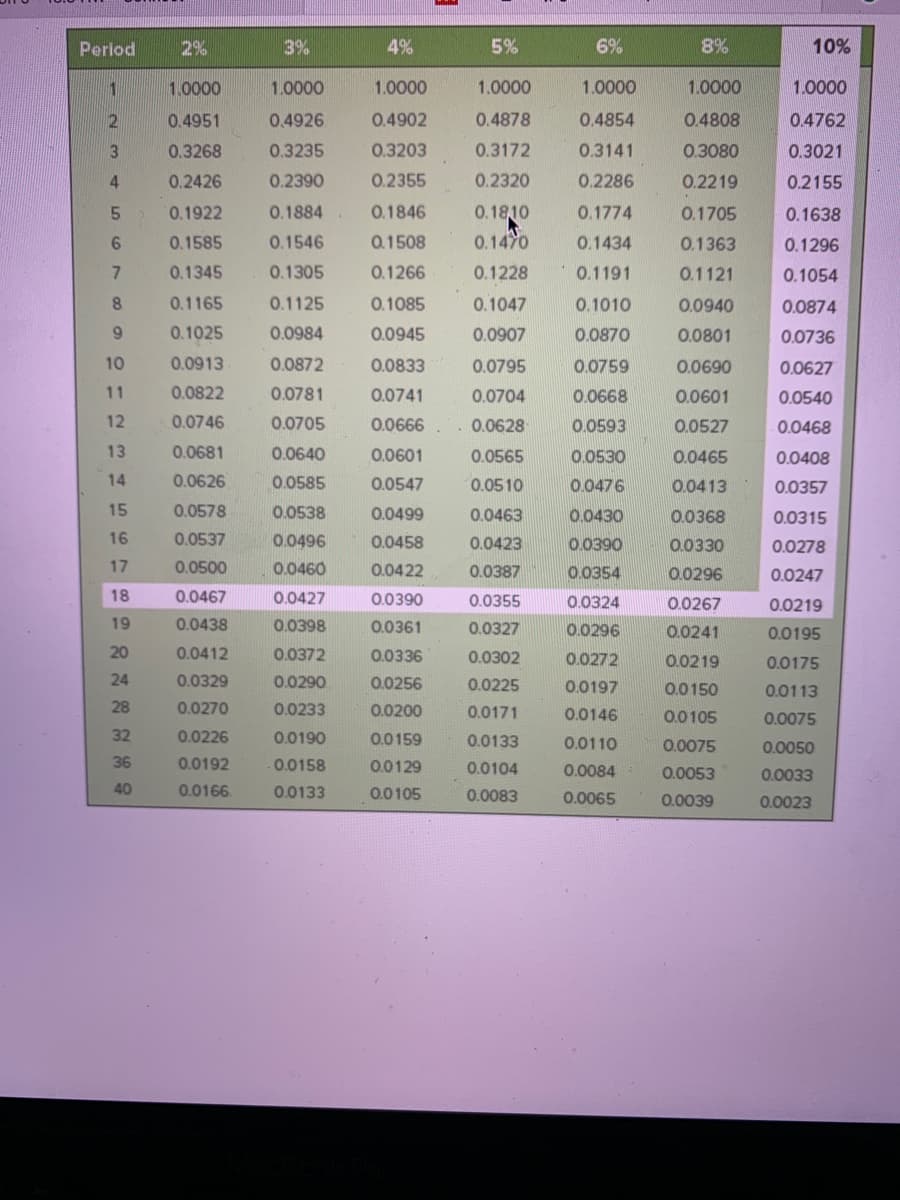

A local Dunkin’ Donuts franchise must buy a new piece of equipment in 5 years that will cost $97,000. The company is setting up a sinking fund to finance the purchase. What will the quarterly deposit be if the fund earns 8% interest? (Use Table 13.3.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Quarterly deposit -

A local Dunkin’ Donuts franchise must buy a new piece of equipment in 5 years that will cost $97,000. The company is setting up a sinking fund to finance the purchase. What will the quarterly deposit be if the fund earns 8% interest? (Use Table 13.3.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Quarterly deposit -

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

A local Dunkin’ Donuts franchise must buy a new piece of equipment in 5 years that will cost $97,000. The company is setting up a sinking fund to finance the purchase. What will the quarterly deposit be if the fund earns 8% interest? (Use Table 13.3.) (Do not round intermediate calculations. Round your answer to the nearest cent.)

Quarterly deposit -

Transcribed Image Text:Period

2%

3%

4%

5%

6%

8%

10%

1

1.0000

1.0000

1.0000

1.0000

1.0000

1.0000

1.0000

2

0.4951

0.4926

0.4902

0.4878

0.4854

0.4808

0.4762

3

0.3268

0.3235

0.3203

0.3172

0.3141

0.3080

0.3021

4.

0.2426

0.2390

0.2355

0.2320

0.2286

0.2219

0.2155

0.1922

0.1884

0.1846

0.18,10

0.1774

0.1705

0.1638

6.

0.1585

0.1546

0.1508

0.1470

0.1434

0.1363

0.1296

0.1345

0.1305

0.1266

0.1228

0.1191

0.1121

0.1054

8.

0.1165

0.1125

0.1085

0.1047

0.1010

0.0940

0.0874

9.

0.1025

0.0984

0.0945

0.0907

0.0870

0.0801

0.0736

10

0.0913

0.0872

0.0833

0.0795

0.0759

0.0690

0.0627

11

0.0822

0.0781

0.0741

0.0704

0.0668

0.0601

0.0540

12

0.0746

0.0705

0.0666.. 0.0628

0.0593

0.0527

0.0468

13

0.0681

0.0640

0.0601

0.0565

0.0530

0.0465

0.0408

14

0.0626

0.0585

0.0547

0.0510

0.0476

0.0413

0.0357

15

0.0578

0.0538

0.0499

0.0463

0.0430

0.0368

0.0315

16

0.0537

0.0496

0.0458

0.0423

0.0390

0.0330

0.0278

17

0.0500

0.0460

0.0422

0.0387

0.0354

0.0296

0.0247

18

0.0467

0.0427

0.0390

0.0355

0.0324

0.0267

0.0219

19

0.0438

0.0398

0.0361

0.0327

0.0296

0.0241

0.0195

20

0.0412

0.0372

0.0336

0.0302

0.0272

0.0219

0.0175

24

0.0329

0.0290

0.0256

0.0225

0.0197

0.0150

0.0113

28

0.0270

0.0233

0.0200

0.0171

0.0146

0.0105

0.0075

32

0.0226

0.0190

0.0159

0.0133

0.0110

0.0075

0.0050

36

0.0192

0.0158

0.0129

0.0104

0.0084

0.0053

0.0033

40

0.0166

0.0133

0.0105

0.0083

0.0065

0.0039

0.0023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education