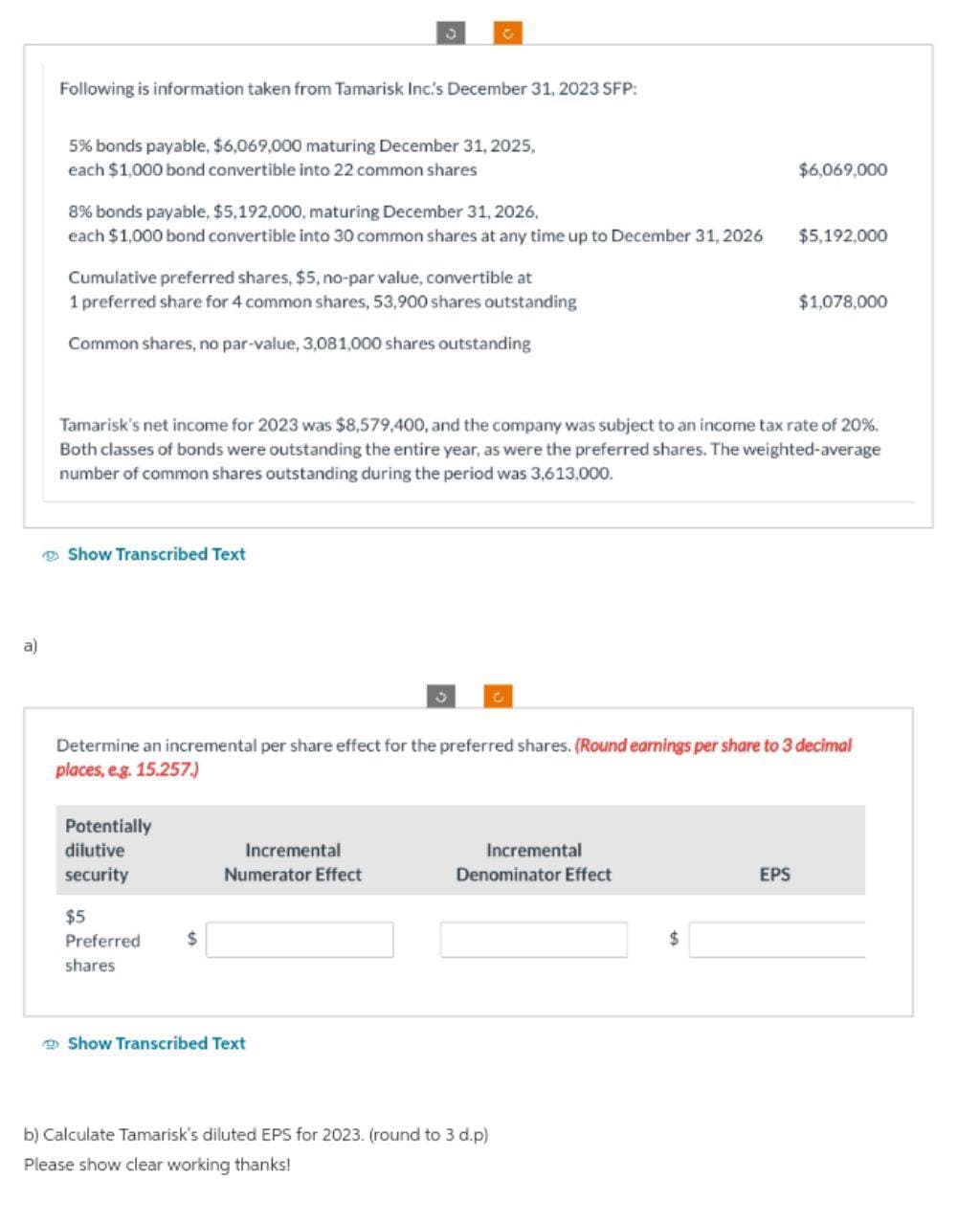

a) Following is information taken from Tamarisk Inc's December 31, 2023 SFP: 5% bonds payable, $6,069,000 maturing December 31, 2025, each $1,000 bond convertible into 22 common shares 8% bonds payable, $5,192,000, maturing December 31, 2026, each $1,000 bond convertible into 30 common shares at any time up to December 31, 2026 Cumulative preferred shares, $5, no-par value, convertible at 1 preferred share for 4 common shares, 53,900 shares outstanding Common shares, no par-value, 3,081,000 shares outstanding Show Transcribed Text S Potentially dilutive security Tamarisk's net income for 2023 was $8,579,400, and the company was subject to an income tax rate of 20%. Both classes of bonds were outstanding the entire year, as were the preferred shares. The weighted-average number of common shares outstanding during the period was 3,613,000. $5 Preferred shares $ Incremental Numerator Effect Determine an incremental per share effect for the preferred shares. (Round earnings per share to 3 decimal places, e.g. 15.257.) Show Transcribed Text 3 Incremental Denominator Effect b) Calculate Tamarisk's diluted EPS for 2023. (round to 3 d.p) Please show clear working thanks! $6,069,000 $ $5,192,000 EPS $1,078,000

a) Following is information taken from Tamarisk Inc's December 31, 2023 SFP: 5% bonds payable, $6,069,000 maturing December 31, 2025, each $1,000 bond convertible into 22 common shares 8% bonds payable, $5,192,000, maturing December 31, 2026, each $1,000 bond convertible into 30 common shares at any time up to December 31, 2026 Cumulative preferred shares, $5, no-par value, convertible at 1 preferred share for 4 common shares, 53,900 shares outstanding Common shares, no par-value, 3,081,000 shares outstanding Show Transcribed Text S Potentially dilutive security Tamarisk's net income for 2023 was $8,579,400, and the company was subject to an income tax rate of 20%. Both classes of bonds were outstanding the entire year, as were the preferred shares. The weighted-average number of common shares outstanding during the period was 3,613,000. $5 Preferred shares $ Incremental Numerator Effect Determine an incremental per share effect for the preferred shares. (Round earnings per share to 3 decimal places, e.g. 15.257.) Show Transcribed Text 3 Incremental Denominator Effect b) Calculate Tamarisk's diluted EPS for 2023. (round to 3 d.p) Please show clear working thanks! $6,069,000 $ $5,192,000 EPS $1,078,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:a)

Following is information taken from Tamarisk Inc.'s December 31, 2023 SFP:

5% bonds payable, $6,069,000 maturing December 31, 2025,

each $1,000 bond convertible into 22 common shares

8% bonds payable, $5,192,000, maturing December 31, 2026,

each $1,000 bond convertible into 30 common shares at any time up to December 31, 2026

Cumulative preferred shares, $5, no-par value, convertible at

1 preferred share for 4 common shares, 53,900 shares outstanding

Common shares, no par-value, 3,081,000 shares outstanding

Show Transcribed Text

3

Potentially

dilutive

security

$5

Preferred

shares

G

Tamarisk's net income for 2023 was $8,579,400, and the company was subject to an income tax rate of 20%.

Both classes of bonds were outstanding the entire year, as were the preferred shares. The weighted-average

number of common shares outstanding during the period was 3,613,000.

$

Incremental

Numerator Effect

Show Transcribed Text

3

Determine an incremental per share effect for the preferred shares. (Round earnings per share to 3 decimal

places, e.g. 15.257.)

Incremental

Denominator Effect

b) Calculate Tamarisk's diluted EPS for 2023. (round to 3 d.p)

Please show clear working thanks!

$6,069,000

$

$5,192,000

EPS

$1,078,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT