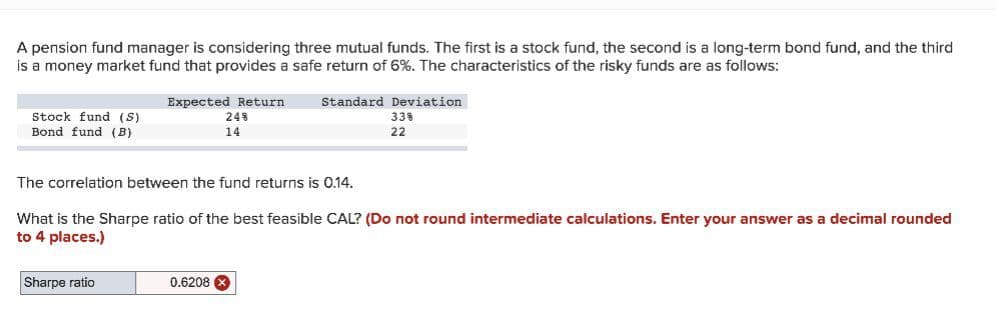

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 6%. The characteristics of the risky funds are as follows: Expected Return 248 Standard Deviation Stock fund (S) Bond fund (B) 338 14 22 The correlation between the fund returns is 0.14. What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Enter your answer as a decimal rounded to 4 places.) Sharpe ratio 0.6208

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 6%. The characteristics of the risky funds are as follows: Expected Return 248 Standard Deviation Stock fund (S) Bond fund (B) 338 14 22 The correlation between the fund returns is 0.14. What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Enter your answer as a decimal rounded to 4 places.) Sharpe ratio 0.6208

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 5P

Related questions

Question

Solve it correctly please.

Transcribed Image Text:A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third

is a money market fund that provides a safe return of 6%. The characteristics of the risky funds are as follows:

Expected Return

248

Standard Deviation

Stock fund (S)

Bond fund (B)

338

14

22

The correlation between the fund returns is 0.14.

What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Enter your answer as a decimal rounded

to 4 places.)

Sharpe ratio

0.6208 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning