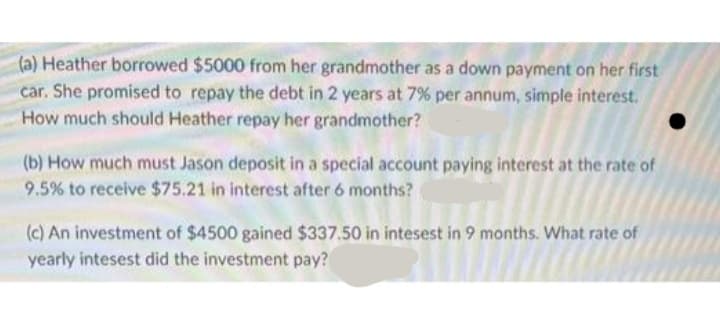

(a) Heather borrowed $5000 from her grandmother as a down payment on her first car. She promised to repay the debt in 2 years at 7% per annum, simple interest. -How much should Heather repay her grandmother? (b) How much must Jason deposit in a special account paying interest at the rate of 9.5% to receive $75.21 in interest after 6 months? (c) An investment of $4500 gained $337.50 in intesest in 9 months. What rate of yearly intesest did the investment pay?

(a) Heather borrowed $5000 from her grandmother as a down payment on her first car. She promised to repay the debt in 2 years at 7% per annum, simple interest. -How much should Heather repay her grandmother? (b) How much must Jason deposit in a special account paying interest at the rate of 9.5% to receive $75.21 in interest after 6 months? (c) An investment of $4500 gained $337.50 in intesest in 9 months. What rate of yearly intesest did the investment pay?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:(a) Heather borrowed $5000 from her grandmother as a down payment on her first

car. She promised to repay the debt in 2 years at 7% per annum, simple interest.

How much should Heather repay her grandmother?

(b) How much must Jason deposit in a special account paying interest at the rate of

9.5% to receive $75.21 in interest after 6 months?

(c) An investment of $4500 gained $337.50 in intesest in 9 months. What rate of

yearly intesest did the investment pay?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you