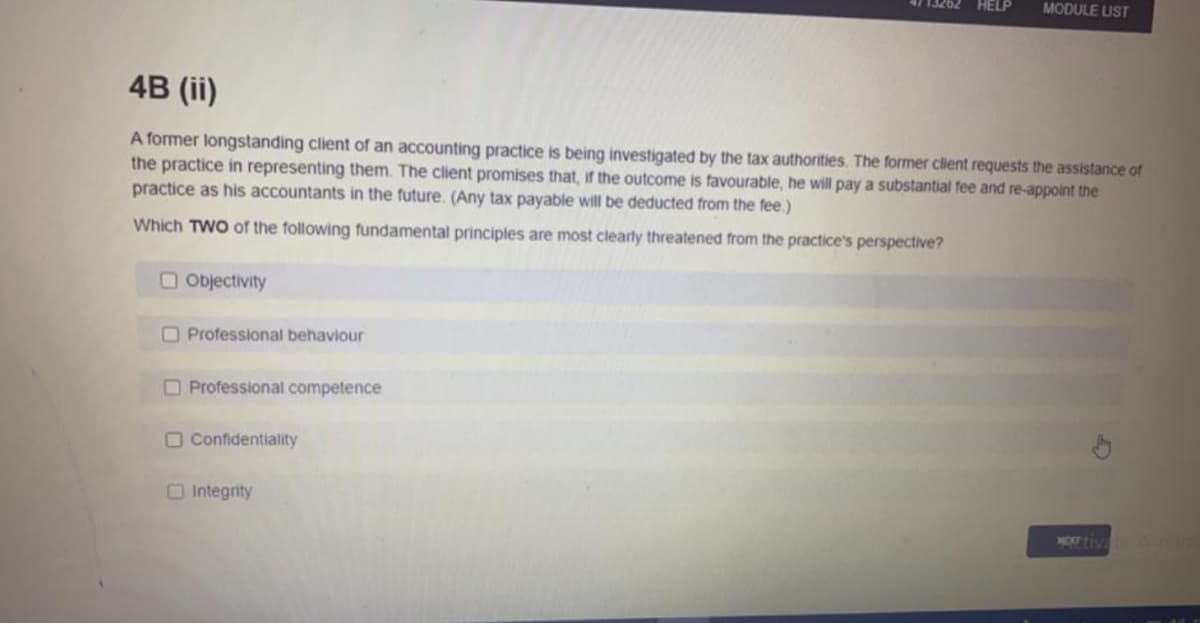

A former longstanding client of an accounting practice is being investigated by the tax authorities. The former client requests the assistance of the practice in representing them. The client promises that, if the outcome is favourable, he will pay a substantial fee and re-appoint the practice as his accountants in the future. (Any tax payable will be deducted from the fee.) Which TWO of the following fundamental principles are most clearly threatened from the practice's perspective?

A former longstanding client of an accounting practice is being investigated by the tax authorities. The former client requests the assistance of the practice in representing them. The client promises that, if the outcome is favourable, he will pay a substantial fee and re-appoint the practice as his accountants in the future. (Any tax payable will be deducted from the fee.) Which TWO of the following fundamental principles are most clearly threatened from the practice's perspective?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3RP

Related questions

Question

100%

Please Solve In 20mins I will Thumbs-up

Transcribed Image Text:HELP

MODULE UST

4B (ii)

A former longstanding client of an accounting practice is being investigated by the tax authorities. The former client requests the assistance of

the practice in representing them. The client promises that, if the outcome is favourable, he will pay a substantial fee and re-appoint the

practice as his accountants in the future. (Any tax payable will be deducted from the fee.)

Which TWO of the following fundamental principles are most clearly threatened from the practice's perspective?

O Objectivity

O Professional behaviour

OProfessional competence

O Confidentiality

OIntegrity

HOT tiv in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you