A manufacturing company purchased electrical services for the next 5 years to be paid for with $70,000 now. The service after 5 years will be $15,000 per year beginning with the sixth year. After 2 years service the company, having surplus profits, requested to pay for another 5 years service in advance. If the electrical company elected to accept payment in advance, what would each company set as a fair settlement to be paid if (a) the electrical company con- sidered 15% compounded annually as a fair return, and (b) the manufactur- ing company considered 12% a fair return?

A manufacturing company purchased electrical services for the next 5 years to be paid for with $70,000 now. The service after 5 years will be $15,000 per year beginning with the sixth year. After 2 years service the company, having surplus profits, requested to pay for another 5 years service in advance. If the electrical company elected to accept payment in advance, what would each company set as a fair settlement to be paid if (a) the electrical company con- sidered 15% compounded annually as a fair return, and (b) the manufactur- ing company considered 12% a fair return?

Algebra and Trigonometry (6th Edition)

6th Edition

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:Robert F. Blitzer

ChapterP: Prerequisites: Fundamental Concepts Of Algebra

Section: Chapter Questions

Problem 1MCCP: In Exercises 1-25, simplify the given expression or perform the indicated operation (and simplify,...

Related questions

Question

The answers are NOT 102456.85 and 109193.11

Transcribed Image Text:40.

A manufacturing company purchased electrical services for the next 5 years

to be paid for with $70,000 now. The service after 5 years will be $15,000 per

year beginning with the sixth year. After 2 years service the company, having

surplus profits, requested to pay for another 5 years service in advance. If the

electrical company elected to accept payment in advance, what would each

company set as a fair settlement to be paid if (a) the electrical company con-

sidered 15% compounded annually as a fair return, and (b) the manufactur-

ing company considered 12% a fair return?

Expert Solution

SAnswer a

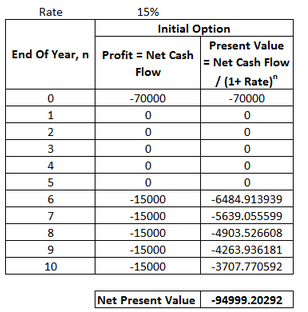

Net Present Value of Initial Option with 15% rate = -94999.20292

Refer the table below for details of calculation.

Present Value of the New Option (of Advance payment after year 2) (with 15% Rate)

= Initial Cost + Present Value of Advance at Year 3

= -70,000 + Advance / (1+0.15) 3

Net Present Value of Initial Option with 15% rate = Present Value of the New Option (of Advance payment after year 2) (with 15% Rate)

-94999.20292 = -70,000 + Advance / (1+0.15) 3

Advance = (-94999.20292 + 70,000 ) x (1.15) 3

= -38,020.66274

~ = -$38,020.66

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:

9780135163078

Author:

Michael Sullivan

Publisher:

PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:

9780980232776

Author:

Gilbert Strang

Publisher:

Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:

9780077836344

Author:

Julie Miller, Donna Gerken

Publisher:

McGraw-Hill Education