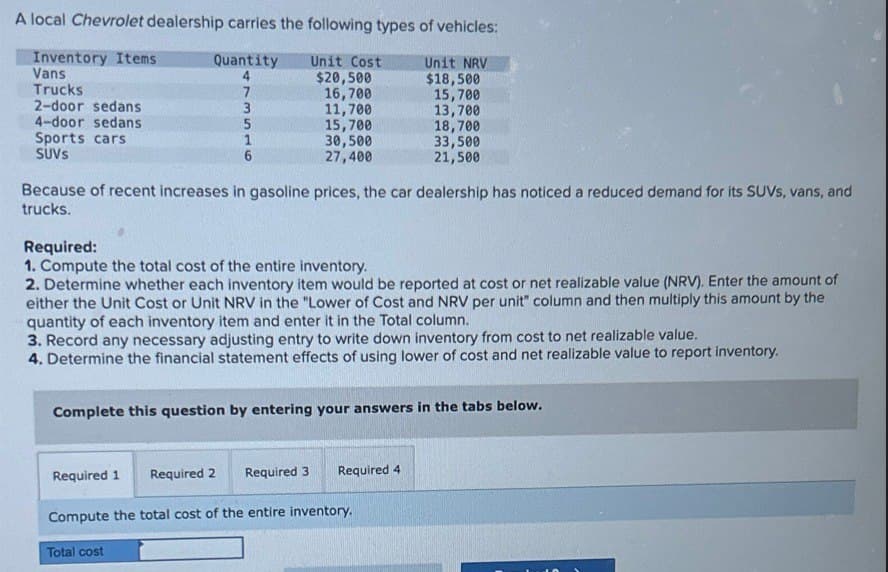

A local Chevrolet dealership carries the following types of vehicles: Inventory Items Quantity Unit Cost Unit NRV Vans $20,500 $18,500 Trucks 7 16,700 15,700 2-door sedans 3 11,700 13,700 4-door sedans 5 15,700 18,700 Sports cars 1 30,500 33,500 SUVS 6 27,400 21,500 Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and trucks. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value.

A local Chevrolet dealership carries the following types of vehicles: Inventory Items Quantity Unit Cost Unit NRV Vans $20,500 $18,500 Trucks 7 16,700 15,700 2-door sedans 3 11,700 13,700 4-door sedans 5 15,700 18,700 Sports cars 1 30,500 33,500 SUVS 6 27,400 21,500 Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and trucks. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

please double underline answer all parts with all work like explanation , computation for each parts and steps answer in text form please remember answer all parts with explanation , calculation clearly for all mostly Bartleby expert did not provide explanation please explain each part with explanation and computation

Transcribed Image Text:A local Chevrolet dealership carries the following types of vehicles:

Inventory Items

Quantity

Unit Cost

Unit NRV

Vans

$20,500

$18,500

Trucks

7

16,700

15,700

2-door sedans

3

11,700

13,700

4-door sedans

5

15,700

18,700

Sports cars

1

30,500

33,500

SUVS

6

27,400

21,500

Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and

trucks.

Required:

1. Compute the total cost of the entire inventory.

2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of

either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the

quantity of each inventory item and enter it in the Total column.

3. Record any necessary adjusting entry to write down inventory from cost to net realizable value.

4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Required 4

Compute the total cost of the entire inventory.

Total cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education