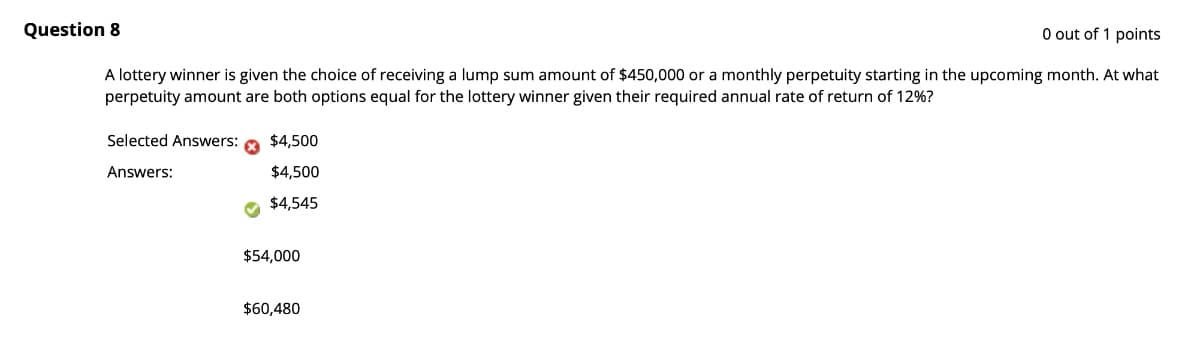

A lottery winner is given the choice of receiving a lump sum amount of $450,000 or a monthly perpetuity starting in the upcoming month. At what perpetuity amount are both options equal for the lottery winner given their required annual rate of return of 12%? Selected Answers: Answers: $4,500 $4,500 $4,545 $54,000 $60,480

Q: A factory costs $970,600. You forecast that it will produce cash inflows of $839,085 in year 1,…

A: The question is related to Capital Budgeting. The Net Present Value is the difference between…

Q: What is the maturity value of a $8,500 note dated June 17, 2020, if it matures on November 15, 2020…

A: As the name implies, maturity is the point at which a financial instrument, such as a bond, etc.,…

Q: Describe how each of the following helps a bank control its credit risk: 1. Position limits 2.…

A: Credit risk refers to the possibility of uncertainty or loss from the borrower for not repaying…

Q: Suppose the European C80 (100) = 30 suddenly becomes an American option. Are there arbitrage…

A: Arbitrage is the simultaneous buying and selling of an item in separate marketplaces in order to…

Q: You Answered Correct Answer Unfortunately, your project just incurred a direct cost of $25,777 for…

A: A project has incurred an additional, unplanned cost. If it intends to earn the same budgeted margin…

Q: On retirement, a workman finds that the company pension calls for payment of P500.00 to him or to…

A: Payment per month is P500 Time period of payments is 20 years or 20×12= 240 months Interest rate is…

Q: Refer to the bond listing table below to determine the current bond yield for CMCD.GC. Click the…

A: Current yield of the bond is the annual coupon as a percentage of price of the bond. It is…

Q: Little Lemon Co. is identifying the value of its equity using the enterprise value approach as they…

A: Enterprise Value: The enterprise value of a company is the market value of a company's operations.…

Q: You want to save $500,000 dollars for retirement in your 401K. Over the next 30 years, How much…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Critically evaluate the influencing investment decision-making

A: Investment decision does not depend on a single factor. There are many factors that influence the…

Q: THANKS !!!

A: As per the given information: Coupon rate - 6.50% Number of bonds purchased - 4 Selling price -…

Q: 25-year 12% semi-annual coupon bond with a R1000 par value is selling for R1520. The bond has a…

A:

Q: Compute the present value of a $160 cash flow for the following combinations of discount rates and…

A: As per the given information: Cash flow - $160 Provided are different combinations of discount rates…

Q: 1) Based on the data in the table below in which the average yield, the standard deviation of…

A: concept. 1. systematic risk. Systematic risk is also called the undiversifiable risk, market risk,…

Q: Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Company A 30% 7% 18% -22% -14% 10% 26% -10%…

A: We have to design two portfolios and then find their average return, standard deviation of return…

Q: Company Miami just paid annual dividend of $25 today. The dividend is expected to grow at 8% for the…

A: Solution: Price of a share of company Miami Stock: $675

Q: An investor depc 1 year from the p 1 st withdrawal c er than the first p 5% less than the drawals,…

A: A statistic used in financial analysis to calculate the profitability of possible investments is the…

Q: Please explain why this statement is (False). If a security's realized return is negative, it must…

A: The realized return of the security is the return that the security has provided in the past. The…

Q: Giant Sales marked their flat screen down by 15% to the discount price of $840. What was the…

A: The company offers a discount to increase sales by attracting more customers. The discount attracts…

Q: Mary earns an annual salary of $81,900 paid biweekly based on a regular workweek of 39.5 hours. Her…

A: The gross earnings of an employee will be equal to the sum of wages at the normal rate and wages…

Q: Two indices contain exactly the same stocks; one is a market-capitalization-weighted index that…

A: 1) Market Capitalization weighed Index is the calculated by sum of individual Market Capitalization…

Q: the time to maturity for 3 bonds, a 2-year, 3-year, and 5-year. Each annual coupon bond has a yield…

A: Price of bond is the present value of coupon payment and present value of par value of bond taken on…

Q: why are Overconfidence and cognitive bias, Representatives heuristic, loss aversion, herding bias,…

A: Behavioral finance is that area of finance which deals with the influence of psychology and the…

Q: Based on Exhibit 7-8, what would be the monthly mortgage payments for each of the following…

A: Annual Percentage Rate The interest charged on borrowed funds or dividends paid to investors,…

Q: The zero coupon bonds of JK industries has a market price of $318.46, a face value of $1,000 and a…

A: A Bond refers to a concept that is defined as an instrument that represents the loan being made by…

Q: Evidence of market inefficiency occurs when investors earn abnormal returns: Only in the short…

A: A Market is regarded as inefficient if: Intrinsic Value of stock is not equal to Market price of…

Q: Postal Express has outlets throughout the world. It also keeps funds for transactions purposes in…

A: The exchange rate is the number of domestic currency units an individual require to purchase one…

Q: Example: What is the multi-year holding period return for this share Initial share price was £1,…

A: Formula for Holding Period Return=Income+(P1-P0)P0 P0= Initial value P1= End of period value

Q: Jerry has an opportunity to buy a bond with a face value of $10,000 and a coupon rate of 14…

A: The IRR is used to evaluate the profitability of a potential investment in terms of the returns from…

Q: The sum P350,000 will be needed at the end of 3 years. If money can be invested at 5% compounded…

A: We need to fist determine the semi annual end of period payment that will accumulate to the desired…

Q: sell 1 abc straddle (x = $55) @$6,50 buy 1 abc strangle (x= $50 , x= $60 ) @ $2,00 . options…

A: Short Straddle: This option holder will Sell a call option and a put option on a stock…

Q: Momentum has been reported in stock returns in many world stock markets. Existence of momentum:…

A: Market efficiency is the ability of markets to process the information quickly and generate the…

Q: ● . A T-Bill has 100 days until maturity. Its discount yield is Y = 0.03862. Determine the bond…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Find the expected monetary value when baking 25 loaves. EMV = S (Type an integer or a decimal.) Find…

A: To determine the expected monetary value (EMV), we first need to calculate the profit on each loaf…

Q: Assume Gillette Corporation will pay an annual dividend of $0.66 one year from now. Analysts expect…

A: Dividend for year 1 is given = $0.66 Now we will calculate dividends from year 2 to year 6 growing…

Q: 6. Find the monthly amortization for a loan of Mr. Frederick Dizon amounting to P750,000 to be paid…

A: Periodic interest rate = Interest rate per annumNumber of months in a year=12%12=1% Thus, the…

Q: Please answer question 2 & 3 after reading the scenario thank you. Question at the end Stephanie…

A: Dividend discount model with fixed growth in dividends With required rate of return (r), current…

Q: A 20-year, 10%, *1,000 bond that pays interest half-yearly is redeemable (callable] in twelve years…

A: Face Value ₹ 1,000.00 Time Period 20…

Q: If Epic, Inc. has an ROE = 29%, equity multiplier = 3.6, a profit margin of 12.4%, what is the total…

A: Information Provided: ROE = 29% Equity multiplier = 3.6 Profit margin = 12.4%

Q: Harry is trying to evaluate a two year project using NPV. There is uncertainty as to the level of…

A: The outlay is £230,000 Contribution is £10 Cost of capital is 10%

Q: Wanda, one of your clients, is a state sheriff’s deputy. Wanda was injured while on duty. Under her…

A: First let us determine which item is taxable under Revenue Ruling 83-77. Under this ruling, sick pay…

Q: A person borrows 10,000 at an interest rate of 8% per year and wishes to repay the loan over a…

A: As per the given information: The amount borrowed - 10,000 Interest rate - 8% per year Loan period -…

Q: Muffin’s Masonry, Inc.’s, balance sheet lists net fixed assets as $26 million. The fixed assets…

A: The book value of assets is the value of assets in the Balance Sheet of the firm. The market value…

Q: A firm has contracted to supply 500,000 gallons of propane fuel for $1.49 million to the local…

A: Given, Number of gallons supplied are 500,000 Total price is $1.49 million

Q: Interest rates on 1-year, 2-year, and 3-year Treasury bills are 5%, 6%, and 7%, respectively. Assume…

A: Pure expectation theory According to pure expectation theory, the forward rates that can be…

Q: What are the tax consequences to and Corporation on the following dates: January 1, ; January 1,…

A: Stock option is an option given by the company to its employees to purchase shares at less than…

Q: .) If $25,000 is deposited in an account that earns interest compounded monthly becomes $32,000…

A: (Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: You received a credit card application from US Bank offering an introductory rate of 1.5% compounded…

A: The credit card balance will increase with the addition of interest on outstanding balance. It will…

Q: On June 1, you borrowed $220,000 to buy a house. The mortgage rate is 8.25 percent. The loan is to…

A: Here, Amount of principal in second payment =?

Step by step

Solved in 3 steps

- On January 1, you win $46,000,000 in the state lottery. The $46,000,000 prize will be paid in equal installments of $5,750,000 over eight years. The payments will be made on December 31 of each year, beginning on December 31 of this year. The current interest rate is 5%. Determine the present value of your winnings. Round your answer to the nearest dollar. $ fill in the blank 2On January 1, you win $4,800,000 in the state lottery. The $4,800,000 prize will be paid in equal installments of $480,000 over 10 years. The payments will be made on December 31 of each year, beginning on December 31 of the current year. If the current interest rate is 6%, determine the present value of your winnings. Use Table 3. Round to the nearest whole dollar.On January 1 you win $3,480,000 in the state lottery. The $3,480,000 prize will be paid in equal installments of $290,000 over 12 years. The payments will be made on December 31 of each year, beginning on December 31. If the current interest rate is 7%, determine the present value of your winnings. Use the present value tables in Exhibit 7. Round to the nearest whole dollar.

- On January 1 you win $50,000,000 in the state lottery. The $50,000,000 prize will be paid in equal installments of $6,250,000 over eight years. The payments will be made on December 31 of each year, beginning on December 31 of this year. If the current interest rate is 12%, determine the present value of your winnings. Use the present value tables in Exhibit 7. Round to the nearest whole dollar. Will the present value of your winnings using an interest rate of 12% be more than the present value of your winnings using an interest rate of 5%?Archibald Andrews has just learned that he won $1,040,000 in the lottery. Archie has three options for payment: 36 equal semi-annual payments of $36,000, the first to occur in exactly one year. Taxes of 15% will be deducted from each payment. For this option, assume interest of 8% APR, compounded semi-annually. What is the present value?Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: (1) $94,000 cash immediately, (2) $38,000 cash immediately and a six-period annuity of $9,700 beginning one year from today, or (3) a six-period annuity of $19,600 beginning one year from today. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Assuming an interest rate of 7%, determine the present value for the above options. Which option should Alex choose?2. The Weimer Corporation wants to accumulate a sum of money to repay certain debts due on December 31, 2030. Weimer will make annual deposits of $190,000 into a special bank account at the end of each of 10 years beginning December 31, 2021. Assuming that the bank account pays 8% interest compounded annually, what will be the fund balance after the last payment is made on December 31, 2030?

- Rita Gonzales won the $41 million lottery. She is to receive $1.5 million a year for the next 19 years plus an additional lump sum payment of $12.5 million after 19 years. The discount rate is 14 percent. What is the current value of her winnings? Use Appendix B and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)Archibald Andrews has just learned that he won $1,040,000 in the lottery. Archie has three options for payment: 20 equal annual payments of $72,000, the first to occur immediately. Taxes of 25% of will be deducted from each payment. Assume an inherent interest rate of 8% APR. What is the present value?The top prize for the state lottery is $105,704,000. You have decided it is time for you to take a chance and purchase a ticket. Before you purchase the ticket, you must decide whether to choose the cash option or the annual payment option. If you choose the annual payment option and win, you will receive $105,704,000 in 25 equal payments of $4,228,160—one payment today and one payment at the end of each of the next 24 years. If you choose the cash payment, you will receive a one-time lump sum payment of $57,293,079.68. At what interest rate would you be indifferent between the cash and annual payment options? (Round answer to 0 decimal places, e.g. 15%.) Interest rate %

- Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: (1) $64,000 cash immediately, (2) $20,000 cash immediately and a six-period annuity of $8,000 beginning one year from today, or (3) a six -period annuity of $13,000 beginning one year from today. (FV of $1, PV of $1, FVA of $1, FVAD of $1 and PVAD of $1) Required 1. Assuming an interest rate of 6%, determine the present value for the above options. Which option should Alex choose? Annuity PV Annuity Immediate PV Option Payment Cash Option 1 ____________ _________ + __________ = $__________0 Option 2 ____________ _________ + __________ = $ 0 Option 3 ____________ __________ + ___________ =…1. You just won the PA lottery! The lottery offers you a choice: you may choose a lump sum today, or $89 million in 26 equal annual installments at the end of each year. Assume the funds can be invested (yield) at an annual rate of 7.65%. What is the lump sum that would equal the present value of the annual installments? : $89,000,000 $38,163,612 $41,083,128 $13,092,576A $1.2 million state lottery pays $5,000 at the beginning of each month for 20 years. How much money must the state actually have in hand to set up the payments for this prize if money is worth 8%, compounded monthly? (a) Decide whether the problem relates to an ordinary annuity or an annuity due. (b) Solve the problem. (Round your answer to the nearest cent.)