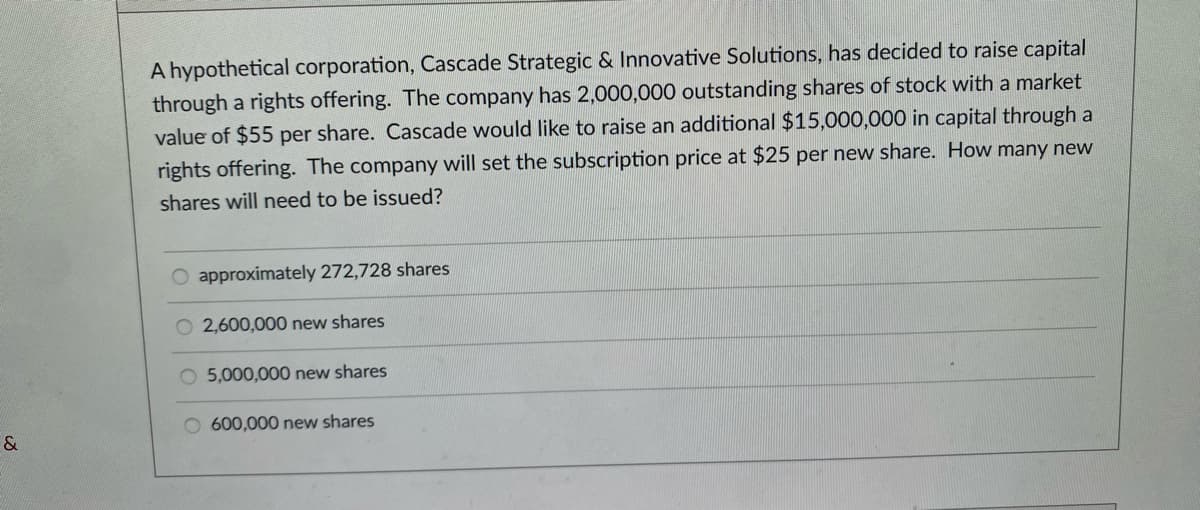

A hypothetical corporation, Cascade Strategic & Innovative Solutions, has decided to raise capital through a rights offering. The company has 2,000,000 outstanding shares of stock with a market value of $55 per share. Cascade would like to raise an additional $15,000,000 in capital through a rights offering. The company will set the subscription price at $25 per new share. How many new shares will need to be issued? O approximately 272,728 shares O2,600,000 new shares O 5,000,000 new shares O 600,000 new shares

A hypothetical corporation, Cascade Strategic & Innovative Solutions, has decided to raise capital through a rights offering. The company has 2,000,000 outstanding shares of stock with a market value of $55 per share. Cascade would like to raise an additional $15,000,000 in capital through a rights offering. The company will set the subscription price at $25 per new share. How many new shares will need to be issued? O approximately 272,728 shares O2,600,000 new shares O 5,000,000 new shares O 600,000 new shares

Chapter3: The Financial Environment: Markets, Institutions And Investment Banking

Section: Chapter Questions

Problem 9PROB

Related questions

Question

Transcribed Image Text:&

A hypothetical corporation, Cascade Strategic & Innovative Solutions, has decided to raise capital

through a rights offering. The company has 2,000,000 outstanding shares of stock with a market

value of $55 per share. Cascade would like to raise an additional $15,000,000 in capital through a

rights offering. The company will set the subscription price at $25 per new share. How many new

shares will need to be issued?

O approximately 272,728 shares

2,600,000 new shares

5,000,000 new shares

O 600,000 new shares

Expert Solution

Step 1

ANSWER:-

600,000 new shares

EXPLANATION:-

calculation of no. of shares:-

capital = $15,000,000

subscription price (discounted price) =$25

No. of shares =15,000,000/25

=600,000 shares

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning