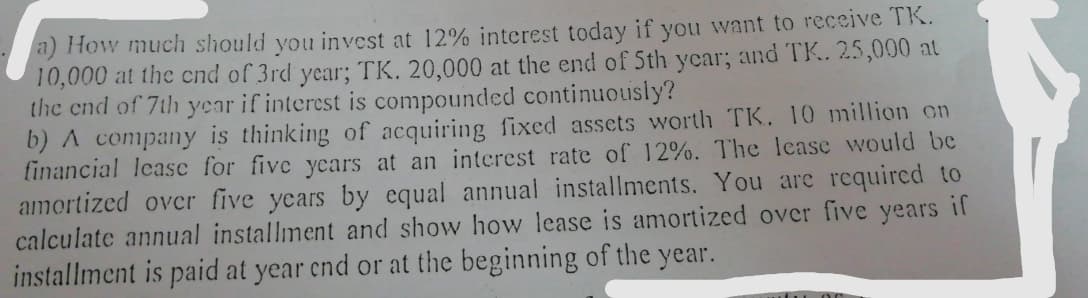

a) How much should you invest at 12% interest today if you want to receive TK. 10,000 at the cnd of 3rd year; TK. 20,000 at the end of Sth year; and TK. 25,000 at the end of 7th year if interest is compounded continuously? worth TK 10 million on aootc

a) How much should you invest at 12% interest today if you want to receive TK. 10,000 at the cnd of 3rd year; TK. 20,000 at the end of Sth year; and TK. 25,000 at the end of 7th year if interest is compounded continuously? worth TK 10 million on aootc

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter19: Lease Financing

Section: Chapter Questions

Problem 2P: Lease versus Buy Consider the data in Problem 19-1. Assume that RCs tax rate is 40% and that the...

Related questions

Question

Transcribed Image Text:a) How much should you invest at 12% interest today if you want to receive TK.

10,000 at the cnd of 3rd year; TK. 20,000 at the end of Sth year; and TK. 25,000 at

the end of 7th year if interest is compounded continuously?

b) A company is thinking of acquiring fixed assets worth TK. 10 million on

financial lease for five ycars at an interest rate of 12%. The lcase would be

amortized over five years by equal annual installments. You are required to

calculate annual installment and show how lease is amortized over five years if

installment is paid at year cnd or at the beginning of the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College