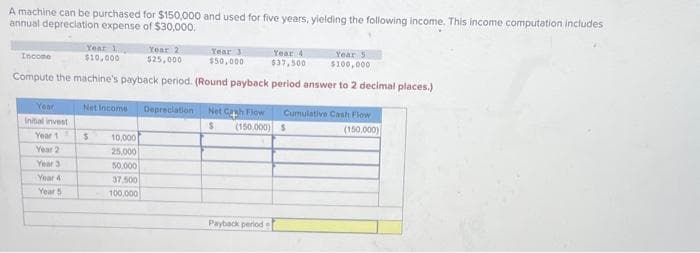

A machine can be purchased for $150,000 and used for five years, yielding the following income. This income computation includes annual depreciation expense of $30,000. Year 1 Year 4 Year 5 Income $10,000 $37,500 $100,000 Compute the machine's payback period. (Round payback period answer to 2 decimal places.) Year Initial invest Year 1 Year 2 Year 3 Year 4 Year 5 S Year 2 $25,000 Net Income Depreciation Net Cash Flow $ (150,000) 10,000 25,000 50,000 37,500 100,000 Year 3 $50,000 Payback period Cumulative Cash Flow $ (150,000)

A machine can be purchased for $150,000 and used for five years, yielding the following income. This income computation includes annual depreciation expense of $30,000. Year 1 Year 4 Year 5 Income $10,000 $37,500 $100,000 Compute the machine's payback period. (Round payback period answer to 2 decimal places.) Year Initial invest Year 1 Year 2 Year 3 Year 4 Year 5 S Year 2 $25,000 Net Income Depreciation Net Cash Flow $ (150,000) 10,000 25,000 50,000 37,500 100,000 Year 3 $50,000 Payback period Cumulative Cash Flow $ (150,000)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11PA: Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and...

Related questions

Question

Please don't give handwritten answer..thanku

Transcribed Image Text:A machine can be purchased for $150,000 and used for five years, yielding the following income. This income computation includes

annual depreciation expense of $30,000.

Year 4

Year 5

Income

$10,000

$37,500

$100,000

Compute the machine's payback period. (Round payback period answer to 2 decimal places.)

Year

Initial invest

Year 1

Year 2

Year 3

Year 4

Year 5

$

Net Income Depreciation Net Cash Flow

$ (150,000)

10,000

25,000

Year 2

$25,000

50,000

37,500

100,000

Year 3

$50,000

Payback period

Cumulative Cash Flow

$

(150,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning