A Ltd agreed to pay B Ltd $6 000 in cash plus 16 000 fully paid shares in A Ltd, these shares having a fair value of $7.5 per share. The business combination was completed and B Ltd went into liquidation. Costs of liquidation amounted to $1 200. • A Ltd incurred accounting and legal costs amounting to $450 in relation to the business combination. • Costs of issuing the A Ltd. shares were $350. On 30 June 2020, B Ltd had reported a contingent liability relating to a guarantee given by that company to another entity. B Ltd did not record the guarantee as a liability because of the difficulty of measuring the liability. The fair value of this contingent liability was assessed as $15 000. . Show Transcribed Text 3 C Required: a) Prepare the acquisition analysis for this business combination. b) Prepare the journal entries in A Ltd to record the business combination.

A Ltd agreed to pay B Ltd $6 000 in cash plus 16 000 fully paid shares in A Ltd, these shares having a fair value of $7.5 per share. The business combination was completed and B Ltd went into liquidation. Costs of liquidation amounted to $1 200. • A Ltd incurred accounting and legal costs amounting to $450 in relation to the business combination. • Costs of issuing the A Ltd. shares were $350. On 30 June 2020, B Ltd had reported a contingent liability relating to a guarantee given by that company to another entity. B Ltd did not record the guarantee as a liability because of the difficulty of measuring the liability. The fair value of this contingent liability was assessed as $15 000. . Show Transcribed Text 3 C Required: a) Prepare the acquisition analysis for this business combination. b) Prepare the journal entries in A Ltd to record the business combination.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 4MCQ

Related questions

Question

Please do not give image format

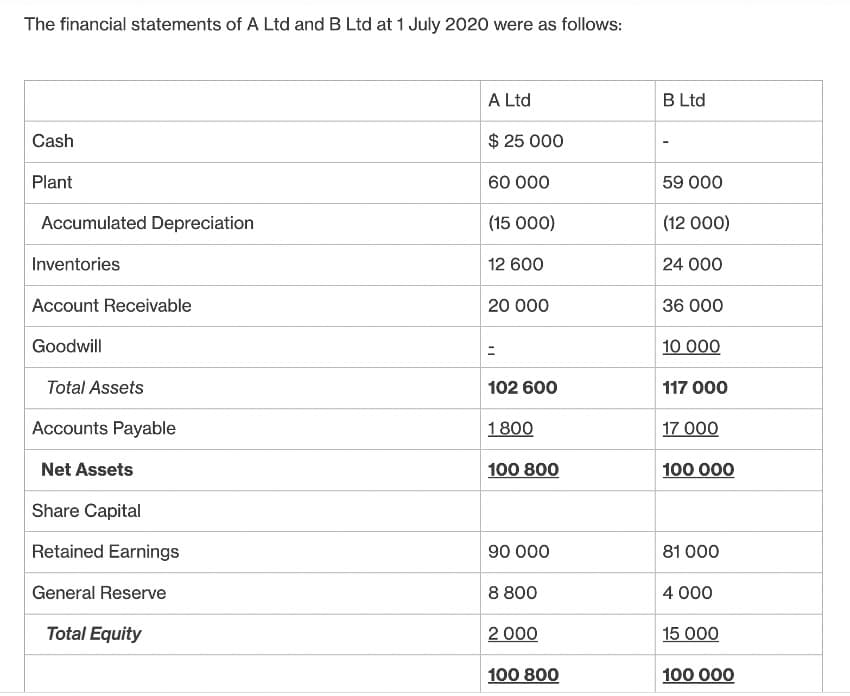

Transcribed Image Text:The financial statements of A Ltd and B Ltd at 1 July 2020 were as follows:

Cash

Plant

Accumulated Depreciation

Inventories

Account Receivable

Goodwill

Total Assets

Accounts Payable

Net Assets

Share Capital

Retained Earnings

General Reserve

Total Equity

A Ltd

$ 25 000

60 000

(15 000)

12 600

20 000

102 600

1800

100 800

90 000

8 800

2 000

100 800

B Ltd

59 000

(12 000)

24 000

36 000

10 000

117 000

17 000

100 000

81 000

4 000

15 000

100 000

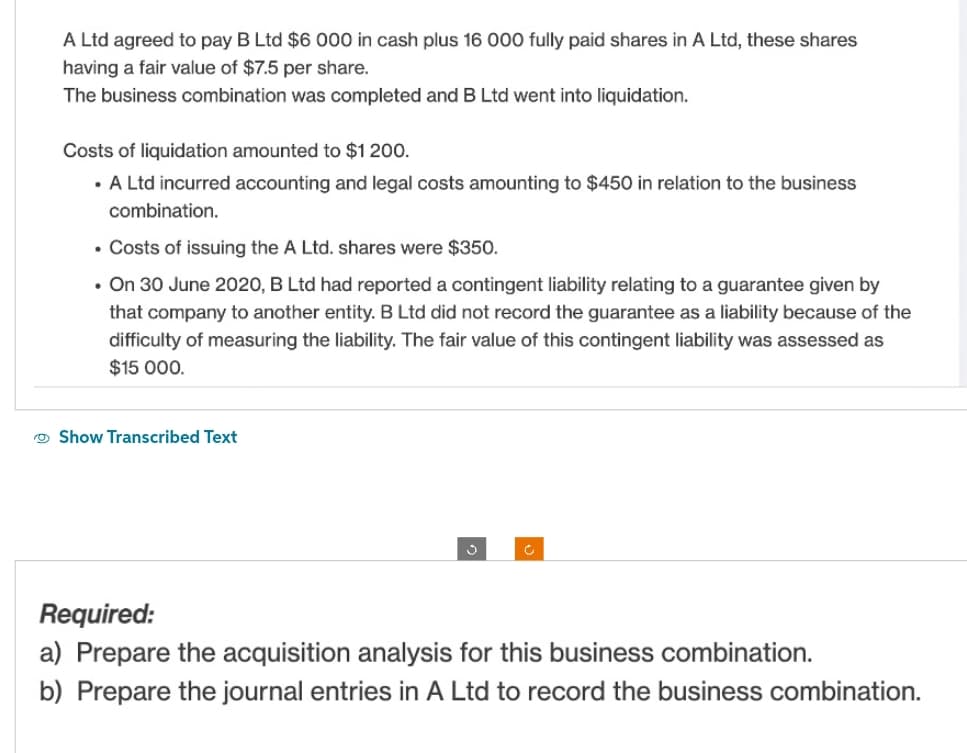

Transcribed Image Text:A Ltd agreed to pay B Ltd $6 000 in cash plus 16 000 fully paid shares in A Ltd, these shares

having a fair value of $7.5 per share.

The business combination was completed and B Ltd went into liquidation.

Costs of liquidation amounted to $1 200.

• A Ltd incurred accounting and legal costs amounting to $450 in relation to the business

combination.

• Costs of issuing the A Ltd. shares were $350.

• On 30 June 2020, B Ltd had reported a contingent liability relating to a guarantee given by

that company to another entity. B Ltd did not record the guarantee as a liability because of the

difficulty of measuring the liability. The fair value of this contingent liability was assessed as

$15 000.

Show Transcribed Text

c

Required:

a) Prepare the acquisition analysis for this business combination.

b) Prepare the journal entries in A Ltd to record the business combination.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning