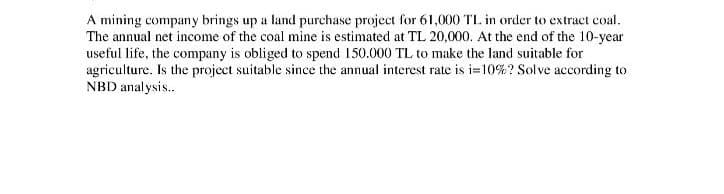

A mining company brings up a land purchase project for 61,000 TL. in order to extract coal. The annual net income of the coal mine is estimated at TL 20,000. At the end of the 10-year useful life, the company is obliged to spend 150.000 TL to make the land suitable for agriculture. Is the project suitable since the annual interest rate is i=10%? Solve according to NBD analysis.

Q: Noah Yobs, who has $75,400 of AGI (solely from wages) before considering rental activities, has…

A: Given data, AGI = $75400Rental activities = $67,860Real estate rental activity income =…

Q: Palmer Jam Company is a small manufacturer of several different jam products. One product is an…

A: Given data is Cost of each case = $50 Price of each case = $90 So, Loss = $50 Profit = $40

Q: For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage,…

A: Given data is

Q: Formulate as a constrained nonlinear program. Clearly indicate the variables, objective function,…

A: The linear programming is formed as follows:

Q: The owners of Sweet-Tooth Bakery have determined thatthey need to expand their facility in order to…

A: Solution - Decision Tree - Each internal node represents a test on an attribute (for example,…

Q: Lauren Moore has sold her business for $500,000 and wants to invest in condominium units (which she…

A: As mentioned in the question, the decision variables will be x1 and x2. x1 = Units of condominium…

Q: oseph Biggs owns his own ice cream truck and lives 30 miles from a Florida beach resort. The sale of…

A: a)

Q: Which capacity choice should the firm make

A: Decision making is the process of choosing best alternative from a given list using the probability…

Q: Hemmingway, Inc., is considering a $5 million research and development (R&D) project. Profit…

A: At Node 4, for building facility, the profit at high demand is 34 million with 0.5 probability, at…

Q: Consider the decision tree'below. You are at the starting decision node DO (shown in the orange…

A: Given data is

Q: An entertainment manager has to organize a concert and is offered the options of doing it outdoors…

A: Since you have submitted a question with multiple subparts, as per guidelines I have answered the…

Q: Lauren Moore has sold her business for $500,000 and wants to invest in condominium units (which she…

A: A mixed integer programming model is as follows Let C= Number of units of condominiums…

Q: The ABC company is considering constructing a plant to manufacture a proposed new product. The land…

A:

Q: A firm has prepared the following binary integer program to evaluate a number of potentia goal is to…

A:

Q: The manager of an e-learning company identified a new course that they could create and sell for $85…

A: Price of course per student = $85 Variable costs per student= $4

Q: A company is considering two options for supplying a product to three markets, Markets 1, 2, and 3,…

A: Given data: There are three markets 1,2,3 The demand in each of the three markets can be either 50…

Q: A desk contains three drawers. Drawer 1 contains twogold coins. Drawer 2 contains one gold coin and…

A: Let Drawer(D), Silver(S) and Gold(G). He has one in three chance of choosing drawer 3 = 1/3.

Q: Suppose my utility function for asset position x is givenby u(x) ln x.a Am I risk-averse,…

A: a. Utility function u(x) = ln(x) Now, we will find the value of u''(x). u'(x) = 1/x u''(x) = -1/x^2…

Q: Player A and B play a game in which each has three coins, a 5p, 10p and a 20p. Each selects a coin…

A: Let's get a matrix with different situations

Q: c. From the following decision tree, develop a payoff table and calculate: * Maximax, Minimax…

A: The value for each of the payoffs and criteria are calculated in excel with the formulas shown in…

Q: The CEO of Lucky Petroleum Co. has been considering to open a new gasoline statioin. He must decide…

A: Find the Given details below: Given details: Size of Station Good Market Fair Market Poor…

Q: George Johnson recently inherited a large sum of money;he wants to use a portion of this money to…

A: (a) In the linear program the general mathematical model and the linear objective function set of…

Q: Let Q be the number of pies they make and sell. The total cost, C(Q) in dollars, for making Q pies…

A: The total cost in making pies is given by C(Q) Total cost = Fixed cost + variable cost Total cost=…

Q: Palmer Jam Company is a small manufacturer of several different jam products. One product is an…

A: Demand cases Produce cases 0.1 0.25 0.45 0.2 7 8 9 10 EMV 7…

Q: Condo Construction Company is going to First NationalBank for a loan. At the present time, the bank…

A: Cost of overstock:Co=0.10 Cost of under-stock: Cu=0.25-0.10=0.15

Q: The produce manager at the local Pig & Whistle grocery store must determine how many pounds of…

A: The Expected Monetary Value concept is taken for decision analysis. For each option, the pay-off are…

Q: Ohio Swiss Milk Products manufactures and distributes icecream in Ohio, Kentucky, and West Virginia.…

A:

Q: A manufacturing firm is looking to invest in new equipment. Options A and B have a known initial…

A: Uniform annual Savings implies the pinnacle interest or energy savings that happen in a given year…

Q: Indigo airlines offers coach and first class tickets.For the airlines to be in a profitab…

A: The process through which the variables that maximize or minimize linear equations are determined is…

Q: Mr Chan lives with his parents in Aberdeen. He owns a flat in causeway bay. The order of preference…

A: Decision making is the core skill required with any leaders like the managers. Finding out all the…

Q: Even though independent gasoline stations have been having a difficult time, lan Langella been…

A: Find the given details below: Given details: Size for the first station Good Market Fair Market…

Q: Hemmingway, Inc., is considering a $5 million research and development (R&D) project. Profit…

A: Determine the expected value of the strategy as shown below: Calculate the expected value for node…

Q: Michelle owns a house in which she keeps valuables worth 100,000 which can get stolen with…

A: Given information, Michelle worth = 10, 000 Probability = 1% Puchasing Coverage = C ( 0; 100,000)…

Q: Suppose we are considering the question of how much capacity to build in the face of uncertain…

A: The probability of various demand levels is as follows: Demand – x units Probability of x 1 0…

Q: Parsa Real Estate Parsa Real Estate is a company that buys and rents real estate. The company is…

A: Given data, Parsa real estate company is looking into buying a new office building = $1M Building…

Q: Lauren Moore has sold her business for $500,000 and wants to invest in condominium units (which she…

A: Let, A = No. of condominiums purchased B = No. of acres of land purchased

Q: Lauren Moore has sold her business for $500,000 and wants to invest in condominium units (which she…

A: The proposed mixed-integer programming model can be straightforwardly addressed by the blended…

Q: Assume that the Wisconsin Cheese Factory currently operates a large facility in Madison, WI. The…

A: risk avoidance

Q: The management of Brinkley Corporation is interested in using simulation to estimate the profit per…

A: Here the unit formula is given by --> Unit profit =Unit revenue - (Procurement +Lbour +…

Q: Muscat Company is a multinational company dealing with various perfumes in Sultanate of Oman. The…

A: Return on investment (ROI) is a financial metric that is commonly used to determine the likelihood…

Q: Demeter has 100 acres of land on which she can plant wheat or rice. The following table shows the…

A: In the first part of the question, If she plants only wheat then, in case of the dry growing…

Q: Aruna owns Pottery Plus, a small firm that produces terra cotta pots for sale in the Edmonton area.…

A: The rule is MC=MR for maximizing profits a. she charges the price according to the quantity where…

Q: The yield on 1-year Treasury securities is 6%, 2-year securitiesyield 6.2%, 3-year securities yield…

A:

Q: A company sells its products to wholesalers in batches of 1,000 units only. The daily demand for its…

A: Given data is

Q: A decision maker is faced with a choice between two projects, both of which have start-up costs in…

A: The question is related to Capital Budgeting. The details of two projects are given. We will…

Q: If the firm does not add new equipment, its profit will be =_____ dollars (round your response to…

A: Profit is the final gain earned after the deduction of total expenditures from the total income.

Q: A small strip-mining coal company is trying to decide whether it should purchase or lease a new…

A: Given MARR (i) =13% = 0.13 Time period (n) =6 years

Q: 3-26 Megley Cheese Company is a small manufacturer of several different cheese products. One of the…

A: Given data is

Step by step

Solved in 2 steps with 1 images

- It costs a pharmaceutical company 75,000 to produce a 1000-pound batch of a drug. The average yield from a batch is unknown but the best case is 90% yield (that is, 900 pounds of good drug will be produced), the most likely case is 85% yield, and the worst case is 70% yield. The annual demand for the drug is unknown, with the best case being 20,000 pounds, the most likely case 17,500 pounds, and the worst case 10,000 pounds. The drug sells for 125 per pound and leftover amounts of the drug can be sold for 30 per pound. To maximize annual expected profit, how many batches of the drug should the company produce? You can assume that it will produce the batches only once, before demand for the drug is known.The Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.

- You now have 10,000, all of which is invested in a sports team. Each year there is a 60% chance that the value of the team will increase by 60% and a 40% chance that the value of the team will decrease by 60%. Estimate the mean and median value of your investment after 50 years. Explain the large difference between the estimated mean and median.W. L. Brown, a direct marketer of womens clothing, must determine how many telephone operators to schedule during each part of the day. W. L. Brown estimates that the number of phone calls received each hour of a typical eight-hour shift can be described by the probability distribution in the file P10_33.xlsx. Each operator can handle 15 calls per hour and costs the company 20 per hour. Each phone call that is not handled is assumed to cost the company 6 in lost profit. Considering the options of employing 6, 8, 10, 12, 14, or 16 operators, use simulation to determine the number of operators that minimizes the expected hourly cost (labor costs plus lost profits).The CEO of Lucky Petroleum Co. has been considering to open a new gasoline statioin. He must decide how large the station should be. The annual returns (IDR billions) will depend on both the size of the station and market factor. After a careful analysis he developed the following table: Size of Station Good Market Fair Market Poor Market Small 50 20 -10 Medium 70 30 -20 Large 100 50 -30 Probability 0.5 0.3 0.2 Compute the expected value of each alternative size of station, and select the best decision. Construct the opportunity loss table and determine the best decision. Compute the expected value of perfect information.

- Condo Construction Company is going to First NationalBank for a loan. At the present time, the bank is willing to lendCondo up to $1 million, with interest costs of 10%. Condobelieves that the amount of borrowed funds needed during thecurrent year is normally distributed, with a mean of $700,000and a standard deviation of $300,000. If Condo needs to borrowmore money during the year, the company will have to go toLouie the Loan Shark. The cost per dollar borrowed fromLouie is 25¢. To minimize expected interest costs for the year,how much money should Condo borrow from the bank?Perdaris Enterprises had an expenditure rate of E′(x) = e0.1x dollars per day and an income rate of I′(x) = 98.8 - e0.1x dollars per day on a particular job, where x was the number of days from the start of the job. The company’s profit on that job will equal total income less total expenditures. Profit will be maximized if the job ends at the optimum time, which is the point where the two curves meet. Find the following.(a) The optimum number of days for the job to last(b) The total income for the optimum number of days(c) The total expenditures for the optimum number of days(d) The maximum profit for the jobNewell and Jeff are the two barbers in a barber shop they own and operate. They provide two chairs forcustomers who are waiting to begin a haircut, so the number of customers in the shop varies between 0 and 4.For n = 0, 1, 2, 3, 4, the probability Pn that exactly n customers are in the shop. A. Calculate L . How would you describe the meaning of L to Newell and Jeff?B. For each of the possible values of the number of customers in the queueing system, specify howmany customers are in the queue. Then calculate Lq . How would you describe the meaning of Lq to Newelland Jeff? C.Determine the expected number of customers being served. D. Given that an average of 4 customers per hour arrive and stay to receive a haircut, determine W andWq . Describe these two quantities in terms meaningful to Newell and Jeff. E. Given that Newell and Jeff are equally fast in giving haircuts, what is the average duration of ahaircut?

- Eades Corp. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $980.35. However, Eades Corp. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on Eades Corp.’s bonds? Value YTM ? YTC ?Michelle owns a house in which she keeps valuables worth 100,000 which can get stolen with probability 1%. She can purchase coverage C of the amount C ∈ [0; 100,000] at premium π = 0.05 dollars for each dollar covered. Her Bernouilli utility function is u(w) = ln(w). Assume she has no other assets. 1. Set up her maximization problem. 2. How much insurance will she choose to buy? 3. How much profits does the insurance company earn on insuring Michelle? 4. Does the fact that the insurance company earn profits mean that Michelle is worse off com-pared to the situation in which she is not insured? Explain what is happening. 5. How much insurance will she buy if insurance companies charge an actuarially fair insurance rate?Eunice, in The scenario, wants to determine how each of the 3 companies will decide onpossible new investments. He was able to determine the new investment pay off for eachof the three choices as well as the probability of the two types of market. If a company willlaunch product 1, it will gain 125,000 if the market is successful and lose 125,000 if themarket is a failure. If a company will launch product 2, it will gain 75,000 if the market issuccessful and lose 75,000 if the market will fail. If a company decides not to launch anyof the product, it will not be affected whether the market will succeed or fail. There is a53% probability that the market will succeed and 47% probability that the market will fail.What will be the companies decision based on EMV? What is the decision of eachcompany based on expected utility value?