A) Inflation rate; B) Interest rate; C) Not doing something; 2. People prefer to receive cash: A) Sooner than later; B) Later than sooner; C) Doesn't matter when; 3. Financial decisions must be based on: A) Risk assessment; B) Time adjusted cash flows; C) Inflation assessment; -. Future vale is equal: A) Initial investment X (1+ k)"; 3) Initial investment X (1+ k.n); C) A+B The term (1+k) is known not 11. The additional value added to the current value of the corporation by accepting a particular project is known as: A) Net profit; B) Net present value; C) A+B; 12. From the decision making standpoint, the financial managers should selected the project that have: A) Negative NPV; B) Positive NPV; C) NPV = 0; 13. The Internal rate of return of a project is defined as the discounted rate that makes a project's NPV: A) Positive; B) Equal to 0; C) Negative; 14 The financial managers should only accept

A) Inflation rate; B) Interest rate; C) Not doing something; 2. People prefer to receive cash: A) Sooner than later; B) Later than sooner; C) Doesn't matter when; 3. Financial decisions must be based on: A) Risk assessment; B) Time adjusted cash flows; C) Inflation assessment; -. Future vale is equal: A) Initial investment X (1+ k)"; 3) Initial investment X (1+ k.n); C) A+B The term (1+k) is known not 11. The additional value added to the current value of the corporation by accepting a particular project is known as: A) Net profit; B) Net present value; C) A+B; 12. From the decision making standpoint, the financial managers should selected the project that have: A) Negative NPV; B) Positive NPV; C) NPV = 0; 13. The Internal rate of return of a project is defined as the discounted rate that makes a project's NPV: A) Positive; B) Equal to 0; C) Negative; 14 The financial managers should only accept

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 16MC: When using the NPV method for a particular investment decision, if the present value of all cash...

Related questions

Question

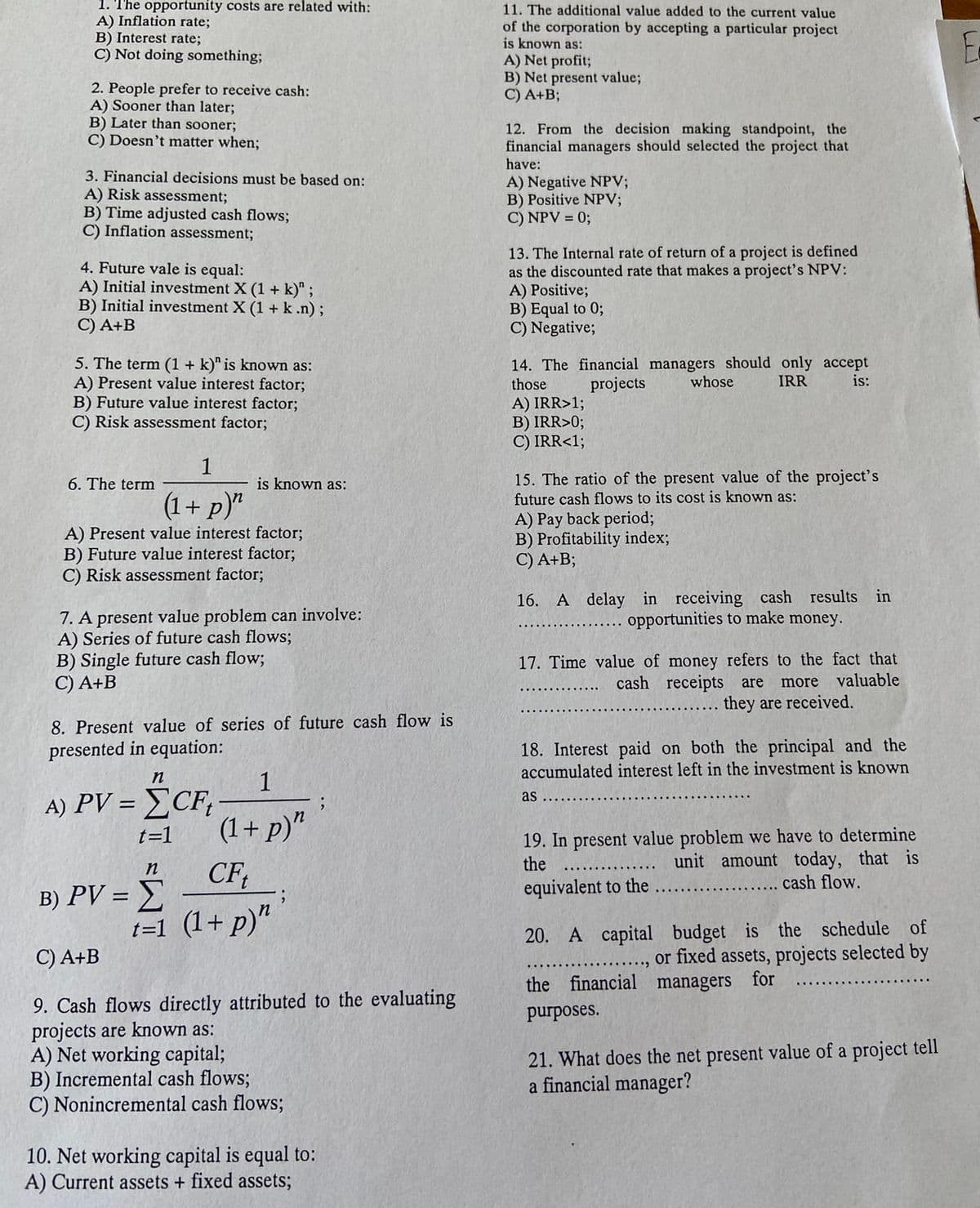

Transcribed Image Text:1. The opportunity costs are related with:

A) Inflation rate;

B) Interest rate;

C) Not doing something;

2. People prefer to receive cash:

A) Sooner than later;

B) Later than sooner;

C) Doesn't matter when;

3. Financial decisions must be based on:

A) Risk assessment;

B) Time adjusted cash flows;

C) Inflation assessment;

4. Future vale is equal:

A) Initial investment X (1 + k)" ;

B) Initial investment X (1+k.n);

C) A+B

5. The term (1 + k)" is known as:

A) Present value interest factor;

B) Future value interest factor;

C) Risk assessment factor;

1

(1+ p)"

A) Present value interest factor;

B) Future value interest factor;

C) Risk assessment factor;

6. The term

is known as:

7. A present value problem can involve:

A) Series of future cash flows;

B) Single future cash flow;

C) A+B

8. Present value of series of future cash flow is

presented in equation:

n

A) PV = CF₁

t=1

n

B) PV = Σ

t=1

1

(1+p)"

CFt

(1+p)"

;

C) A+B

9. Cash flows directly attributed to the evaluating

projects are known as:

A) Net working capital;

B) Incremental cash flows;

C) Nonincremental cash flows;

10. Net working capital is equal to:

A) Current assets + fixed assets;

11. The additional value added to the current value

of the corporation by accepting a particular project

is known as:

A) Net profit;

B) Net present value;

C) A+B;

12. From the decision making standpoint, the

financial managers should selected the project that

have:

A) Negative NPV;

B) Positive NPV;

C) NPV = 0;

13. The Internal rate of return of a project is defined

as the discounted rate that makes a project's NPV:

A) Positive;

B) Equal to 0;

C) Negative;

14. The financial managers should only accept

those projects

IRR

is:

A) IRR>1;

B) IRR>0;

C) IRR<1;

15. The ratio of the present value of the project's

future cash flows to its cost is known as:

A) Pay back period;

B) Profitability index;

C) A+B;

whose

16. A delay in receiving cash results in

opportunities to make money.

17. Time value of money refers to the fact that

cash receipts are more valuable

they are received.

18. Interest paid on both the principal and the

accumulated interest left in the investment is known

as

19. In present value problem we have to determine

the

unit amount today, that is

cash flow.

equivalent to the

20. A capital

budget is the schedule of

or fixed assets, projects selected by

the financial managers for

purposes.

21. What does the net present value of a project tell

a financial manager?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning