A person does not have to complete a return form if he has no income or chargeable income. Select one: True O False

A person does not have to complete a return form if he has no income or chargeable income. Select one: True O False

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

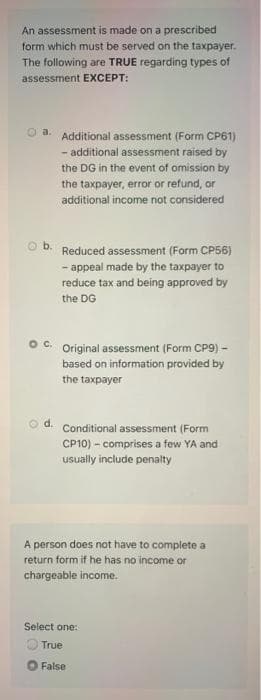

Transcribed Image Text:An assessment is made on a prescribed

form which must be served on the taxpayer.

The following are TRUE regarding types of

assessment EXCEPT:

a. Additional assessment (Form CP61)

- additional assessment raised by

the DG in the event of omission by

the taxpayer, error or refund, or

additional income not considered

Reduced assessment (Form CP56)

- appeal made by the taxpayer to

reduce tax and being approved by

the DG

Original assessment (Form CP9) -

based on information provided by

the taxpayer

d.

Conditional assessment (Form

CP10) – comprises a few YA and

usually include penalty

A person does not have to complete a

return form if he has no income or

chargeable income.

Select one:

O True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you