property & equipment70,000CommonStocks64,000Retained earnings17,000Total Equity81,000Total Liability and Equity157,000Other assts 10000Total Assets157,000Sur Corporation Income StatementDecember 31, 2019Other Financial information of Sur corporation December 31, 2019Net sales (revenue)$150,000· Average Number of Common shares outstanding 16,000 Shares· Market price of Common share $3.5Cost of goods sold80,000Gross profit70,000Operating expenses30,000EBIT- (Operating profit)40,000Interest expense10,000EBT- ( Earnings before taxes)30,000Income tax 10,000Net Income (net profit)20,000You have to find the following ratios…Category Prior Year Current Year Accounts payable 3,123.00 5,969.00 Accounts receivable 6,987.00 8,940.00 Accruals 5,642.00 6,108.00 Additional paid in capital 19,885.00 13,325.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,986.00 18,120.00 Current portion long-term debt 500 500 Depreciation expense 1,035.00 988.00 Interest expense 1,290.00 1,167.00 Inventories 3,006.00 6,743.00 Long-term debt 16,856.00 22,001.00 Net fixed assets 75,521.00 74,000.00 Notes payable 4,072.00 6,540.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,244.00 34,874.00 Sales 46,360 45,055.00 Taxes 350 920 What is the firm's cash flow from financing?

- Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00 8,910.00 Accruals 5,635.00 6,187.00 Additional paid in capital 19,527.00 13,950.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,974.00 18,270.00 Current portion long-term debt 500 500 Depreciation expense 975.00 976.00 Interest expense 1,278.00 1,155.00 Inventories 3,048.00 6,717.00 Long-term debt 16,569.00 22,919.00 Net fixed assets 75,968.00 73,882.00 Notes payable 4,045.00 6,584.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,870.00 34,759.00 Sales 46,360 45,347.00 Taxes 350 920 What is the firm's cash flow from operations? What is the firm's dividend payment in the current year? What is the firm's net income in the current year?#10 Item Prior year Current year Accounts payable 8,123.00 7,716.00 Accounts receivable 6,048.00 6,607.00 Accruals 997.00 1,500.00 Cash ??? ??? Common Stock 10,094.00 11,603.00 COGS 12,653.00 18,393.00 Current portion long-term debt 4,911.00 5,090.00 Depreciation expense 2,500 2,763.00 Interest expense 733 417 Inventories 4,245.00 4,824.00 Long-term debt 14,141.00 13,226.00 Net fixed assets 51,826.00 54,004.00 Notes payable 4,339.00 9,940.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,688.00 30,532.00 Sales 35,119 45,044.00 Taxes 2,084 2,775 What is the firm's total change in cash from the prior year to the current year? Answer format: Number: Round to: 0 decimal places.Particulars As on 31.3.2019(Rupees. In Lacs)As on 31.3.2020(Rupees. In Lacs)Investment in FinancialAssets- 100Equity Share Capital 150 160Long term Loans taken 100 200Dividend paid - 26Dividend received - 10Interest received - 15 Calculate the debt-equity ratio & comment

- Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,139.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,349.00 Interest expense 40,500 41,741.00 Inventories 279,000 288,000 Long-term debt 337,728.00 398,725.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,280.00 Retained earnings 306,000 342,000 Sales 639,000 847,106.00 Taxes 24,750 48,618.00 What is the current year's return on assets (ROA)? (Round to 4 decimal places.)Reference is made to the 2022 Balance Sheet of Tram-Ropes limited.Tram-Ropes Limited Balance Sheet 2022Cash 1,000,000.00 Accounts Payable 8,000,000.00Acc. Receivable 12,000,000.00 Notes Payable 8,500,000.00Marketable securities 3,000,000.00 Long-term Debt 20,000,000.00Inventories 7,500,000.00 Common stock 7,500,000.00Fixed Assets 26,500,000.00 Preferred Stock 6,000,000.00Total Assets 50,000,000.00 Total Liabilities and Equity 50,000,000.00Additional Information:i. The Long-Term debt consists of 8% annual coupon bonds, with15 years to maturity and are currently selling for 95% ofpar.ii. The company’s common shares which have a book value of $20per share are currently selling at $25 per share.PREPARED BY THE CI, MGMT2023 4iii. Preferred shares have a book value of $100 per share. Theseshares are currently selling at $120 per share and paysdividends of 6% per annum on book value.iv. The dividend growth rate is expected to be 3%, and dividendfor 2023 is projected to be $5.00 per…17. Maymay Company trial balance has the following selected accounts: Cash (includes P100,000 in bond sinking fund for long term bond payable) 500,000 Accounts receivable 200,000 Allowance of uncollectible accounts 50,000 Deposits received from customers 30,000 Merchandise inventory 70,000 Unearned rent 10,000 Investment at fair value to profit or loss 20,000 What amount should Mumay Company report as total current assets in its statement of financial position? Group of answer choices 740,000 640,000 720,000 670,000