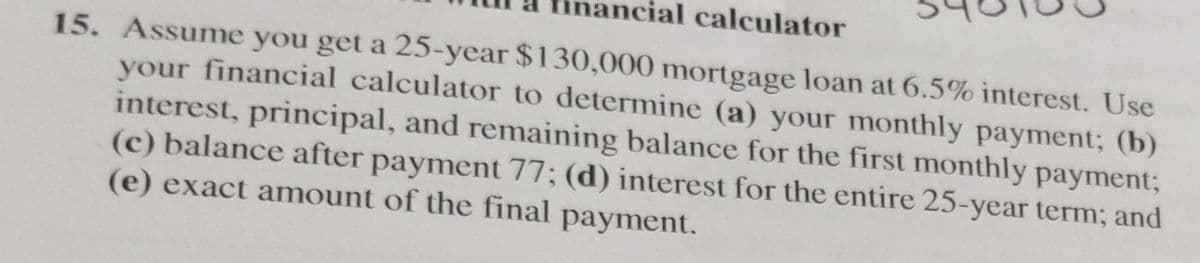

a inancial calculator 15. Assume you get a 25-year $130,000 mortgage loan at 6.5% interest. Use your financial calculator to determine (a) your monthly payment; (b) interest, principal, and remaining balance for the first monthly payment; (c) balance after payment 77; (d) interest for the entire 25-year term; and (e) exact amount of the final payment.

Addition Rule of Probability

It simply refers to the likelihood of an event taking place whenever the occurrence of an event is uncertain. The probability of a single event can be calculated by dividing the number of successful trials of that event by the total number of trials.

Expected Value

When a large number of trials are performed for any random variable ‘X’, the predicted result is most likely the mean of all the outcomes for the random variable and it is known as expected value also known as expectation. The expected value, also known as the expectation, is denoted by: E(X).

Probability Distributions

Understanding probability is necessary to know the probability distributions. In statistics, probability is how the uncertainty of an event is measured. This event can be anything. The most common examples include tossing a coin, rolling a die, or choosing a card. Each of these events has multiple possibilities. Every such possibility is measured with the help of probability. To be more precise, the probability is used for calculating the occurrence of events that may or may not happen. Probability does not give sure results. Unless the probability of any event is 1, the different outcomes may or may not happen in real life, regardless of how less or how more their probability is.

Basic Probability

The simple definition of probability it is a chance of the occurrence of an event. It is defined in numerical form and the probability value is between 0 to 1. The probability value 0 indicates that there is no chance of that event occurring and the probability value 1 indicates that the event will occur. Sum of the probability value must be 1. The probability value is never a negative number. If it happens, then recheck the calculation.

Hello! I need the answer of part d) and e) of the question attached.. Thanks in advance!

Step by step

Solved in 2 steps with 1 images